Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Why the US is at the start of a “stimulus wave”

Reveal which stock I bought three times during the Liberation Day crash

My prediction for what the Federal Reserve will do at Wednesday’s meeting

Give me take on the latest Magnificent 7 tech stock earnings

Preview of this week's market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Back in March 2020, when COVID was sweeping across the globe, I made one of the toughest calls of my career.

The market was in free fall. Headlines were screaming about lockdowns, ventilator shortages, and Great Depression 2.0. The S&P 500 had just cratered more than 30% in under a month. People were terrified.

But something interesting happened: the VIX—the market’s so-called “fear gauge”—spiked above 80. That was higher than the 2008 financial crisis. In that moment, it was clear to me that panic had reached an extreme.

So I did what any good investment analyst would do: I trusted the data and bought the dip. Not because the news was good. Not because the data looked great. But because when the VIX spikes that high, it usually marks a bottom.

That lesson stuck with me. And I used it again this year.

“The Bottom is Near”

On April 9th, 2025, during what we now call the “Liberation Day Crash,” I sent out an alert to my 1,200 TikStocks Portfolio members.

It simply read: “The Bottom is Near.”

At the time, the S&P 500 had fallen -14% in just three days. The Nasdaq was down more than -21% from its highs. It was one of the fastest corrections in modern market history. And once again… the VIX had spiked above 50.

That’s rare. Since the VIX was introduced in 1993, we’ve only seen a handful of readings above 50. Each time, it’s occurred near major market bottoms: 2002, 2008, 2020, and now 2025.

And here’s the crazy part: in every single one of those cases, buying the S&P 500 during the VIX spike would’ve delivered powerful returns over the next 6–12 months.

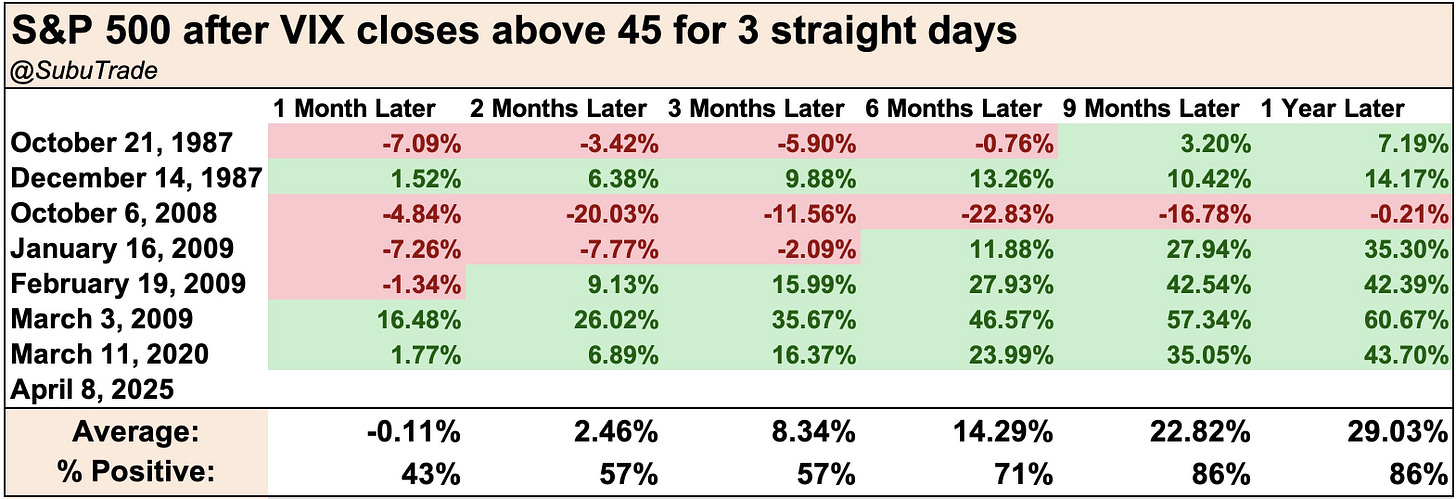

That includes a 60% return a year after the Global Financial Crisis and a 44% return after the COVID Crash over the samew time frame. Overall, any time the VIX was over 45 for three days - as we were this time last month - 12-month S&P 500 returns averaged 29%. That’s nearly triple the average annual return.

And since the April 9th alert, the S&P 500 is up +9%, while the stocks we bought in the TikStocks Portfolio during the crash are each up double digits.

The Bear Case Always Sounds Smart on the Lows

Why does “buying the fear” like this work so reliably?

Because market psychology is one of the most fascinating—and underappreciated—elements of investing. At the top, no one wants to hear bad news. Everything is sunshine, soft landings, and AI productivity miracles. Nobody talks about risks.

But at the bottom? All you hear is doom.

In the days leading up to April 8th, my inbox was flooded with subscribers asking if this was “the next 2008.” There were rumors the U.S. dollar would lose its reserve status. Headlines said the Fed was powerless. The Trump administration was talking about firing Powell. Every chart looked like a waterfall.

And yet, that's exactly the kind of environment where bottoms are born. Because when everyone is convinced things are going to zero, there’s no one left to sell. Of course, sentiment is just one part of my process.

But when you combine extreme sentiment with compelling fundamentals (like Trump walking back the worst of the tariff chaos) and improving technicals (breadth thrusts, bullish reversals), you get an edge.

That’s what happened in April, as we have a VIX spike above 50 (only the 5th time in 25 years), softening tone from the White House, and a Zweig Breadth Thrust (only 14 in history—all marked bottoms).

All that told me the panic was peaking—and opportunity was knocking.

The Lesson: Fade the Extremes

The hardest trades in the moment are often the most profitable in hindsight.

When you buy during a VIX spike, it never feels “safe.” The news is scary. The charts look broken. And your gut is telling you to wait. But that discomfort? That’s where the big gains are made.

That’s why I stepped in and bought the dip during the COVID crash. And it’s why I did it again multiple times during the Liberation Day crash. Because markets are forward-looking. They bottom long before the headlines get better.

So the next time the VIX spikes, the economy feels like it’s unraveling, and everyone in your group chat says it’s “this time is different”—remember it never feels good to buy the bottom. But if you can stay calm, stay liquid, and trust the process… you might just catch it anyway as I helped our 1,200 TikStocks Portfolio members do during the Liberation Day crash:

And if you’re not sure where to start? You can always follow my moves in the TikStocks Portfolio. We’ve navigated this one beautifully—and I’m already positioning the portfolio for the next leg of the rally.

Because as I discussed on yesterday’s podcast, the “stimulus wave” is only beginning.

Stay safe out there,

Robert