It's a historic blood bath out there today.

And there are a few reasons for this.

First is the unwind of the "carry trade." The Japanese central bank surprised markets last week by raising interest rates for the first time since 2016. This unexpected move has led to a sudden appreciation of the yen, which is causing massive unwinding of carry trades, where investors had borrowed yen to invest in higher-yielding assets elsewhere.

As I wrote earlier this year in my newsletter titled, "The Biggest Market Trend You've Never Heard Of" this "carry trade" and a depreciating yen were a key tailwind for the market:

As these positions are reversed, it's creating a ripple effect across global markets, leading to widespread volatility and global market sell-offs. And seeing that this trade still has plenty of room to unwind, we could see further downside:

Second, we've had disappointing earnings reports from some of the major tech players, particularly Amazon, which saw a -10% drop after issuing disappointing guidance. This has shaken investor confidence in the Magnificent 7 stocks that have been driving the market since the October 2022 lows.

Lastly, the U.S. jobs report came in weaker than expected, raising concerns about the strength of the economic recovery and the potential for slower growth ahead. This combination of factors is creating a perfect storm of market anxiety and sell-offs.

If I could do it over, I would've hedged the portfolio going into earnings as I did last quarter. That said, our protective stop losses - another risk management strategy - for our trading portfolio were triggered. This automatically sold Robinhood (HOOD), Coinbase Global (COIN), NVIDIA Corp. (NVDA), Hims & Hers Health (HIMS), and Palantir Technoloigies (PLTR).

This was a good thing, as it significantly limited our downside for these high risk, high reward positions and also locked in some gains.

But most importantly, it made sure we have some cash to deploy while everyone is panicking.

The Oldest Rule in the Book

The famous Warren Buffett quote to "buy when there's blood in the streets" is easier said than done.

As I wrote the last time we had a major pullback in October 2023, when it's actually time to buy, you won't want to. And while we certainly could have more downside from here, there are plenty of signs that we're closer to the end of this sell-off than the beginning.

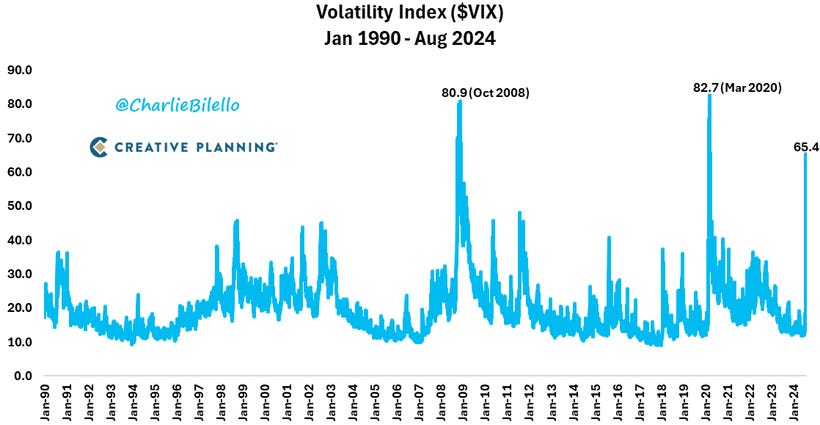

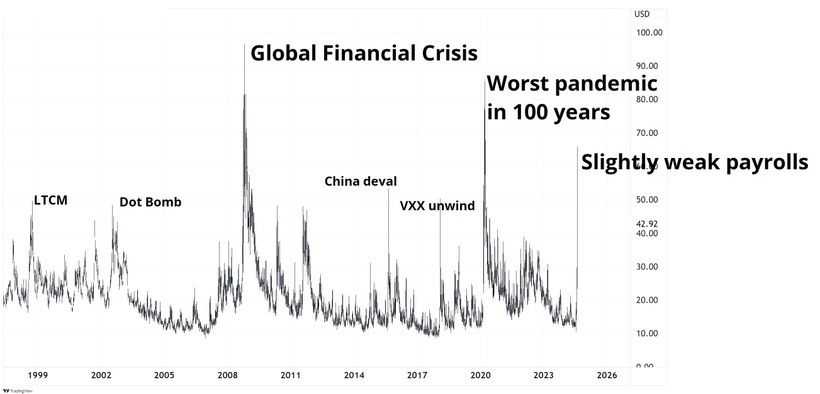

First is the CBOE Volatility Index (VIX), which hit its highest level since the March 2020 COVID-19 Crash this morning. The "fear index" surged from 23 to 65, which would be the largest one day VIX surge in history if it holds:

To me, this seems a bit overdone. Yes the carry trade unwind is a major headwind, Mag7 earnings were just OK, and we had one weak jobs report. But I simply do not view this as anywhere near as significant as a 100-year pandemic or the Global Financial Crisis.

These VIX spikes are statistically one of the best times to buy stocks. Just look at the returns after previous spikes of this magnitude:

That tells me that this is likely a capitulation event. That means we're likely witnessing the panic selling stage, where investors rush to exit their positions, driving prices to irrationally low levels.

This is confirmed both by the VIX spike and the Goldman Sachs Panic Index...

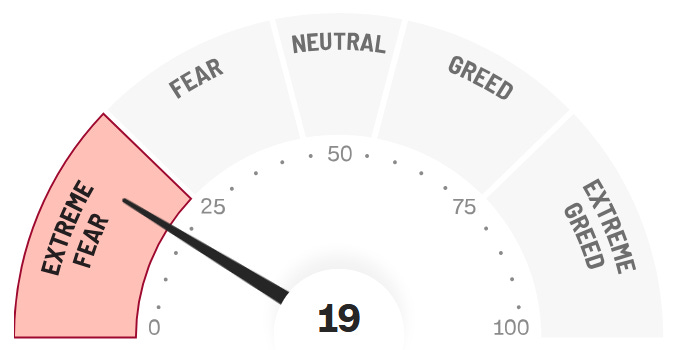

...and the CNN Fear & Greed Index...

...both of which are also signaling we're near bottom. These capitulation events are often followed by a rebound as the panic subsides and more rational, long-term investors step in to buy undervalued assets.

Plus, the fact that this correction in US stocks and crash in Japanese stocks is happening so fast is actually a good thing for long-term investors. From the Wall Street Journal this morning:

"As a guideline, sudden market selloffs are less dangerous than those that unfold progressively over time. This is because investors who rationally price in bad economic data often do so slowly, as it trickles in. Flash crashes, conversely, are often a sign that some tidbit of bad news made speculative bets go awry, triggering a cascade of trades, many of them automated. "

With all that in mind, we're going to make some portfolio changes today.

The Music Has Stopped (and That's OK)

One of my guiding investment axioms over the last six months is you need to "keep dancing while the music's playing."

This is why we kept adding to our Speculative Portfolio positions (always with stop losses, of course). However, it seems the music has stopped for the time being.

As I discussed in yesterday's podcast (listen on Spotify or Apple), we're likely at the beginning of a market "regime change." That means the trades that have been working during this bull market will likely not work as well, including the Magnificent 7 tech stocks and crypto positions that have helped the TikStocks Portfolio deliver superior returns over the last 18-month bull run.

I am still a long-term bull on the Magnificent 7 tech stocks in the portfolio. However, a few of them are now trading below their 200-day MA…