Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

One major red flag I see in the market

Are rising bond yields and commodities a warning sign?

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

The market pessimists have been completely discredited.

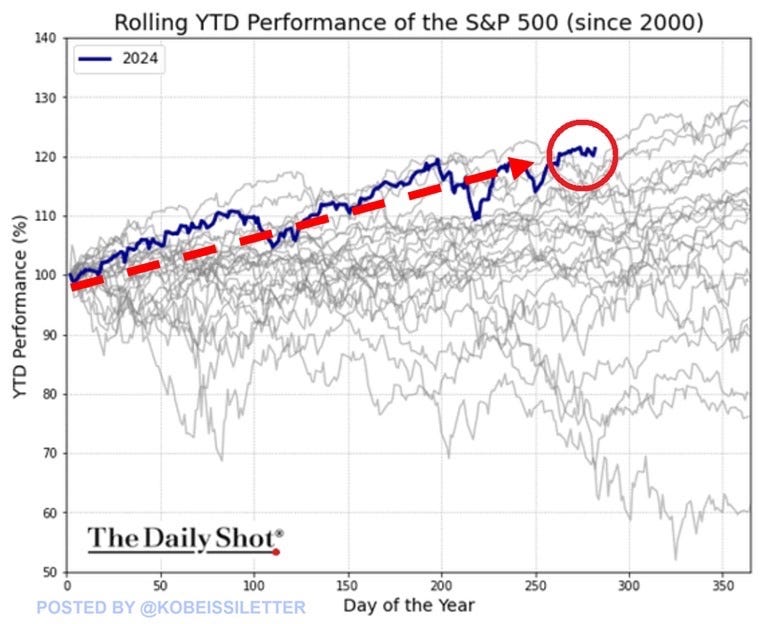

At least they should be. The S&P 500 is now up over 22% this year. That’s the best year-to-date performance this century.

Yet if you remember, going into the year Wall Street had their lowest expectations in a decade for the market, with many pessimistic analysts calling for a recession.

These misguided analysts on mainstream networks and social media tried to scare you out of the market at every down tick in the last year. They'd talk about yield curve inversions and un-iversions, yen carry trades, wars in the Middle East, Kamala Crashes, AI bubbles, SAHM Rules, employment figure revisions, Nancy Pelosi's trades, insider selling, and a host of other meaningless catalysts for a stock market crash.

But they’re being wrong. And thankfully for me and our 1,000 Patreon Portfolio members, I’ve been very right.

So, when I tell you where I think markets are headed next, listen up.

These Are the Good Times

The S&P 500 has put in 47 new all-time highs this year.

Thankfully, I’ve been long US stocks the entire year and have made hundreds of thousands of dollars for myself and millions for our community.

But it may surprise you to learn I expect the good times to keep rolling for US stocks. I've been saying for over a year about how US stocks are in their "goldilocks" phase.

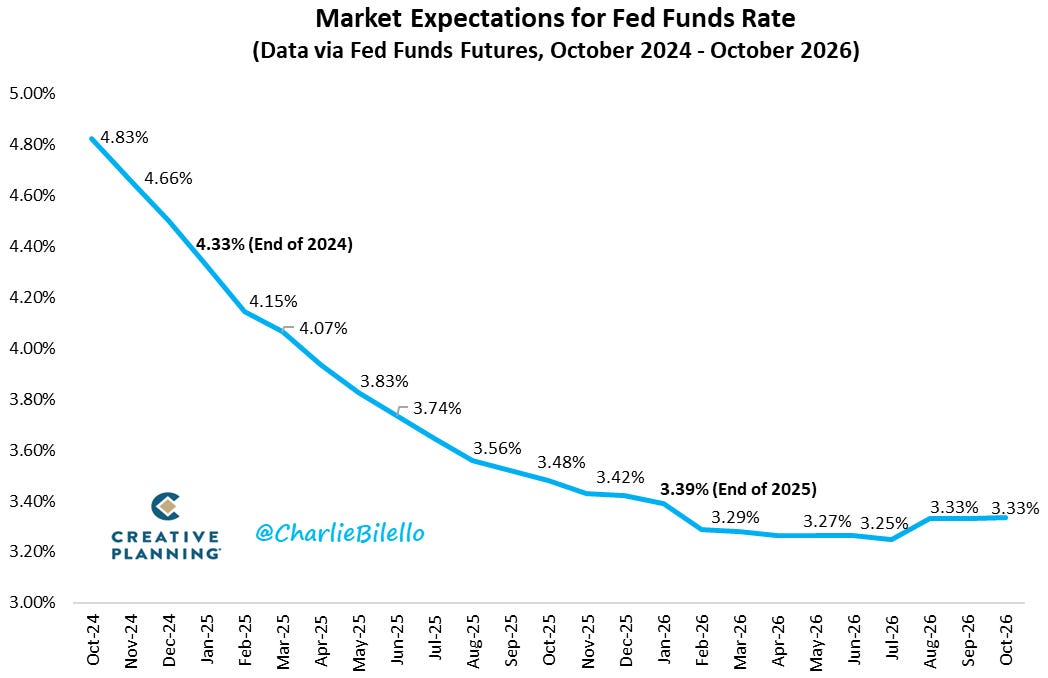

This means that we have the following market conditions: falling and stable inflation, slow but steady economic growth, a Federal Reserve who's easing monetary policy.

