Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Is the US on the brink of recession?

How to manage your portfolio with stocks at all-time highs

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

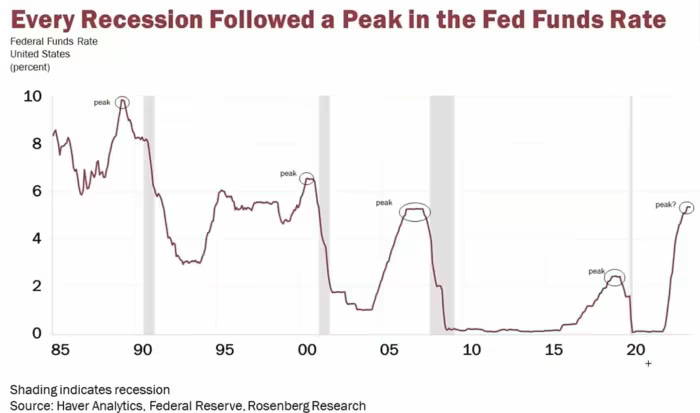

Two weeks ago, the central bank decided to lower interest rates for the first time since the COVID-19 Crash in March 2020.

But they did something that hasn’t been done in over a decade: they cut interest rates by 50 basis points.

The size of this initial cut generated some interesting reactions. Jeffrey Gundlach, who manages $91 billion at DoubleLine Capital, said that they were cutting so aggressively because the US is falling into recession. He even added that when this recession is discussed in the history books they will say it started in September 2024.

There is some credence to Gundlach’s thesis.

When the Fed Brings Out the Big Guns

The Fed often cuts interest rates aggressively - like 50 basis points - to stimulate the economy.

It’s also true the Fed typically only cuts 50 basis points when we have a crisis.

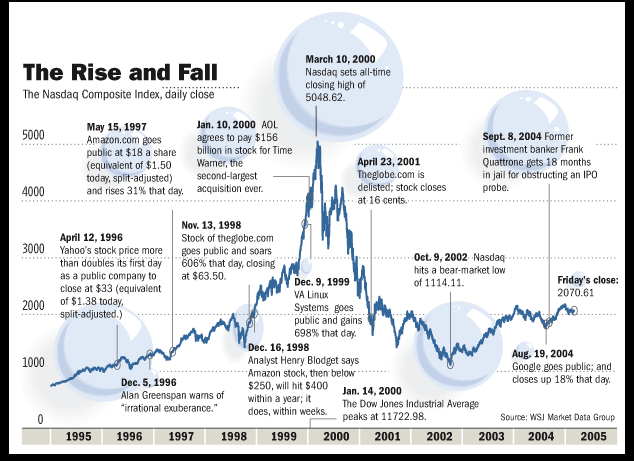

For instance, the Federal Reserve cut interest rates 50 basis points in January 2001 with a recession starting four months later. And over the next year and a half, the unemployment rate surged and the S&P 500 fell 39% as the Dot Com Bubble burst.

The Fed also cut interest rates by 50 basis points on September 18, 2007, 17 years to the day before the latest jumbo cut. And again, the S&P 500 fell -54% over the next year as the unemployment rate surged and the US fell into recession a few months later.

Now the Federal Reserve once again slashed interest rates 50 basis points. If this echoes 2001 and 2007 - the last two times the Fed did a “jumbo” cut - that means Jeffrey Gundlach may be right and the US is on the brink of a recession.

Or is this time different?

Fewer Similarities than Meets the Eye

I’ve stayed consistent in my view that the US is not on the brink of recession, going on record with this outlook as far back as June 2023.

This has proven correct. And since I still don’t expect a recession, this jumbo 50 basis point cut from the Federal Reserve needs to be viewed in a different light.

When the Fed cuts rates in absence of a recession, the S&P 500 is higher a year later 19 out of 20 times. And since 1971, the S&P 500 is higher 6 months later 100% of the time after the first cut with an average gain of +13%. This combination of a massive easing cycle without a recession is one of the best statistical times to own stocks.

And for now, that is my base case.

I Remain Cautiously Optimistic on the Markets

Could I be wrong and a recession has already started? Of course.

Forecasting the stock market and economy is never 100% certain. This is a game of probabilities. We used factors and history to guide our decisions, but there is no guarantee any thesis will be proven correct.

But from everything I’m seeing, a recession is not around the corner. And while my publicly managed Patreon Portfolio is +43% in the last year - beating the S&P 500 and Nasdaq - I expect the bull run to continue into 2025 (you can join the nearly 1,000 investor in our community here).

And if if my outlook changes, you’ll be the first to know.

Stay safe out there,

Robert