Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

My #1 market prediction for 2025

Is the current pullback a “shakeout”?

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Predicting the future is hard.

For instance, I recently came across a list of predictions made in 1925 about what life would be like in 2025.

Some were spot on, which one headline stating the average lifespan would increase by 20 years. Considering the average lifespan of a US citizen has grown from 58 in 1925 to 79 in 2024, those predictions were spot on.

But it doesn’t always shake out that way. In fact, some predictions on this list sound completely insane, particularly the one that said there will be “nothing to laugh at” in 2025, which is funny considering the prediction itself made me laugh when I first read it.

In the investing space, strategists reveal their annual predictions at the start of every year. I kind of hate doing these as there are so many events that are unpredictable. For instance, not a single person in January 2020 expected the global economy to shut down due to COVID-19. And it was the same in January 2022 when nobody expected Russia to invade Ukraine.

Nevertheless, I am a man of the people, so I do one of these every year anyway.

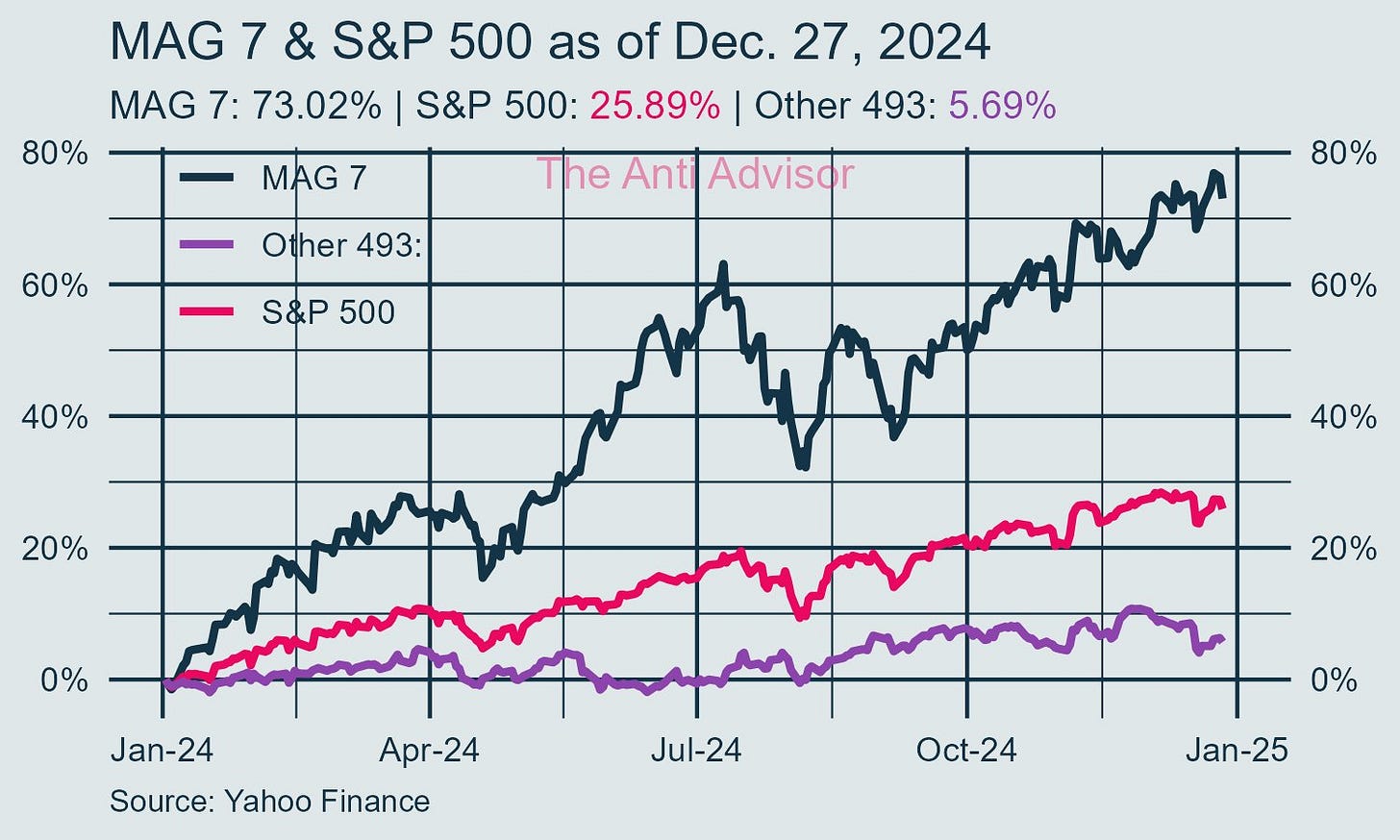

Obviously, I am not always right. But my predictions last year were spot on, as I wrote that the S&P 500 bull market would continue, that Magnificent 7 tech stocks would outperform the S&P 500, and cash would be the worst performing asset class in 2024.

All of these turned out to be accurate. While the average Wall Street investment bank expected a mere +1% gain for the index at the start of 2024, my forecast showed we would well exceed that target. For that one, I give myself an A.

Same goes for my second prediction, as the Magnificent 7 tech stocks surged an average of 65% in 2024 compared to 23% for the S&P 500.

And while cash was not the worst performing asset in 2024 - it was actually US government bonds - it was the 4th worst performing asset, so I give myself a B+ on that one.

So what are my predictions for 2025? Let’s dig into them.

#1. The Return of Volatility

The last few years have not been very volatile in the markets.

In fact, the worst pullback we had in 2024 was the 8.5% correction in August during the yen carry trade panic.

TikStocks Portfolio members used this correction to buy Bitcoin, Nvidia, and more, making us a TON of money. If you want to join the over 1,000 members in our investing community who get access to my portfolio and real-time trades, click here).

