Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Why the market is crashing (and why it's on purpose)

How my “controlled demolition” theory got confirmed by Trump and Bessent

What Argentina in the 1930s can teach us about tariffs, populism, and economic decline

The best case scenario for this trade war

When I think stocks will bottom (including one of my favorite sentiment signals)

Preview of what investors need to watch going into the week

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Thursday and Friday marked the worst back-to-back market days since March 2020.

And it looks like today could be the worst day yet.

It’s brutal out there. And if this is your first real crash, I feel for you—because I’ve been there. The emotional rollercoaster, the red screens, the doubts creeping in. That is all normal.

But I’ve been doing this for a long time. Whether it’s the European Debt Crisis, Trump’s Tariff Crash in 2018, COVID, The Great Inflation, and now Trump’s Tariff Crash 2.0, I’ve seen my fair share of financial panics. They are all different and horrible in their own way.

That said, the best thing you can do right now is understand why this is happening so you can develop a plan of action.

And I’ll tell you mine today.

Why Are Stocks Crashing?

If you’ve been reading my work the last month, you know I’ve been talking ad nauseum about how the Trump administration is orchestrating a “controlled demolition” of the US economy (you can listen to my podcast on this from March 16th on Spotify and Apple).

This was just a theory I developed until President Trump shared a video detailing my exact "controlled demolition" thesis on his Truth Social account last Friday. This isn’t something I’m happy to be right about. It’s the policy equivalent of burning down your house to cook a steak.

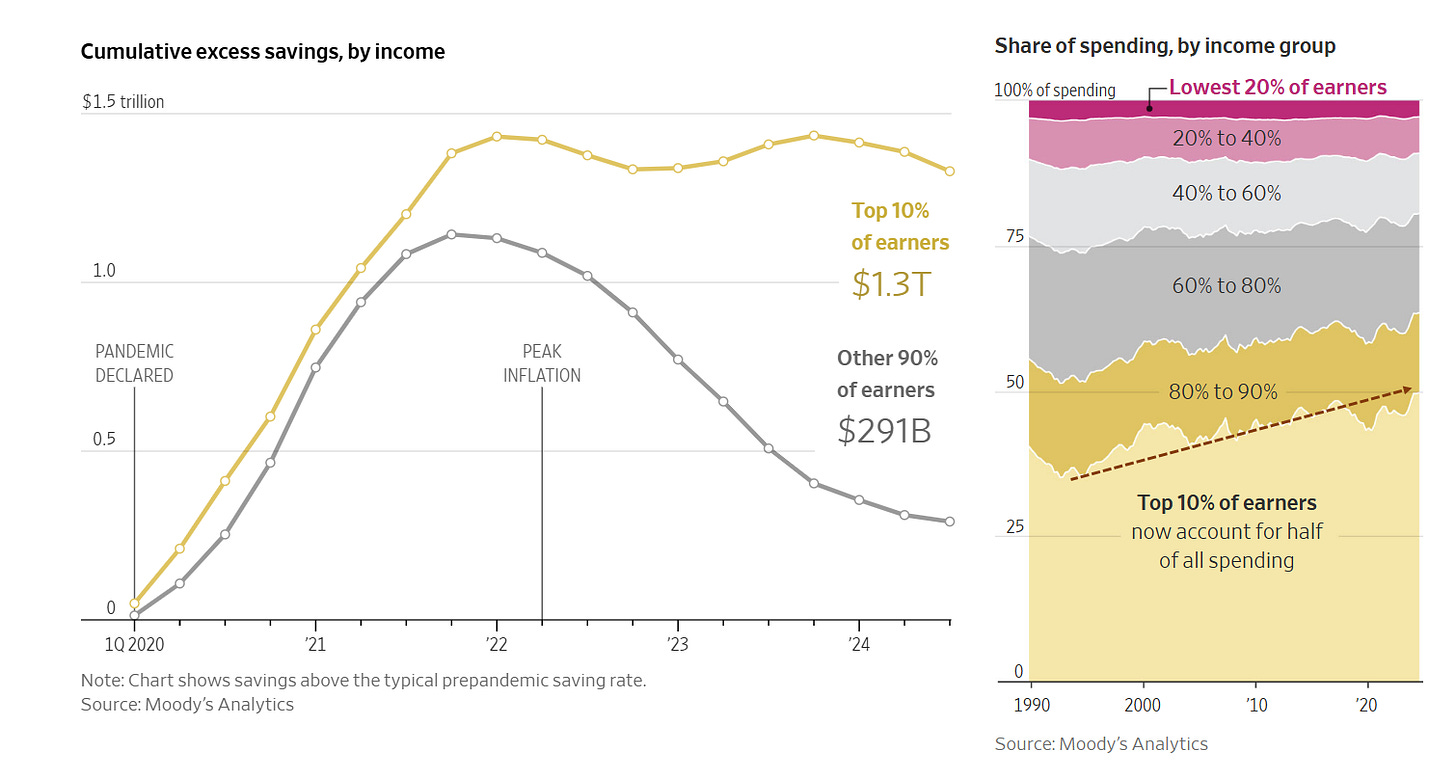

In their eyes, the US economy was on an unsustainable path. And to bring down US government bond yields and issue debt at lower rates, they aimed to create a “reverse wealth effect.” This includes crashing US stocks to slow spending, which makes some sense as 90% of US stocks are owned by 8% of the population and that same subset is responsible for 50% of US consumer spending. Treasury Secretary Scott Bessent confirmed this is their strategy on a podcast last Friday.

This possibility of this was already spooking the market in early March. And the confirmation of it contributed to the panic we saw last Thursday and Friday.

To add insult to injury, we got the “Liberation Day” tariff roll out last week. Investors were expecting a potential 10% tariff on all nations. The Nasdaq rallied when news broke that Trump was leaning towards this policy.

But then we got the dreaded “Liberation Day” posterboard that will be enshrined in market history as it caused the fastest market crash since 1987:

I know many think Trump is using his Art of the Deal approach here by asking for something outrageous as his opening bid. And trust me, what he’s asked for is outrageous. Even the loudest Trump backers like Elon Musk, Bill Ackman, and Stan Druckenmiller are all turning on him over this trade policy.

But even if he is trying to Art of the Deal this trade negotiation, these methods damage US credibility on the world stage. And the idea of implementing 65% tariffs on Chinese goods would likely cause the worst economic depression since the 1930s.

The market is also freaked out because these tariffs and not targeted nor are they reciprocal as the administration had been claiming. And top economic advisor Peter Navarro was on TV even this morning saying 0% tariffs on the US isn’t enough for the US to drop their tariffs.

This is bad. Like, really, really bad. However, as an investor, your job is to determine how much bad news has already been priced into the market.

And in my view, we’re getting close to “peak bad.”

Sell When You Can (Not When You Need To)

I can’t say I played this market crash perfectly.

However, I did see that there was a chance the Trump administration were going to crash stocks on purpose to try and bring rates down. I said it publicly multiple times in this newsletter, on my podcast, and on my social media accounts.

This was the reason I went on a selling spree in the TikStocks Portfolio in mid-March. We sold so many high-risk tech and crypto positions that my cash pile now grew to 20% of my portfolio.

And when you include defensive positions like gold - which I’ve been long since October 2023 - and treasuries, nearly one-third of the portfolio was in a defensive posture. Could I have sold more? Of course, but everything else I hold are long-term positions. And taking these decisive, defensive moves saved our members thousands.

But more importantly, it gave us dry powder to take advantage of cheap stocks.

And while it’s hard to tell when we hit bottom, I’m seeing some encouraging signs.

