Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

What Isaac Newton, Bill Ackman, and Scott Galloway all have in common

How Trump’s latest tariff threats affect the market

My outlook for US stocks, Bitcoin, and small caps

Is Berkshire Hathaway a buy after Warren Buffett’s departure?

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

The smartest people in the world are wrong all the time.

I’m not talking about the average retail investor panic-selling the dip. I mean billionaires. Nobel Prize winners. The literal smartest humans to ever walk the planet.

Paul Tudor Jones and Steve Cohen—two of the most legendary hedge fund managers in history—have both said they expect their analysts to be right just 55% of the time. Which means if you’re wrong 45% of the time… you’re doing world-class work.

That’s because your edge in markets doesn’t come from being right all the time—it comes from managing risk, sizing your bets, and letting your winners run.

Which brings us to today. At the start of the year, I revealed my top three predictions for 2025. That included a return of volatility, a new IPO boom, and a peak in the crypto bull market.

The first two were right on the money, as volatility hit its highest level since March 2020 during the Liberation Day crash.

And the IPO market has been red hot with Circle Internet Group (CRCL), eToro (TORO), and CorWave (CRWV). And while I think crypto has more upside over the next few months, a cycle peak in 2025 is still in play.

But in this week’s update, I wanted to dig into three more market predictions for this year… even if I end up being wrong.

✅ Prediction #1: Stocks Are Headed Much Higher

After we called the stock market bottom in April, I laid out what I called the “stimulus wave” thesis—a market setup driven by falling rates, fiscal dominance, and a flood of liquidity.

But here’s the thing… the hardest part of a bull market isn’t being right. It’s staying long while everyone around you sounds “smarter” being cautious and bearish.

