The Most Powerful Market on Earth

Trump's tariff reversal wasn’t about politics—it was about survival...

Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

How the most important financial market on Earth forced Trump to pullback on his Liberation Day tariff plan

Why there are signs foreign countries may be moving away from the US dollar as their go-to reserve currency

Which stocks and financial assets are on my radar even after we deployed half of our cash position last week

Why you shouldn't worry about timing "the bottom" during a stock market crash

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Seeing the bond market panic is a little like seeing your parents cry as a kid. You might not fully understand what’s going on, but you know it’s bad.

And last week? The bond market broke down in a way I’ve rarely seen.

Now, I’ve been investing professionally for 15 years. I’ve seen my share of wild markets—the global financial crisis, the European debt crisis, Trump’s first trade war, COVID, inflation surges, crypto booms and busts. But other than maybe March 2020, nothing compares to the chaos that was unleashed after Trump revealed his “Liberation Day” tariffs on April 2.

The S&P 500 dropped 14% in just three days. If it had closed at the lows that Monday, it would’ve been the worst three-day stretch for markets in over a century—worse than 1987, 2008, or even the COVID crash.

But here’s the twist: it wasn’t the stock market, the Fed, or even political pressure that forced a reversal.

It was the US government bond market.

The “Controlled Demolition” Plays Out

To be clear, this wasn’t a surprise to us.

Back in early March, I started warning about a policy pivot I called the “controlled demolition” or “Volcker-ing” of the U.S. economy. The idea: crash the stock market to slow the economy and bring down interest rates so the government could refinance its $36 trillion debt at lower yields.

Sound insane? Maybe. One of the investment research companies I’m on retainer with sure thought so. But there were signs everywhere saying I was onto something.

For instance, Trump’s Treasury Secretary openly said they weren’t focused on the stock market. Trump himself said he “wasn’t watching it.” This was a huge shift from Trump 1.0, when the S&P 500 practically served as his reelection scoreboard.

That shift forced me to pivot. In February, I sold three-quarters of one of my largest Magnificent 7 positions. In March, I trimmed 50% of my crypto holdings. These moves brought our cash to 20% by March 11.

Add in defensive exposure—gold, agricultural commodities, and Treasuries—and we were ready for what came next.

The Bond Market’s Red Line

Then came Liberation Day. Stocks cratered, volatility exploded. But Trump didn’t blink—until the bond market broke.

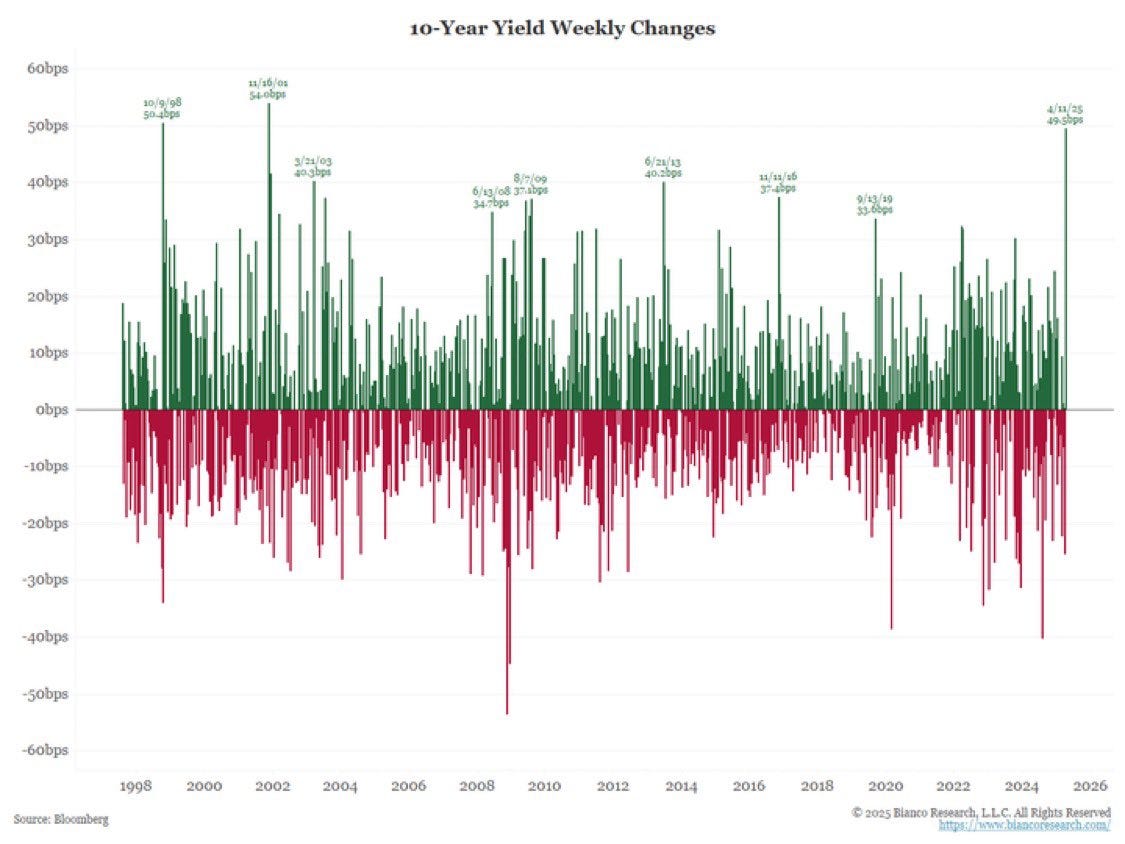

Last Tuesday night, the 10-year yield had its biggest weekly increase since 2001, while the 30-year yield had its biggest weekly increase since 1982. That’s not normal.

Why does this matter?

Because when the U.S. borrows money, it does so by issuing Treasury bonds. Our biggest buyers? Foreign governments like China and Japan—who also happen to be the primary targets of Trump’s tariffs. On Tuesday night, they retaliated not just with tariffs, but by dumping U.S. debt.

This is catastrophic for two reasons:

It pushes interest rates up—not just for the government, but for US mortgages, credit cards, and business loans.

It undermines U.S. global dominance, which relies on Treasuries being viewed as the safest, most liquid asset in the world.

When yields spike and the U.S. dollar drops (as it did that night), it means global investors aren’t just selling Treasuries—they’re leaving the U.S. financial system altogether.

That’s not a warning shot. That’s a cannonball.

And it’s why Trump backtracked. On Wednesday, he walked back the Liberation Day tariffs, announcing a 10% flat rate for most countries and leaving only China with a 125% levy.

Markets rallied hard. It was the third-best day ever for the S&P 500 and second-best for the Nasdaq. Not because investors love tariffs—but because they love stability and a semblance of certainty.

And we now know Trump’s red line: a -20% drawdown on the S&P 500 and a bond market revolt. That’s when the “Trump Put” kicks in.

But don’t get too comfortable. Bond yields are still surging. More worryingly, the U.S. dollar is falling while yields rise—suggesting foreign investors are still losing faith.

And this unusual dynamic should inform how you invest in the near-term.

My Outlook—and What We’re Doing

Could Trump fully abandon the tariff plan or cut a deal with China? Maybe—but I’d put the odds around 30%. More likely, the Fed steps in and cuts rates to stabilize markets, as JPMorgan CEO Jamie Dimon suggested on Friday.

The good news? The worst of the panic appears to be behind us. That’s why I deployed more cash this past week than I have in the last three years.

That includes buying heavily on Monday, Tuesday, and Thursday near the bottom when all hope seemed lost…

…which has helped our over 1,000 TikStocks Portfolio members make timely buys despite the market chaos:

But I’m also still being tactical. We’ve kept a 10% cash position and stayed heavy on defensives. If conditions improve further, I’ll keep adding to our core names as early as today if conditions remain advantageous (you can see my full portfolio and get real-time trade alerts here).

But I’m not chasing—we’re building for the next cycle, not swinging for home runs in a hurricane.

As always, if my thinking changes—you’ll be the first to know.

Stay safe out there,

Robert