The Market is an Emotional Being

The fact is unless something fundamental changes, it's still not looking good in the near-term despite sentiment being rock bottom. The market is throwing a tantrum to try and prevent Trump from making an egregious policy mistake. And it's not working. The pain will continue until we get one of the following:

Trump says uncle and pulls back on his tariff policies (unlikely)

China and our other trading partners negotiate new trade deals with the US (unlikely in the near-term)

Congress steps in and reigns in the executive branches tariff powers (likely)

This is all very scary. And I feel for you. But one lesson I’ve learned over 15 years of investing through global financial crises, pandemics, and political chaos is the bear case is always most convincing at the bottom. For instance, stocks bottomed in March 2020 well before we had a vaccine or fully understood how to treat COVID-19. And in 2022, we bottomed with inflation still at 9%.

The fact is the market is forward looking. It attempts to “discount” what the US economy and its businesses will be like ~9 months into the future. That’s why we’re selling off so severely right now, because the expectations changed so rapidly for trade policy.

Because right now, everyone can only see the bad things coming and ignore the release valves, like Congress reigning in Trump’s tariff powers. But that doesn’t mean you want to rush back into the stocks - like the Magnificent 7 - that were working the last few years. The playbook has changed and you need to adapt to this new “market regime” and not follow the old one.

And if you want to make a lot of money, you also need to keep your cool and pick the right stocks.

Keeping Your Head When Others are Losing Theirs

We’re in the middle of the worst market capitulation event since the COVID-19 crash.

This has also been the fastest S&P 500 crash ever as from peak-to-trough the index has fallen -14.3% in three days. That has never happened before in history, with the worst three-day stretch prior being -13.4% in October 2008. We are breathing rare air right now.