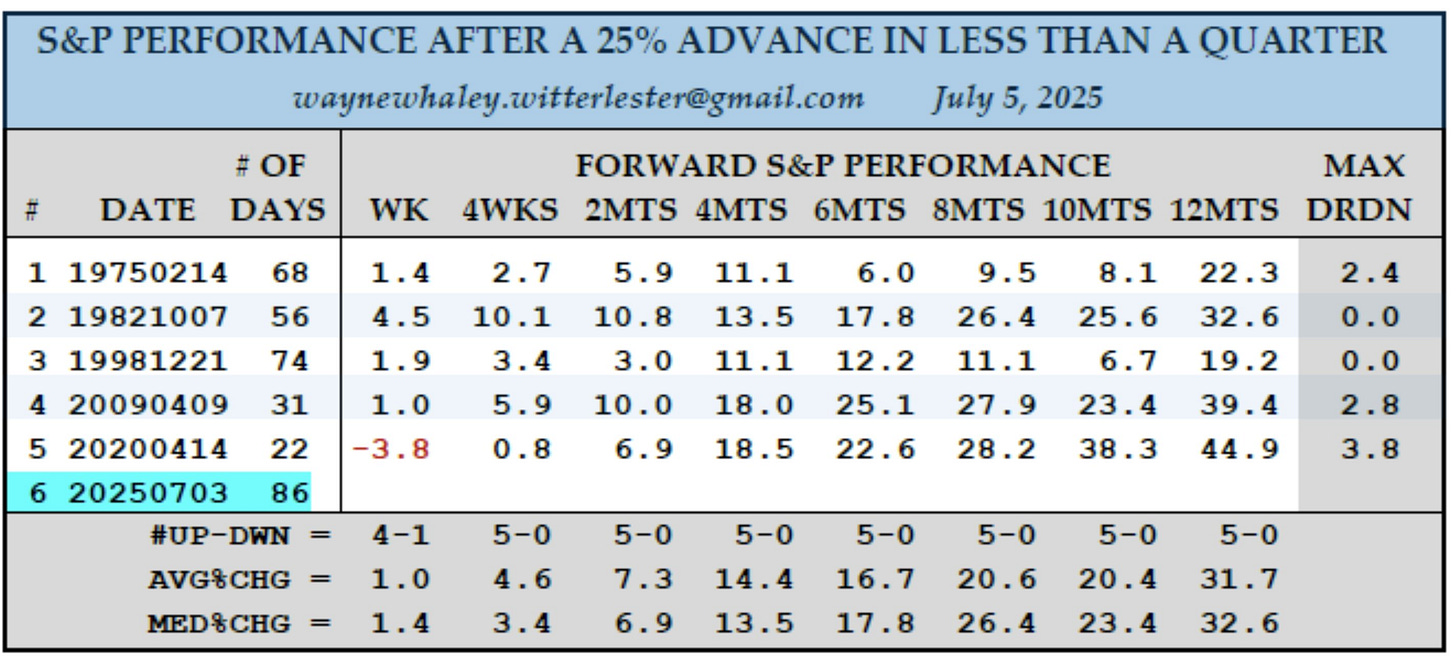

Right now, we’re coming off one of the best quarters ever for the S&P 500—up 25%. Since 1950, there have only been five quarters like that. And in the previous four instances, the next 12 months produced an average gain of +31.7%:

Not to mention: the S&P just had the best bear market recovery in history—up 24% in just 80 days. That’s not weak price action. That’s rocket fuel.

Meanwhile, a record-breaking $7.4 trillion is still sitting in Money Market Funds. That’s cash on the sidelines. As confidence returns, that money will rotate back into risk assets—and stocks are the primary beneficiary.

That’s why I still believe we’re early in this move. Yes, the market feels stretched in the short term. But the “stimulus wave” is still building. And unless something breaks, I think stocks are headed much, much higher over the next 6–12 months.

✅ Prediction #2: Bitcoin Hits $165,000 This Cycle

I first laid out my $165,000 target price for Bitcoin back in March 2024.

At the time, it raised some eyebrows as Bitcoin was trading at $62,000. But now? It’s starting to look very possible… if not likely:

Bitcoin is still in a strong Stage 2 uptrend. The NUPL (Net Unrealized Profit/Loss) is at 54%—far from the 75% levels we typically see at cycle peaks. That tells me we’re not at the euphoric “end of cycle” blow-off top yet.

Search trends are still muted. Social media isn't full of laser eyes. And I haven’t gotten a single text from a cousin asking what altcoin to buy. All signs we’re not at mania phase… yet.

But the macro backdrop is screaming “buy.” We’ve got a weaker dollar, rising debt, and fiscal dominance—a perfect setup for hard, scarce assets like Bitcoin.

While I’m not a Bitcoin maximalist, I do think BTC - and crypto stocks like the one with potentially +400% upside - is the single best hedge against government overspending and currency debasement right now.

✅ Prediction #3: Small Caps Are About to Rip

Falling interest rates help small caps more than any other asset class. These companies are more sensitive to borrowing costs, real estate, and consumer behavior. If the soft landing continues—or we get any kind of economic re-acceleration—small caps are going to move.

But here’s the catch: don’t buy a small cap index or ETF.

Indexes like the Russell 2000 - and the ETFs that track them - are deeply flawed, as their structure requires they kick out their best-performing stocks. When a company grows too large for the index, it’s removed—unlike the S&P 500 or Nasdaq where top-performing companies (like Nvidia) grow into larger weightings.

Instead, focus on select, high-quality small caps.

If you want access to my small cap and options portfolios, please contact our team at info@tikstocks.com and we’ll get you setup.

Staying Long and Strong

I don’t have a crystal ball. And like I said at the top: investors get things wrong all the time. It’s part of the game.

But what sets successful investors apart isn’t perfection—it’s the willingness to admit when they’re wrong, and the conviction to go big when they’re right.

So far in 2025, we’ve been very right. The return of volatility, a peaking crypto market, and the next IPO boom… all predicted.

And now we’re positioning our portfolios to capture what’s next.

Stay safe out there,

Robert