Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Revealing which high-growth stock I bought during the Liberation Day crash

Why China’s currency manipulation - not trade deficits - is the real issue with US-China trade relations

Explore whether stocks have bottomed or this is a “bull trap”

Discuss where I plan to deploy the rest of our cash position

Preview of this week's Apple, Microsoft, Amazon, and Meta Platforms earnings reports

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Over the weekend, my cousin—who barely checks her 401(k)—texted me:

She’s not alone. Whether it’s in the TikStocks Discord, podcast comments, or family group chats, this is the question everyone’s asking. And I get it—since Trump took office, the S&P 500 has dropped as much as -21% from its all-time high.

The main culprit? The misguided "Liberation Day" tariffs, which triggered one of the fastest stock market sell-offs in history in early April.

Since then, the Trump administration has started to walk some of it back—announcing a 90-day pause on most tariffs (except those on China) and abandoning the idea of firing Federal Reserve Chair Jerome Powell.

If you’ve been following my moves in the TikStocks Portfolio, you know we raised cash before the crash—and deployed over half of it at the panic lows in early April.

That’s why my inbox has been flooded with messages like this…

…and this…

…over the last few weeks. But while stocks have staged an impressive rebound thanks to the partial policy reversals, the big question now is: how much damage has already been done?

Bottom Signals Are Piling Up

Let’s rewind.

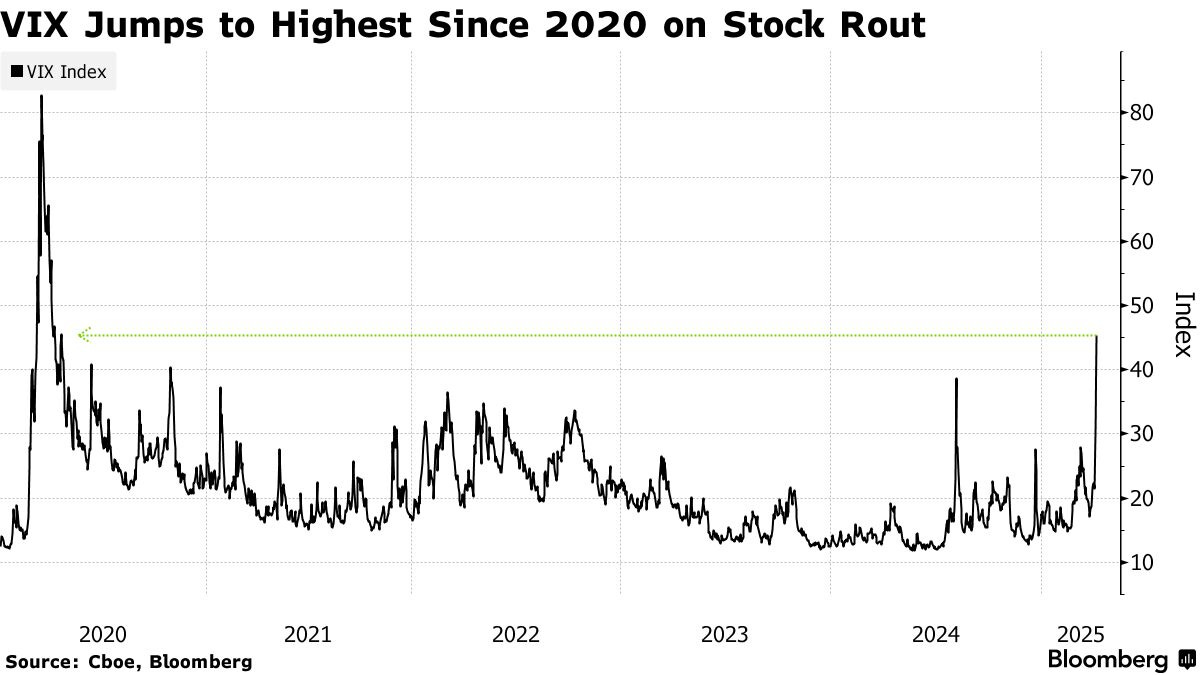

The S&P 500 dropped -14% in just three days earlier this month. The S&P 500 and Nasdaq entered a bear market. The VIX hit 50 on April 8, marking one of the highest fear readings since COVID. It felt like the bottom—because that’s how bottoms feel.