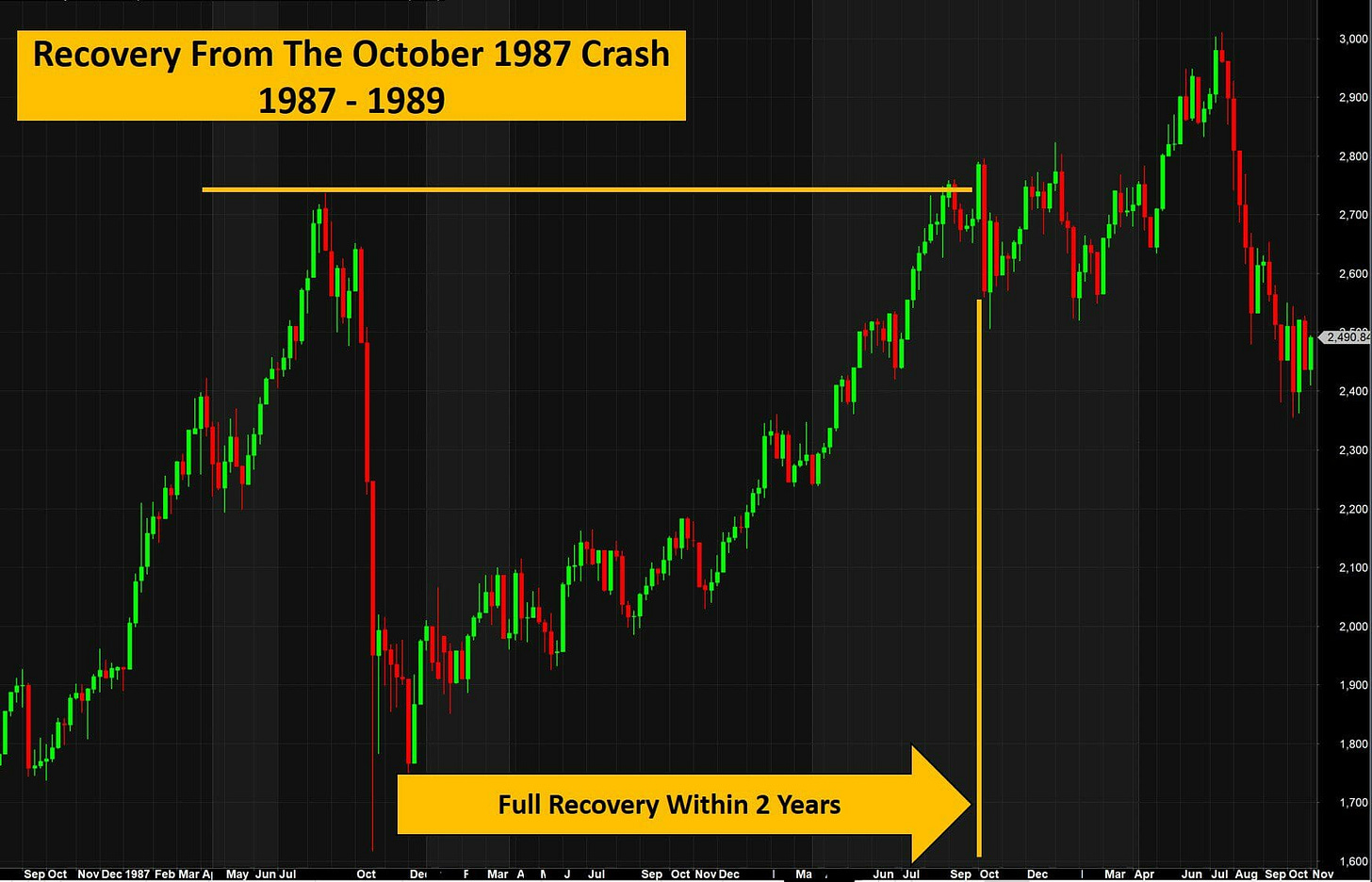

However, these capitulations and indiscriminate selling usually happen near bottoms, not tops. And as they say, the faster the crash, the faster the rebound. While I was obviously not around for the 1987 crash, I have studied it extensively. And the S&P 500 made a full recovery in 18 months…

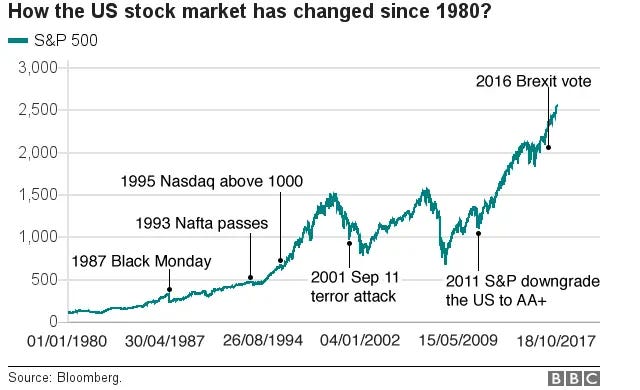

…only to go significantly higher over the following five years to the point where the Black Monday crash looked like a tiny blip on the chart:

That doesn’t make what’s happening now feel any better. I get that I am right there with you and I feel for anyone who is near retirement and just saw their nest egg get cut by 20% or more.

However, most of you who read this have years left on your investing journey. While this is scary, the way you take advantage of this is extending your time horizon from days to years. Do not look at what is happening in the near-term. Focus on what the market will look like a few years from now.

Because I’ve made plenty of money in my career investing during crashes. Any Millennial investor has seen multiple crashes at this point. They all seemed like the end of the world at the time.

And while it seems like the world is collapsing in on you now, you will one day look back on this crash and laugh at how insane it was. But you can only do that if you survive this period. Do not over trade. Do not use leverage. And do not panic sell. The time to sell was last month and that window has closed.

Your goal now is to take advantage of this situation. Whether that’s buying something like an S&P 500 index fund - my largest portfolio position - or high-quality individual stocks, you need to keep your head while everyone else is losing theirs.

If you’re a free reader, this is where I leave you. But for our over 1,000 TikStocks Portfolio members, let’s dig into the portfolio changes we’ll make today to take advantage of this.

And for any free reader who wants to upgrade, you can sign up today and get 25% off your first year if you use this link.

Making Some Portfolio Changes Today

We are in the middle of a massive capitulation event.