This setup has been clear to me since October 2023 and was driven home further when it became clear the market was about to move from a high interest rate “regime” to a low interest rate regime.

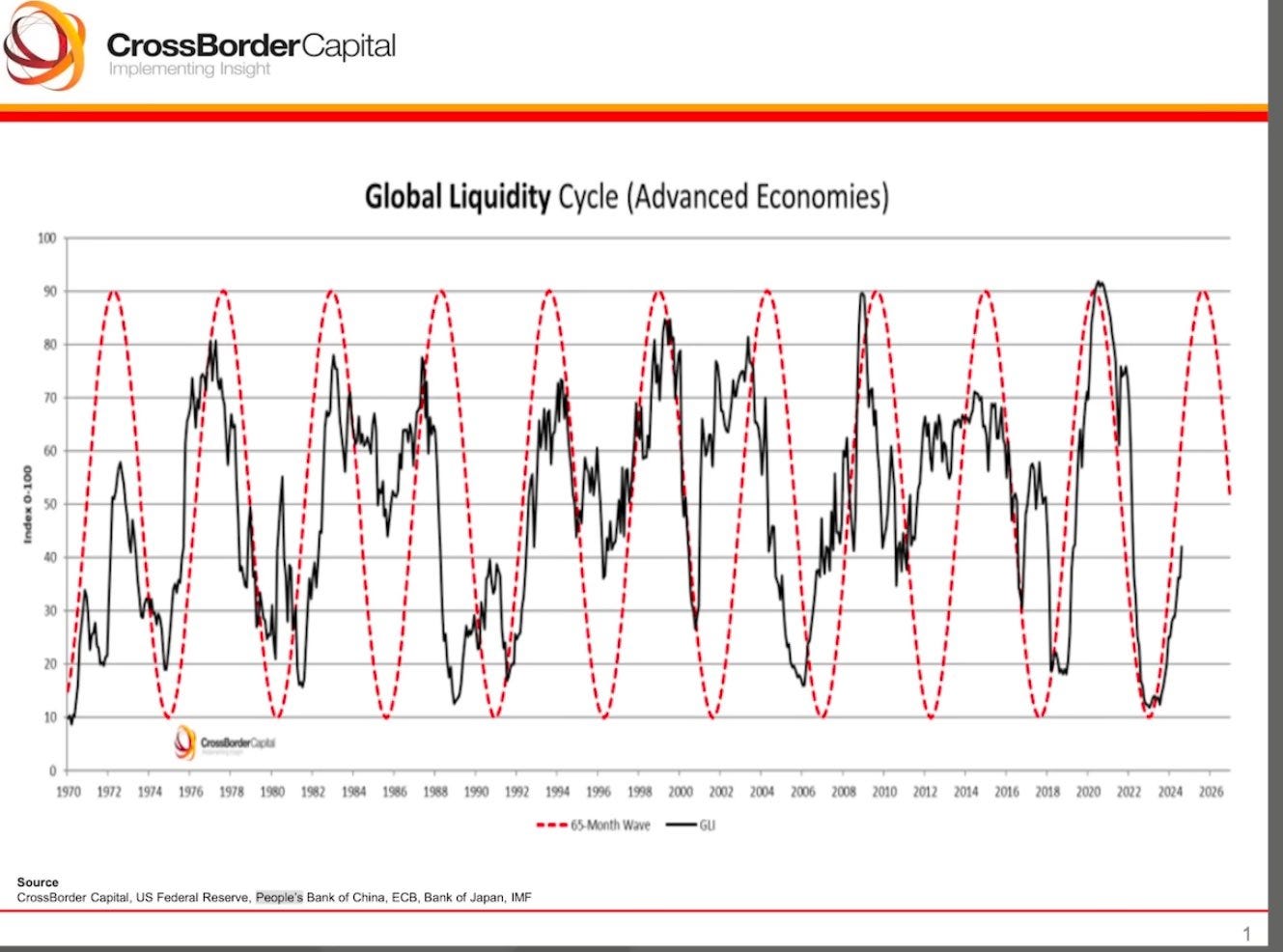

And as we’ve been talking about for months, we are currently in the midst of a global liquidity boom.

Ride the Liquidity

Governments around the world are now turning on the money printers.

September had the largest monetary easing since March 2020. The latest chapter in this global liquidity boom came a few weeks ago when the Chinese government announced a massive stimulus package aimed at boosting economic growth and stabilizing financial markets.

The People's Bank of China unveiled plans to inject over 1 trillion yuan (approximately $140 billion) into the economy by cutting banks' reserve requirement ratios, targeted lending facilities, and open market operations.

I’ve outlined other reasons to remain optimistic about the markets here and here. But this global liquidity boom could be the catalyst for a massive move higher in equities over the next 12 months.

While there will always be things to worry about in the markets, it’s important to pay attention to the things that really move markets like earnings, liquidity, and sentiment.

And remember these are the good times. It won’t always be this easy. There will be tough times at some point in the not-so-distant future. That much is guaranteed.

But this is the time to make hay while the sun is shining. And that means being aggressive with your portfolio, which is exactly what I’m doing with our 1,000 Patreon Portfolio members.

And either way, keep a long-term perspective, ignore the noise, and most importantly, don’t listen to doomers.

Stay safe out there,

Robert