Everyone’s Bullish... That’s My Signal to Slow Down

I bought the April crash lows, but I'm not chasing here...

Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Why stocks look primed for a massive 12-month run

How I’m investing in the short-term after the stock market’s latest surge

Dealing with FOMO in life and investing

My market outlook for the week ahead

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Back in April, the market was in full-blown panic mode.

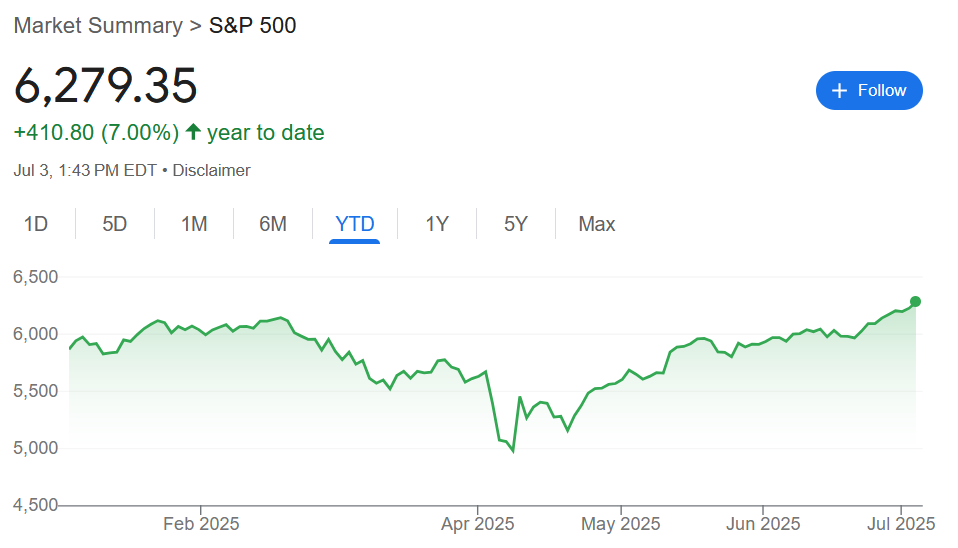

The S&P 500 had just dropped 15% in three trading days. Headlines were screaming about a new global trade war, escalating conflict in the Middle East, and the return of “stagflation” in the U.S. Sentiment collapsed. Investors were fleeing stocks in droves.

But then something unusual happened; the VIX spiked over 50. In my 15 year investing career, I’d learned these “VIX spikes” were historically incredible buying opportunities.

And I followed the signal and started buying stocks. We’d anticipated the Liberation Day crash, raising the TikStocks Portfolio’s cash to 20% prior to the temporary meltdown. That meant we had plenty of dry powder to put to work.

For instance, on April 10th—literally the day after the bottom—I sent out a buy alert that said:

Perfectly timing the market bottom is not realistic. The goal is to buy when things look to be their worst. That is when stocks bottom as equities discount the future, meaning they will bottom well before the coast is clear. Always have, always will.

And we did exactly that—adding to core positions during the Liberation Day crash, then leaning into high-growth names like Palantir (PLTR) and MicroStrategy (MSTR) as the market started to recover.

Those moves paid off, as the S&P 500 has rallied 25% since that April low and the TikStocks Portfolio sits at all-time highs:

But here’s the thing: We leaned in when everyone was scared.

And now that everyone’s feeling bold? It’s time for caution.

The Case for Caution (Short Term)

Let’s be clear: I still believe we’re in the early stages of a major bull run and laid out my bull case again on yesterday’s podcast (listen for free on Spotify and Apple). But no market moves in a straight line. And right now, there are multiple signs we’re due for a breather.

Relative Strength Index (RSI): The 14-day RSI for the S&P 500 just crossed into overbought territory above 70. Historically, this suggests we’re stretched—and that a short-term pullback is likely.

Moving Average Convergence-Divergence (MACD): We’re starting to see “bearish divergence” where price makes a new high, but MACD doesn’t confirm it. This often precedes short-term corrections.

CNN Fear & Greed Index: After spending much of April in “Fear” territory, the index is now approaching Extreme Greed. When everyone feels good, that’s often when you want to start trimming—not buying.

None of these indicators are perfect. But together, they paint a clear picture: sentiment has flipped from panic to euphoria in just two months. That’s not sustainable in the short-term.

But if you have a long-term view and can ride the waves, the future looks bright.

The Big Picture Still Looks Great

The bull case is alive and well when you zoom out.

Let’s revisit the stimulus wave thesis. In my April 29th essay, I wrote:

“Put it all together and you have the setup for a very different environment 9-12 months from now: easier monetary conditions, a softer dollar, and a wave of global liquidity hitting risk assets. That’s the world I’m investing for—not the messy headlines you're seeing today.”

While this seemed like a pipe dream in April, it’s now playing out in real time.

Trump is openly calling for rate cuts and warning Republicans not to slash spending if they want to win in November. Meanwhile, Powell is back to threading the needle—talking tough on inflation, but signaling a willingness to ease if the data softens.

At the same time, there’s a massive pool of sidelined capital.

According to the Fed, $7.4 trillion is sitting in money market funds. If even 10% of that gets redeployed into equities, that’s $740 billion in potential inflows. For context, the S&P 500 gained 6.1% in May alone… on just $56 billion of fund inflows.

Now imagine what happens with 13x that firepower.

And don’t forget the FOMO trade. A lot of professional fund managers missed the April–June rally. They’re now trailing their benchmarks badly—and they have to catch up. That creates even more buying pressure as performance chasers pile in.

How I’m Playing It

This is where nuance matters.

I’m not chasing here. We were aggressive when others were fearful—and we were rewarded. Now it’s time to protect gains and wait for better setups. Doesn’t mean I want put on some short-term trades with tight stops, but the setups have to be A+ for me to act (you can get my trades in real-time by signing up here).

And I’ve got a short list of small caps I’m watching closely. I’ll only deploy significant capital when we get a reset in indicators like RSI, MACD, and overall marketsentiment.

I don’t need to be early—I just need to be positioned when the next leg higher starts.

Because my goal is to beat the S&P 500 again this year. In 2023, we delivered a 36% gain followed by a 45% gain in 2024. Currently in 2025, the TikStocks Portfolio is ahead of the S&P 500 once again:

The last few months have been a powerful reminder that price leads narrative. In April, the headlines screamed disaster—but the market was already bottoming. Now, the headlines are full of bullish chatter—and the market is probably due for a pause.

But the trend is higher. And we were there when it mattered.

Now, we manage the risk… and prepare for what’s next.

Stay safe out there,

Robert