Is Trump intentionally tanking the market?

Seems that way on the surface. Trump and his officials have made a few ominous comments about stocks in the last week. This includes the president saying the US economy would be in a "transition period" after dodging a question about whether the US was headed for a recession. That's in addition to his Treasury Secretary Scott Bessent saying the US economy is in for a "detox" period from government spending.

It seems that Trump and his cabinet may be channeling their inner Paul Volcker.

And if you don't know who that is, you need to read the rest of this newsletter.

The Volcker-ing of the US Economy

Back in the 1980s, Paul Volcker, then Chairman of the Federal Reserve, took drastic steps to combat inflation. He hiked interest rates to stratospheric levels, pushing the U.S. economy into a deep recession.

For instance, when the Federal Reserve raised interest rates to fight inflation in 2022, the federal funds rate (FFR) - or rate set by the Fed - hit 5.3%. This pales in comparison to what Volcker did when he hiked the FFR to over 19%.

It was painful, but it worked—Volcker broke the back of inflation and set the stage for the long bull market of the 1980s and 1990s.

Today’s situation isn’t identical, but there are parallels. Instead of fighting runaway inflation, Trump’s administration seems focused on transitioning the US economy away from a US government deficit-fueled economy to one propelled by private sector investment. It also wants to be more isolationist, hence the heavy usage of tariffs, with the following aims:

Slow economic growth (which could lead to a recession)

Stamp out any remaining inflation

Bring down the US national debt and deficits

This is the "detox" period that Bessent is referring to. Whether it will be successful is anyone's guess. But there is no use complaining about their aims. As a risk manager, my job is to play the cards we are dealt.

And right now, the portfolio is in a decent position to ride out this storm. But we need to diversify and bolster our defenses even further while taking more profits on our winning trades as the "globalization" trend that drove markets over the last 15 years potentially unwinds.

A Great Re-Pricing is Happening

The stock market does its best to discount the future.

And when those expectations about the future change, stocks reprice. That's what is happening now in a nutshell. After Trump's Election Day victory, the market began pricing in favorable policies from the incoming administration. Many thought Trump would be friendly to the stock and crypto markets as he was in his first term...

...and how he'd been signaling as recently as August 2024:

This is in stark contrast to Trump's latest comments on the stock market:

Therefore, the market is unwinding all the bullishness that was priced in between the lead up to Election Day and him taking office. We're seeing that across asset classes as both US stocks and crypto have given back their gains over the last six months.

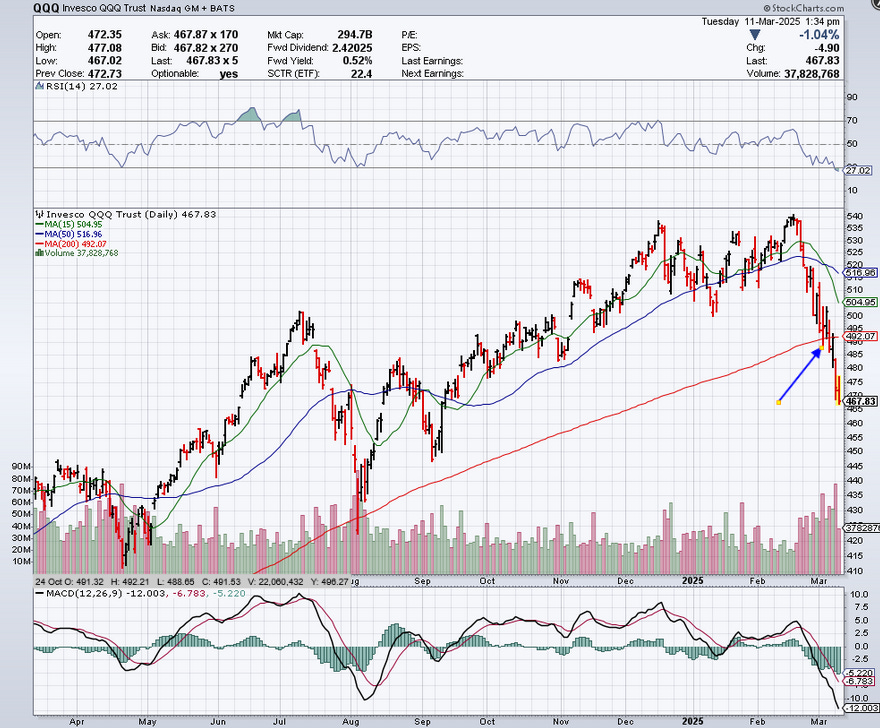

This has led to a technical breakdown in both the Nasdaq index...

...and Bitcoin (BTC)...

...as both are now trading below their 200-day moving averages. As any market technician knows, nothing good happens below the 200-day MA. And much like we have taken profits on a few positions in the last two months and reallocated into cash and defensive holdings, we will continue that process today.

Taking More Profits on Tech, Crypto…

I am making some major portfolio changes today: