Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Whether it’s a good time to “buy the dip” on tech stocks

How investors should think about the latest uptick in volatility

Explore whether Nvidia is a buy after earnings

A preview of this week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Well, that got ugly fast.

Over the past two weeks, stocks got taken to the woodshed. While the S&P 500—my largest portfolio position—has held up relatively well, tech stocks haven't been as lucky.

At its lowest point, the tech-heavy Nasdaq was down 10% from its all-time high. That included the fastest 5% drop since September 2020—a clear sign that investors are hitting the panic button.

So, what’s behind the sell-off? It’s a toxic mix of Trump’s new tariffs, spending cuts from the Department of Government Efficiency (DOGE), and weakening U.S. economic data. And if there’s one thing markets hate more than bad news, it’s uncertainty. Right now, they’re getting a heavy dose of both.

But here's the thing—volatility isn't a death sentence for the bull market. In fact, it's a normal part of any market cycle. The key is knowing why it's happening and, more importantly, how to navigate it.

By the end of this update, you’ll not only understand the root causes of this recent turbulence but also have a few proven strategies to protect your portfolio and capitalize on the chaos.

My #1 Prediction for 2025 is Already Coming True

Every year, I release my "predictions issue" to kick off the new year. And my top call for 2025? A resurgence in market volatility.

The bull run that started in October 2022 was almost too easy. Other than a few hiccups—like the yen carry trade panic last year—stocks seemed to go up in a straight line. For nearly two years, the best move was to ignore the noise, hold onto your positions, and let the market do the heavy lifting.

That’s exactly what I did—and what over 1,000 TikStocks Portfolio members did too. And the results speak for themselves: our portfolio finished 2023 and 2024 up +36% and +45%, respectively.

But now, volatility is back. And here’s a crucial reminder: stock market volatility is normal. Since 1928, the average year has included at least one 10% correction in the S&P 500.

With the S&P 500 currently only 4% off its all-time high, a bit more downside would not only be typical but could also be healthy. Corrections reset expectations, wash out weak hands, and set the stage for the next leg higher.

In fact, I believe the pullback we’re seeing now might be exactly what the bull market needs to last even longer.

Volatility isn’t a sign to run for the hills—it’s a sign to sharpen your strategy.

Speculators Are Getting Whacked

The latest market sell-off has been almost entirely confined to the “speculative” or “high-risk” corners of the market.

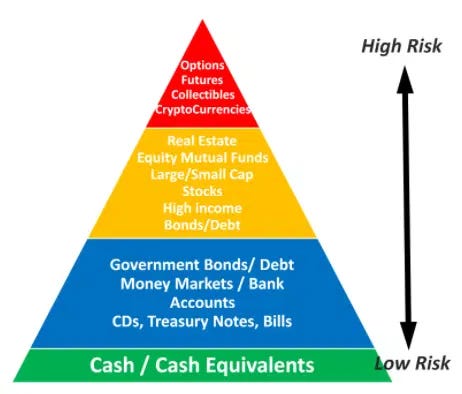

As I outlined in my 2022 book, A Beginner’s Guide to High-Risk, High-Reward Investing, you can think of asset classes as part of a “risk pyramid.” At the top, you’ve got high-risk assets like altcoins, high-growth stocks, and options. At the base, you find safer investments like U.S. government bonds and cash.

And what’s been getting crushed lately? You guessed it—the top of the pyramid. That’s why the S&P 500, a relatively low-risk investment, has barely moved while the riskier assets are in freefall. High-growth darlings like Palantir Technologies (PLTR), speculative altcoins like Solana (SOL), and even the Magnificent 7 tech stocks like Nvidia (NVDA) have led the charge lower.

But let me be clear: this isn’t the end of the bull market. It’s a good old-fashioned speculative shakeout, and that’s actually a good thing. Historically, when the market flushes out excess speculation, it creates incredible buying opportunities in the strongest names.

We’ve seen this movie before. During the 2010s bull run, there were mini-bubbles in 3-D printing stocks like 3D Systems (DDD) in 2013…

and cannabis stocks like Tilray (TLRY) in 2019:

Those sectors got wrecked, but the broader market shrugged it off and went on to make new highs.

Why? Because washing out speculative froth allows capital to reallocate into stronger hands. It lets valuations reset and keeps the bull market on a more sustainable path—rather than letting it end in an all-out bubble collapse.

And with market fundamentals, technicals, and sentiment—topics I dove into on this week’s Room to Run podcast (listen on Spotify and Apple)—still looking solid, I view this as a temporary correction in the context of a longer-term bull market.

This is the same playbook I’ve used during previous bouts of market volatility, and I was proven right each time.

But I know some of you want to hear concrete strategies to protect your portfolio during this turbulence.

And I’ve got a few suggestions for you.

Pulling Out the Defensive Playbook

I believe this bull market is simply catching its breath after the surge of post-election euphoria in the U.S.

