The S&P 500 just logged its third-largest daily gain in history.

But today? We’re giving some of that back. So what gives?

The reality is, face-ripping rallies like this typically happen in bear markets, not bull markets. And as we’re seeing today, it doesn’t mean the pain or volatility is over—especially in the near term.

But zoom out and the picture gets brighter. After the five largest one-day rallies in S&P 500 history, the average 12-month return was +29.6%. That’s what matters if you’re already invested or looking to stay the course with long-term positions.

In the short term though? The average one-month return after those rallies was -7.8%. In other words: more chop is likely before any real trend takes hold.

It’s a similar story for the Nasdaq. Yesterday was the second-largest gain ever for the index—but in past cases (2001, 2008), we saw new lows shortly after. This is why I’ve been reminding you for weeks: focus on where the market will be in 12 months—not 12 hours.

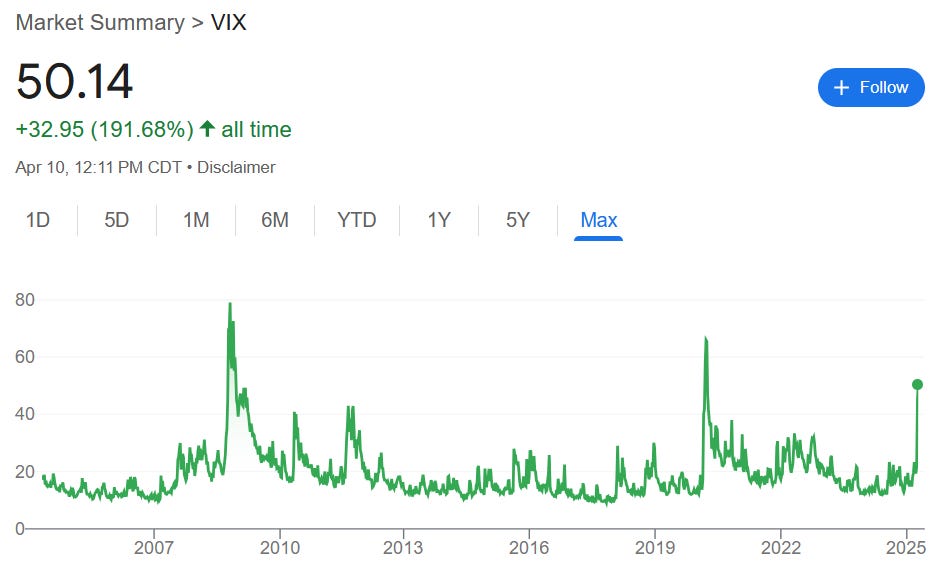

Yes, this is still a high-risk environment. The VIX is over 50—something that’s only happened a handful of times in history. Fear is high. But historically, that’s when major bottoms form.

We’ve been seeing signs of that. That’s why we’ve been scaling in—last Friday, Monday, and again yesterday.

Are we going to nail the exact bottom? Of course not. Nobody does. But you don’t need to. You manage risk, follow signals, and tilt the odds in your favor.

We’ve now deployed about a third of the cash we raised in mid-March. And we’re still sitting on a 12% cash position—our highest since 2022. On top of that, we’ve got another 10% in defensives: gold, ags, and Treasuries. Gold is actually up on the year and Treasuries are as good as cash in this environment.

For this reason, we're going to add to a few more long-term positions today. Again, perfectly timing the market bottom is not realistic. The goal is to buy when things look to be their worst. That is when you bottom as stocks discount the future as stocks will bottom well before the coast is clear. Always have, always will.

With that in mind, I am making the following buys today.