Violent. Ugly. Hopeless.

But there’s data to back it up too. We saw some of the worst market sentiment data I’ve seen in my career. This includes the VIX spiking above 50 along with this recent University of Michigan consumer confidence data showing 12% of Americans think stocks won't gain over the next 12 months.

That’s the highest reading ever, beating even the Dot Com Bubble, Global Financial Crisis, and COVID Crash:

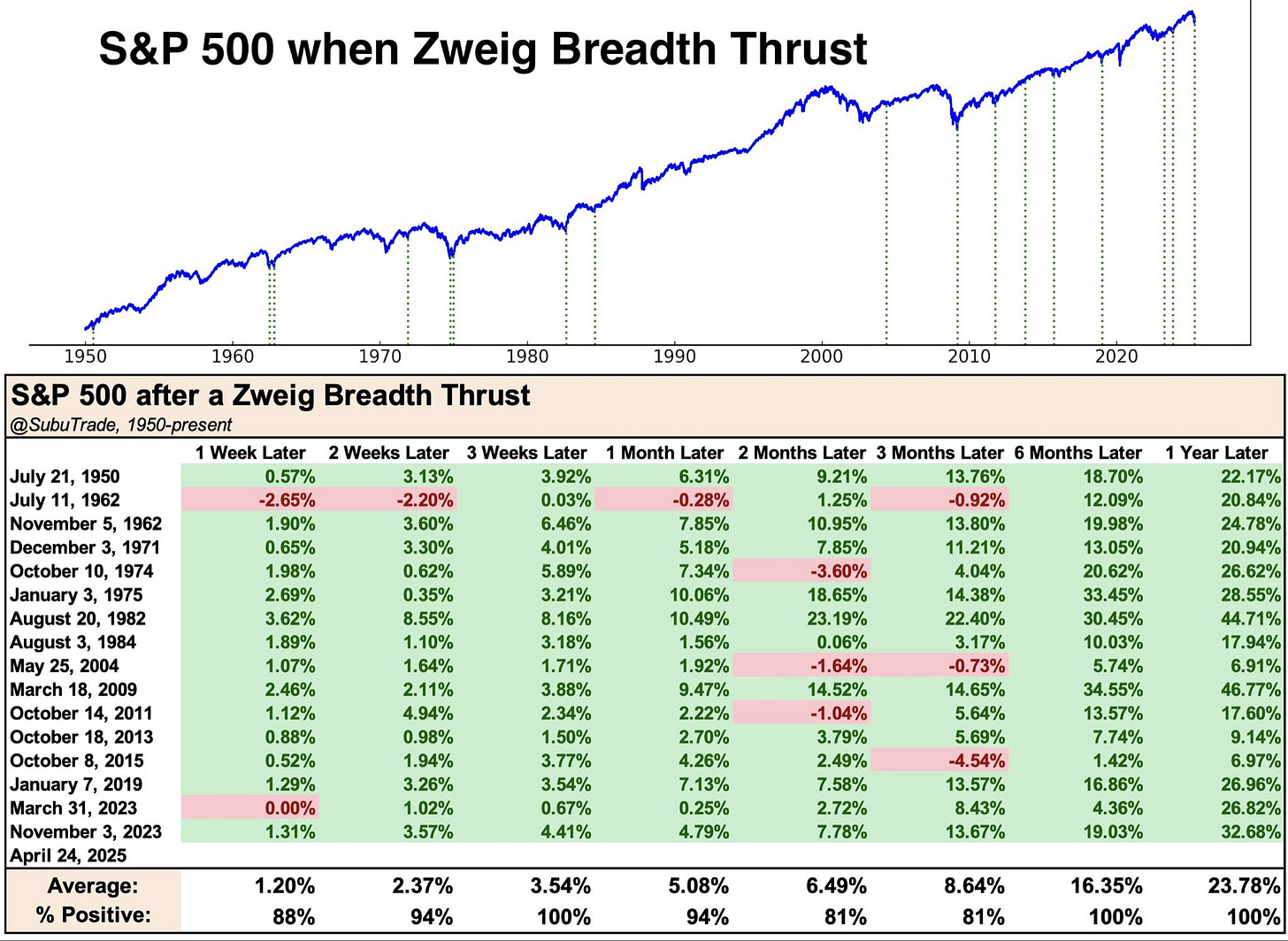

We also triggered a Zweig Breadth Thrust this week—a technical signal that occurs when the 10-day moving average of advancing stocks jumps from below 40% to above 61.5% within 10 trading days. Historically, this signal has marked major turning points in the market.

While some consider it market voodoo, it’s consistently one of the most reliable indicators that the worst might be behind us.

When coupled with the 98.5% upside day on April 9th - meaning almost every stock on the NYSE closed higher - the signs posts for stocks hitting bottom on April 8th are piling up.

And on the policy front, we’re seeing the Trump administration back away from its most chaotic trade war rhetoric. The 90-day tariff pause, the “de-escalation” leaks, even Trump's softening tone after Walmart, Target, and Home Depot’s CEOs reportedly warned him that shelves would go empty within two weeks? These aren’t coincidences. They’re political pivots.

Even the Fox News base is signaling discomfort—only 38% approve of Trump’s economic handling, with 56% disapproving. That’s not a number you can ignore if you’re staring down a midterm cycle where you may be impeached if you lose the House or Senate.

So yeah, if you're looking for reasons to believe we’ve bottomed, they’re there. And we've been acting on them; I’ve added more to the TikStocks Portfolio over the past two weeks than I have since the COVID lows in 2020. And so far, each of those buys are up double digits.

But that doesn’t mean I’m going all in just yet.

This Does Not Mean We’re “All Clear”

There are still a few hurdles we haven’t cleared.

First, let’s be real about the near-term fundamentals: they’re still bleak. Import volumes—a key real-time indicator of economic health—have collapsed to levels not seen since the early COVID lockdowns.

That could lead to empty shelves in the next few weeks if Chinese tariffs are not reversed.

Manufacturing PMIs are contracting sharply, with some regional Fed surveys hitting their lowest readings since 2009. It’s ugly out there under the hood, no two ways about it. Even CEOs of the world’s largest companies have said a recession - even a short one like in 2020…

…with Apollo Global Management expecting a recession to hit by summer:

And technically? We’re not exactly “winning” there either.

