It should be clear to everyone now: Trump is intentionally engineering an economic slowdown.

I flagged this six weeks ago when I laid out the administration’s “controlled demolition” strategy—crashing stocks by stoking uncertainty through chaotic tariff and trade policies, all to trigger a negative wealth effect.

And it's starting to work. For one, the latest trade and manufacturing data shows a bleak picture for the economy in the near-term thanks to Trump’s tariffs:

49% drop in global container bookings

64% drop in U.S. imports

30% drop in U.S. exports

28% drop in global shipments

22% drop in new orders

20% drop in general business conditions

This is why the VIX—Wall Street’s “fear index”—spiked last week to levels not seen since the COVID crash in March 2020. But just like back then, we used that panic to our advantage. While hitting the buy button might’ve felt queasy in the moment, those positions are well in the green—and I’m even more bullish on their long-term upside now.

Why? Because I believe the next phase is coming: Fed rate cuts.

While Powell remains tight-lipped, Fed Governor Waller said yesterday the Fed is likely to cut rates even if Trump backs off further on tariffs. That fits the thesis I laid out in March: manufacture market chaos, slow the economy, then unleash stimulus.

Plus, we now have Treasury Secretary Scott Bessent doing damage control. In a wide-ranging interview yesterday, he laid out the administration’s current stance:

All options on the table if market chaos continues including Treasury toolkit to boost buybacks

Tax cuts will be much more than extending the Tax Cuts and Jobs Act

The "VIX spike" has likely peaked

Will start interviewing successors for Jerome Powell this fall

Nobody in the administration thinks tariffs on China are sustainable

US dollar is still the global reserve currency and we have a strong dollar policy

US to create a global trading system centered around the US, not China

Had Bessent said all this a few weeks ago, markets might have avoided the panic. But again, the chaos appears to be by design. That makes our buys during last week’s selloff - our most active week since March 2020 - look even more well-timed.

And it’s why now is the perfect time to review the portfolio—and make a few more strategic buys on beaten down market leaders as the VIX remains in the "spike zone."

Core Portfolio (SPY, QQQ, etc.)

As we talked about in last month's portfolio update, the main US indexes - the S&P 500 and Nasdaq - were pricing out the favorable policies many investors expected Trump to focus on early on his his presidency. This included tax cuts, deregulation, and spending cuts.

Then came Liberation Day, which triggered one of the fastest sell-offs since the COVID Crash. Luckily, we had raised our cash position to its highest level in three years in anticipation of this crash. This was a risky - and unusual - move by me since I have to be right on both the exit and the re-entry.

But so far, we have nailed both. Not only did we raise our cash position to 20% prior to the crash, we successfully re-deployed half of that into the market near the most recent lows:

That doesn't mean we won't re-test the lows - or go even lower - if the Trump administration starts to ramp up the trade war rhetoric again. But the key is we now know where the "Trump Put" lives:

20% decline on the S&P 500

The 30-year Treasury at 5.0%

The 10-year Treasury at 4.5%

We still have a lot of technical damage on both indexes. The S&P 500 is trading well below its 200-day MA:

And it's a similar story for the Nasdaq, which is trading below a downward sloping 200-day MA along with a "death cross" whereby the 50-day MA crosses the 200-day MA:

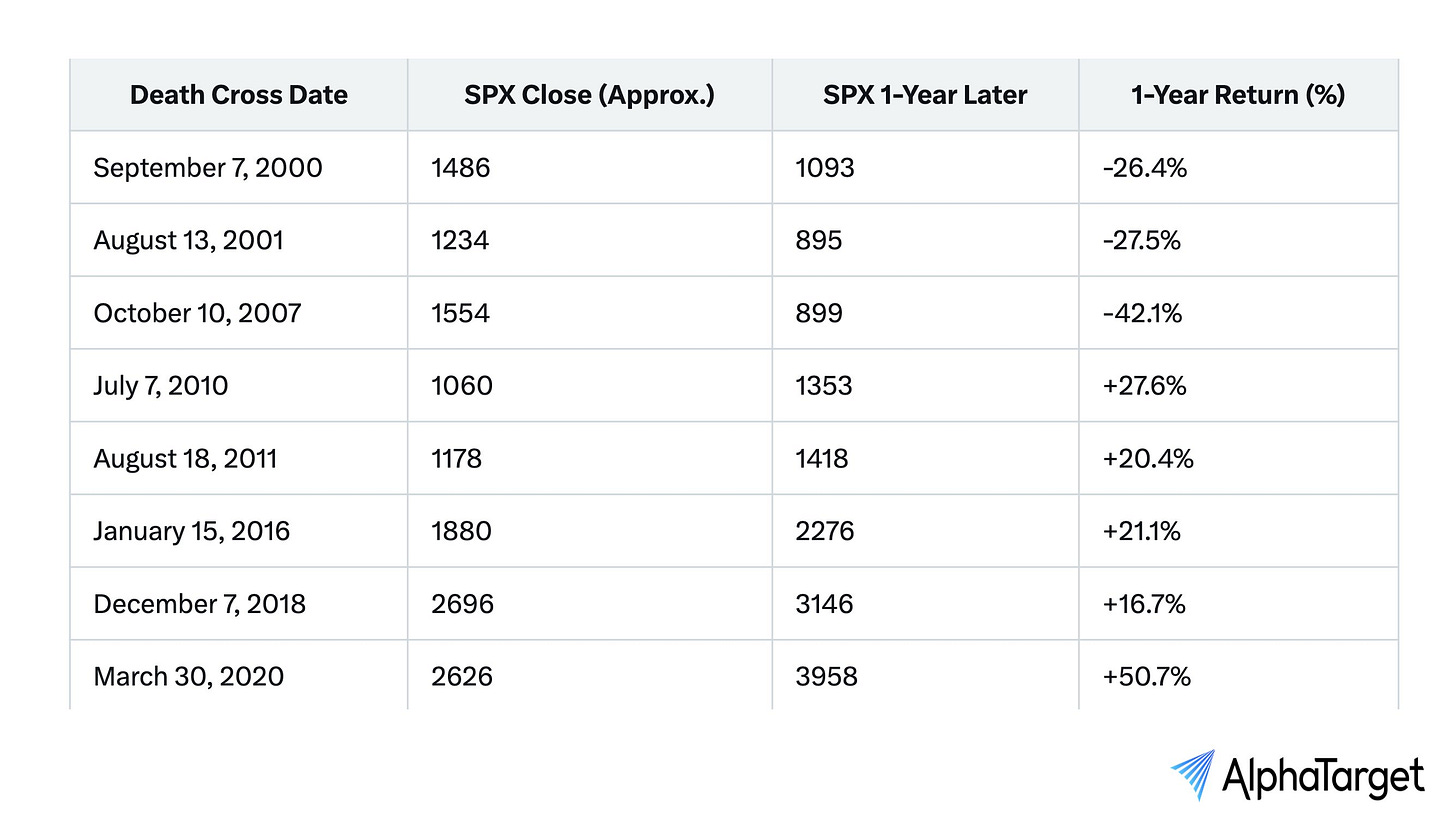

This is the first death cross - where the 50-day MA crosses the 200-day MA - since March 2022 for the S&P 500. Historically, the S&P 500 has averaged a 6.3% gain in the 12 months following a death cross, with the index rising two-thirds of the time during that period.

While the death cross has preceded some significant bear markets—such as those in 1929, 1938, 1974, and 2008—it has also occurred during periods that did not lead to severe downturns. Therefore, while the death cross can be a signal of caution, it does not guarantee a prolonged market decline.

Plus, if you have a multi-year time horizon like me, it is still worth adding to these positions. But we could see more downside in the near-term.

Whatever you do, don't wait to try and time "the bottom." You will most likely miss out.

New Members: Allocate 1% of your portfolio to the SPDR S&P 500 ETF (SPY and 1% to the Invesco QQQ Trust (QQQ).

Mega Cap Tech Holdings (GOOGL, AAPL, etc.)

One theme of the Trump team's rhetoric has been a failure of globalization.

Even Trump's crypto czar David Sacks had this to say on a recent podcast:

"We've had a bipartisan consensus in Washington for decades that unfettered free trade is a good thing. But throwing open our markets to these foreign products without thinking about the consequences was a mistake."

Last week, this messaging seemed like a death sentence for Magnificent 7 stocks as these companies are the poster children for globalization. While we cut our largest Magnificent 7 position - Microsoft (MSFT) - by 75% back in February, we still have a hefty allocation to these stocks.

That begs the question: is it time to buy the dip on the Magnificent 7 tech stocks like Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), and Tesla (TSLA) or are the risks still too high?