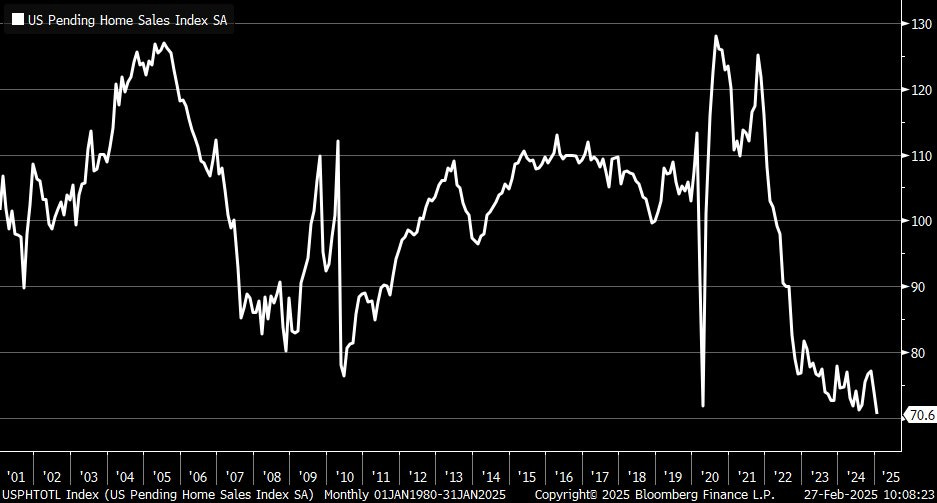

But let’s face it—there are some headwinds. Fears over Trump’s tariffs, the Department of Government Efficiency (DOGE) spending cuts, and their expected negative effects on the U.S. economy are giving investors pause. Add in weak economic data, like pending home sales dropping below the depths of the Global Financial Crisis and COVID-19 lockdowns, and it’s no wonder the markets are a bit jittery.

If your portfolio is structured like our TikStocks Portfolio, you probably took a hit last week. But diversification saved the day. We hold a few positions specifically designed to counterbalance periods of stock market weakness.

Our first line of defense is our position in the SPDR Gold Shares (GLD), which tracks the price of gold. When uncertainty rears its ugly head, investors flock to safe-haven assets like gold. Concerns over economic slowdowns, tariffs acting as a stealth tax on businesses, and potential austerity measures have all contributed to gold’s strong performance.

Our $GLD position—opened in October 2023 and now up 44%—provides a solid hedge against market volatility and declining confidence in equities.

Another defensive gem in our portfolio is the Invesco DB Agriculture Fund (DBA), which tracks agricultural commodities. Food prices are remarkably resilient, even during economic downturns. Persistent inflation and supply chain disruptions have kept agricultural commodities stable, offering an uncorrelated return stream when traditional equities stumble.

If you aren’t comfortable investing in commodities, there are a few defensive stock sectors you can hide out in as well.

Where to Hide: Healthcare, Staples, and Utilities

For those seeking refuge in the stock market, I recommend focusing on healthcare, consumer staples, and utilities—sectors known for their durability during uncertain times. The easiest way to gain exposure to these sectors is through exchange-traded funds (ETFs). Here are my top picks:

iShares Medical Device ETF (IHI): Captures the steady demand from an aging population and ongoing innovation in treatments and technologies.

Vanguard Consumer Staples ETF (VDC): Covers essential goods like food, beverages, and household products, which remain in demand even when the economy stumbles.

iShares US Utilities ETF (IDU): Offers exposure to utilities, known for their reliable cash flows and attractive dividends—a true defensive stronghold.

These sectors not only provide stability but also exhibit lower volatility and more predictable earnings growth. While they might not deliver the explosive gains of high-growth tech stocks, they offer a strong foundation to help weather economic turbulence.

For a more tangible hedge, consider hard asset ETFs. These investments track real estate, pipelines, and infrastructure—all of which tend to hold value during economic uncertainty and inflationary periods.

Vanguard Real Estate ETF (VNQ): This ETF provides broad exposure to real estate investment trusts (REITs), generating income from commercial properties, residential housing, and industrial spaces. REITs historically perform well in inflationary environments as landlords can raise rents to offset rising costs.

Alerian MLP ETF (AMLP): Focuses on master limited partnerships (MLPs) tied to energy pipelines and storage infrastructure. These assets thrive on long-term contracts and often generate strong dividend yields, making them particularly attractive to income-focused investors.

These assets benefit from long-term contracts and tend to generate strong dividend yields, making them attractive for income-focused investors.

Keep Climbing the Wall of Worry

Volatility always feels uncomfortable in the moment. Red days stack up, financial media cranks up the doom-and-gloom headlines, and suddenly every bear on Twitter/X seems like a market sage.

But if history has taught us anything, it’s this: markets climb the wall of worry.

There’s never been a time when the market wasn’t grappling with some seemingly existential threat—trade wars, inflation, Fed tightening, geopolitical conflicts, pandemics, you name it. Each of these “crises” had its day in the sun, but none of them changed the market’s long-term trajectory.

Over the long run, stocks go up. Why? Because businesses innovate, economies grow, and capital finds its way into productive assets. This cycle of progress is what keeps the market grinding higher, no matter how scary the headlines get.

This time is no different. The core pillars of this bull market remain rock solid—AI-driven productivity growth, strong corporate earnings, favorable demographic trends, and, eventually, a more accommodative Federal Reserve policy later in 2025.

The goal isn’t to perfectly time every dip and spike—that’s a fool’s game. The real objective is to stay in the game while structuring your portfolio so you can sleep soundly at night, even when the market throws a tantrum.

And as always, I’ll be here to help you navigate the ups and downs, keeping you focused on the big picture while others are distracted by the noise.

Keep your head up, stay disciplined, and let’s keep climbing that wall of worry together.

Stay safe out there,

Robert

Salut