It was a similar story in 2023, where we had a max drawdown of 8.5%. This is not normal, and in fact the run for the S&P 500 from the start of 2023 to the end of 2024 was the best consecutive years for the index since the 1997 to 1998 bull run.

This was very unusual. In fact, on average, the S&P 500 has a pullback of -14% every year, according to JP Morgan Asset Management.

Part of the reason markets were so resilient is most market participants were still pretty bearish going into 2024, meaning there was a lot of cash on the sidelines that had yet to make its way into the market. As I wrote in last year’s predictions issue, the average wall street investment bank expected the S&P 500 to rise a mere 1% in 2024. Considering we finished the year up nearly 24%, these forecasts were wildly off base.

Thankfully for our investing community, I knew years where Wall Street has unusually low target prices for the S&P 500 are often the best years for stocks. That’s a key reason we stayed long the market all year, finishing with my best return ever of 45%.

And while I think 2025 will be a fine year for stocks, the easy money has been made.

It will be much more challenging to make money this year than the last two, which is why my main prediction is we will have multiple double digit pullbacks in 2025, with a potential -16% drawdown to the long-term S&P 500 trendline. I’m not expecting any massive new highs or new lows, and expect he S&P 500 will finish with a single digit gain for the year.

#2: Crypto Bull Market Will Peak

I made the case as recently as November 2024 that the crypto bull market is “late cycle.”

The most reliable crypto cycle indicator is the Net Unrealized Profit & Loss (NUPL) which typically peaks at 75% every cycle.

Considering it’s currently at 57%, the indicator is saying we are over three-quarters of the way through this bull run:

Retail investor sentiment, Google search data, and a handful of other metrics that helped me time the crypto market bottom in February 2023 are also pointing to us being late cycle.

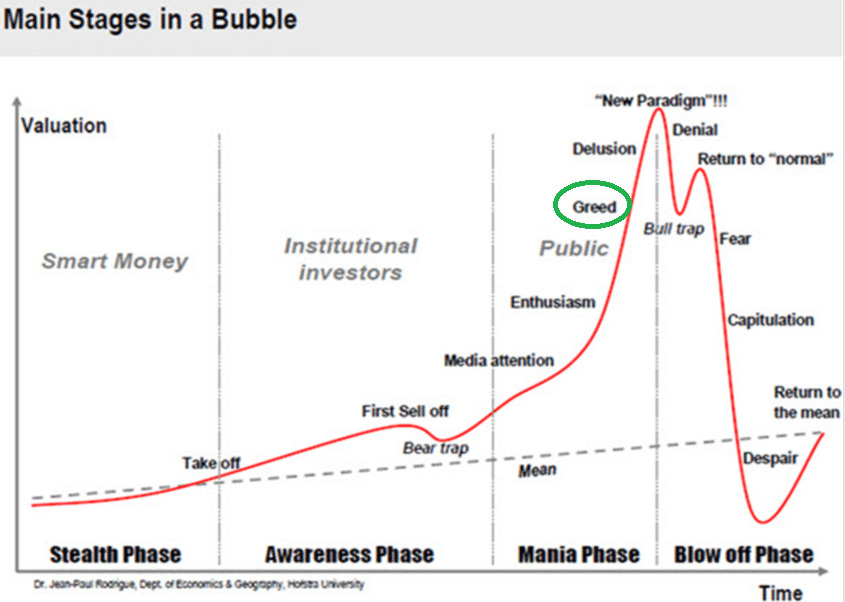

If I had to guess, I’d say we are now in the “greed” part of the crypto bull run:

In baseball terms, we’re in the top of the 7th inning. While that may spook some of you, the catch is this is the most profitable leg of the crypto cycle (if you want to get my crypto buys in real-time, click here).

But I do expect this cycle to peak in the second half of 2025. So while we are still holding out positions, I will be ringing the cash register throughout the year as I wind down my crypto portfolio.

#3. A New IPO Boom

The IPO market has been on life support since 2021.

That year, we saw a staggering 908 IPOs following 429 in 2020.

But it’s been crickets since then; only 151 IPOs hit US markets in 2022, a measly 100 in 2023, and just 210 so far in 2024.

But get ready for a comeback in 2025.

With the Federal Reserve cutting rates and the S&P 500 posting strong gains for two consecutive years, investor sentiment is shifting. Bull markets create ideal conditions for IPOs: higher valuations, more available capital, and an appetite for risk.

I expect pent-up demand will play a huge role. Companies that delayed their IPOs during the market slowdown are ready to strike while conditions improve, including Stripe, SpaceX, OpenAI, Klarna, and Databricks.

The pieces are in place for a vibrant IPO market in 2025—and it’s a sector I’ll be watching closely for opportunities. I’m even buying one stock poised to reap massive profits from this IPO boom (you can see it here).

Anything Can Happen in the Markets

While my predictions hit the mark last year, I’m the first to admit that markets are unpredictable. I’m always ready to adjust my outlook—and my portfolio—when new data emerges.

That said, the trends we’re seeing now lay a solid foundation for optimism in 2025. The data points to a strengthening economic recovery, groundbreaking innovation in key sectors, and a wave of investor confidence that could push markets higher. From the peak of the crypto bull run to a revitalized IPO market, the year ahead could be transformative.

But let’s not forget—flexibility and risk management remain essential. Markets can pivot quickly, and even the best-laid forecasts can crumble in the face of unexpected events. As boxer Mike Tyson famously said, “everyone has a plan until you get punched in the face.”

My goal is to equip you with the tools and insights to navigate these challenges, seize opportunities, and sidestep any punches the market throws our way.

Here’s to a profitable and prosperous 2025.

Stay safe out there,

Robert