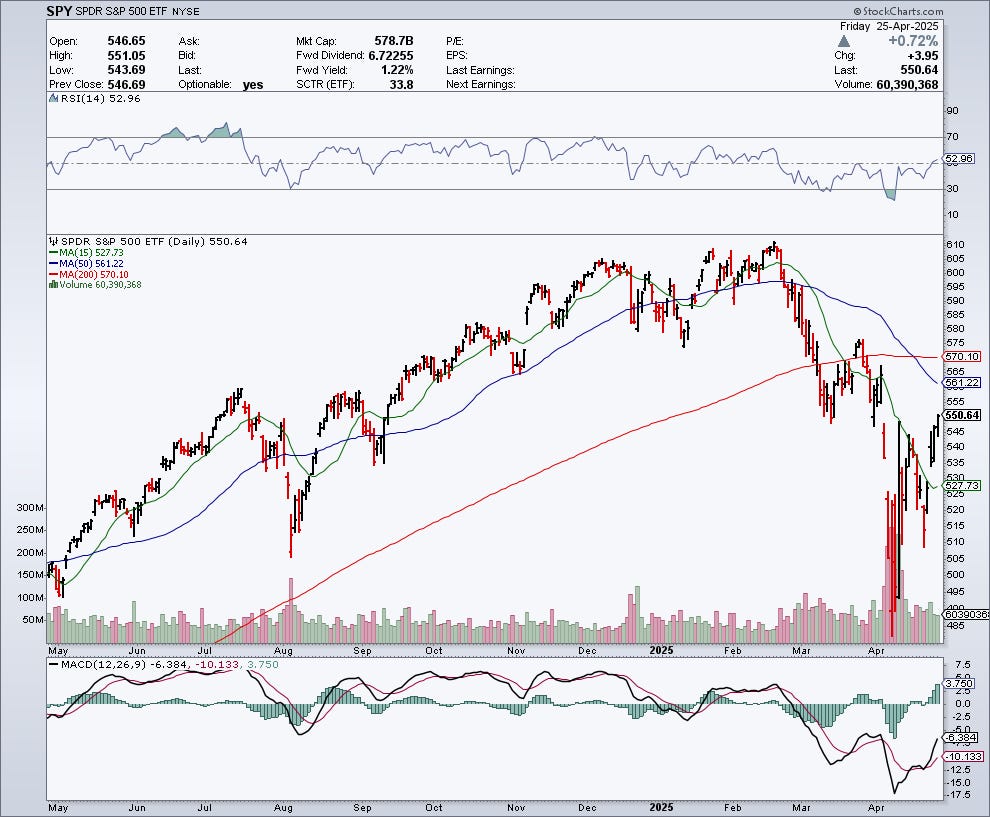

The S&P 500 and Nasdaq are both trading firmly below their 200-day moving averages. Even worse, those 200-day lines are starting to slope downward—a classic sign of the primary trend changing to “down” and not just a garden variety pullback.

Look at the biggest components too: the Magnificent 7. Names like Apple, Microsoft, Nvidia, and Amazon—they're not leading this rally. They’re stuck below key moving averages themselves, still in technical downtrends. Leadership is missing, and without leadership, it’s hard to sustain a new bull run.

Plus, even though Trump’s misguided policies have been somewhat reigned in, there has been significant damage to America’s reputation as the premier destination for global investment. This is why we saw a bond market revolt two weeks ago along with foreign investors dumping US stocks like they’re going out of style:

So for now, this still feels like a fragile rally. We may have seen the bottom, but there’s no guarantee we don’t re-test those lows. My base case is that the worst is over—but I’m still holding 10% cash in case we get another swing lower.

Because I’ve been doing this a long time, and one thing I’ve learned is you don’t need to catch a market bottom - even though we may have (you can see the buy alerts here) - to make money. Because when we enter a new uptrend, there will be plenty of time to get on the train.

P.S. If you want full access to my portfolio moves—and research on names like Palantir, Nvidia, and Tesla—I’m offering 3 months free right now with an annual premium TikStocks Portfolio subscription.

To join the 1,200+ members already inside and access our private Discord, click here now.

Here’s How I’m Seeing Things

While I do think the worst of the crash is behind us—and that April 8th will likely mark the official bottom—I'm not naïve about how fragile this rally still is. The near-term fundamentals are ugly. The technicals are wobbly. And political risk isn’t going away anytime soon.

That’s why while I’m cautiously optimistic, I won’t be surprised if we re-test the panic lows from April 9th which are about 10% lower from where we are today on the S&P 500.

It wouldn’t be unusual to see a retest, especially in a volatile environment like this. It’s actually pretty common historically. And if it happens, it won’t invalidate the broader thesis that the worst damage is already in the rear-view mirror.

Because whether we bounce straight up or chop around first, smart investors don’t need to perfectly catch the bottom to win big.

Stay safe out there,

Robert