Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

My best investment over the last year (and it’s still a buy)

Who the market thinks will win the US presidential election

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Not sure if you’ve heard, but there’s an election in a few weeks.

At present, it’s a dead heat between Donald Trump and Kamala Harris. The former president has the edge on betting markets like Kalshi…

…while the current vice president has the lead in aggregate national polls:

Over the next few years, I expect the broader market to rise regardless of who wins.

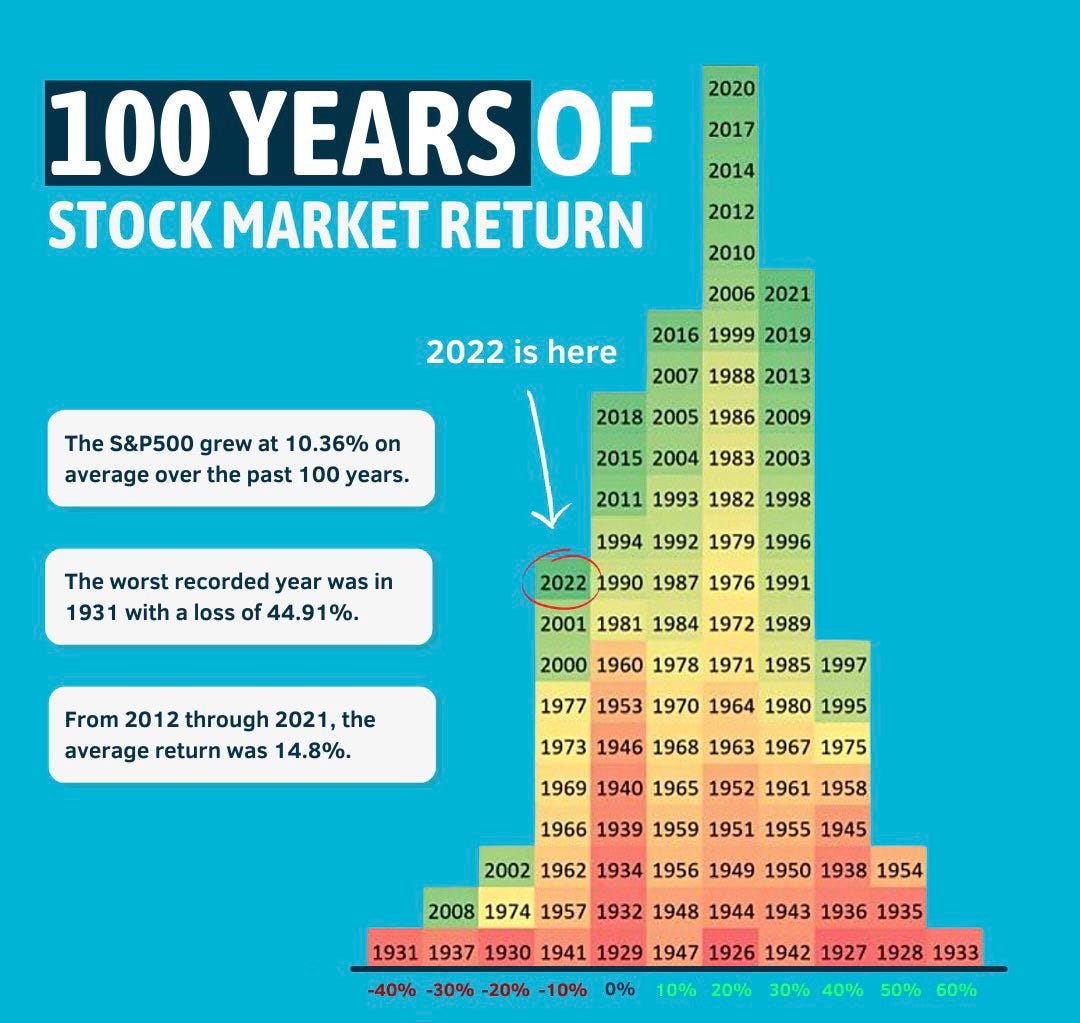

This is simply because stocks tend to go up more years, as the S&P 500 has finished in positive territory for the year 75% of all years over the last century.

Whether Republicans or Democrats control the White House has had little-to-no impact on the broader market over long periods of time:

So you should stay invested regardless of who wins. However, there will certainly be sectors that do better under certain candidates.

And we’ll dig into those now.

Three Stocks for a Trump Win…

Trump will likely deregulate certain industries.

The most obvious to me is financials, which we are currently seeing rally as Trump gains in the polls and betting markets.

Trump pushed for deregulation in the banking and financial sectors, particularly targeting Dodd-Frank reforms. A return to this policy would likely benefit banks and financial services firms by reducing compliance costs and increasing profitability. If I were playing this, I’d focus on regional bank ETFs like the iShares US Regional Banks ETF (IAT) as they are much more sensitive to changes in policy.

Energy stocks could also benefit as Trump has historically supported policies that boost fossil fuel production, including deregulation of oil and gas industries and expanding drilling on federal land. That could benefit companies operating in the oil and gas space, particularly pipelines like those held in the Alerian MLP ETF (AMLP):

Lastly, Trump has been courting donations for the crypto community. I’d expect crypto to stage a major rally if he wins, which you could play via a Bitcoin ETF like the iShares Bitcoin Trust ETF (IBIT):

While these will likely work great in the event of a Trump presidency, the playbook will be different if Kamala prevails.

…and Three Stocks for a Kamala Win

If Kamala Harris wins the presidency, we’ll likely see a focus on clean energy, healthcare reform, and social justice initiatives.

Each of these areas will have a significant impact on certain sectors of the market, and here are three stocks that could benefit the most. On the clean energy front, we can expect continued support for policies that push renewable energy and a faster transition away from fossil fuels.

NextEra Energy (NEE) is one of the world’s largest renewable energy companies, specializing in wind and solar power. As the U.S. continues to prioritize clean energy, NEE is well-positioned to benefit from government contracts and incentives.

Healthcare is another area where Kamala Harris has been vocal about expanding coverage, reducing costs, and pushing for reforms to lower prescription drug prices.

UnitedHealth Group (UNH), the largest health insurance provider in the U.S., could see a mixed impact, but as a giant in the industry, UNH tends to adapt well to policy changes.

You could also play this trend broadly through the Vanguard Health Care ETF (VHT) which holds a broader basket of healthcare stocks like Eli Lily (LLY), AbbVie (ABBV), and Johnson & Johnson (JNJ).

With increased healthcare access and expanded coverage likely under a Harris presidency, both of these plays are poised to capture a larger market share as millions more Americans could enter the healthcare system.

So overall, it doesn’t matter that much on the whole who wins from an investing perspective. But there will definitely be some winners and losers if you drill down to specific sectors.

These six stocks should give you the playbook for how to approach this election. But if you want to see exactly which stocks I’m buying in my personal portfolio, you should join our 1,000 member community on Patreon.

Stay safe out there,

Robert