Before we get started, I wanted to let you know the third episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

How we're at the beginning of a market "regime change"

Which mega cap tech stock looks like the strongest buy on this dip

How Warren Buffett dumping 50% of his Apple stake affects my outlook on the company

Preview of what's to come this week

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Is a Democrat or Republican run administration better for the stock market?

Many investors are asking themselves this question as the US presidential election is only a few months away. If the election were held today, the winner would be a tossup between Donald Trump and Kamala Harris, the latter of which is leading in a recent Reuters poll:

But on the other hand, Polymarket - the world’s largest predictions market - shows former President Trump has a 52% chance of taking the presidency.

Like I said, the race is a toss up for now. But the data on which party is better for the stock market isn’t as clear as you might think.

Let’s Dig Into the Data

Before we get started, I want to make clear that I am not biased towards any political party. I am not on or against your “team” as I believe anyone who makes it to the highest levels in politics is almost certainly a money and power hungry sociopath who doesn’t have my or your best interest at heart.

So while I’ve been called both a Trump supporter and Biden / Kamala supporter before, rest assured my allegiance lies in trying to accurately predict who will be president so I can make money for myself and our 1,000 Patreon Portfolio members.

Because at my core I’m not a democrat or republican… I’m an economist.

Knowing that, let’s dig into what the data tells us about how the stock market performs depending on which political party is in power.

A bird's eye view will tell you that since 1951, the S&P 500 delivered an average annual return of 11.5% under Democratic presidents and 7.1% under Republican presidents, which I’m sure is surprising to many since Republicans are considered pro-markets and pro-business.

But raw statistics are useless without context. For instance, presidents often inherit the economic conditions set by their predecessors, like when Bill Clinton inherited an economy on the upswing from George H.W. Bush during the Dot Com Boom in the 1990s, an economic tailwind Clinton had basically nothing to do with.

While Barack Obama inherited the Great Recession from George W. Bush, an economic downturn he also had nothing to do with.

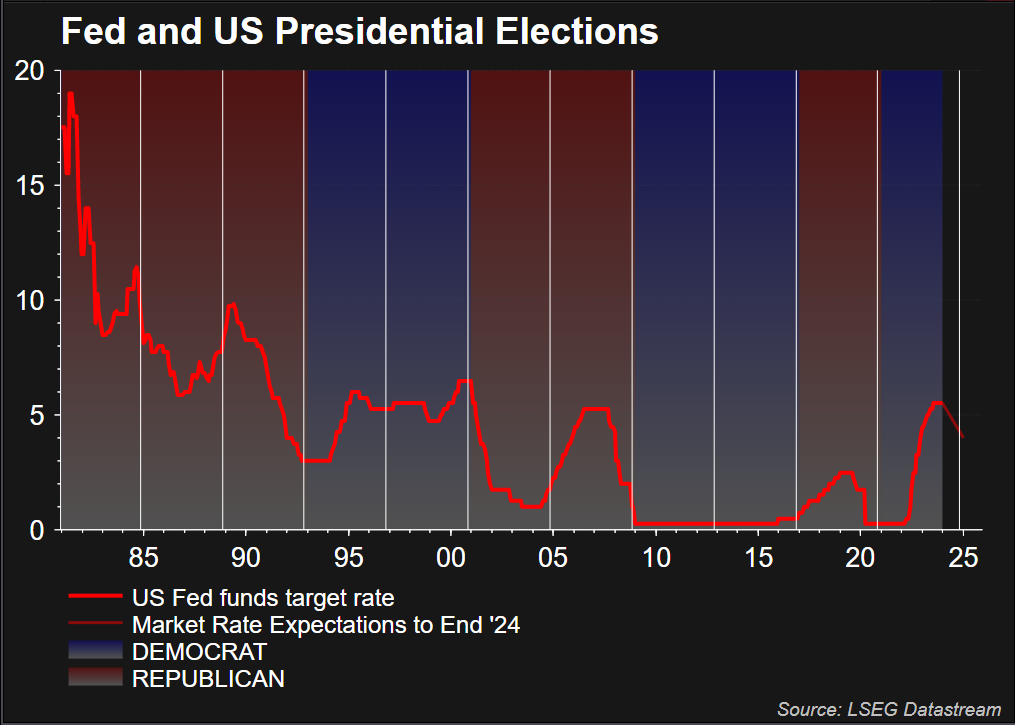

Second, the Federal Reserve’s monetary policies play a critical role in stock market performance. Interest rates were near 0% for nearly the entirety of Obama’s administration, so it’s not a huge surprise stocks performed great during his presidency.

Conversely, the Fed raised rates significantly when Bush Jr. was in office, which at least partially explains why he’s one of three presidents to leave office with a negative annualized S&P 500 return (the others being Herbet Hoover and Richard Nixon).

So looking at raw returns doesn’t really tell the whole story, as many presidents inherit good or bad economies or they get stuck with a Fed that isn’t doing them any favors. This is why there isn’t really a good answer as to which party in power is “better” or “worse” than another.

It Doesn’t Matter As Much As You Think

The fact is stocks tend to go up most years.

In fact, the S&P 500 has finished in positive territory for the year 75% of the time over the last hundred years, and there’s little correlation between these returns and which party is in power.

I’d say the only reliable data point I found in my research is how markets perform when we have a split Congress. In fact, historically, the S&P 500 has averaged annual returns of 13.4% during periods of divided government, compared to 10.7% during unified government.

This trend is often attributed to legislative gridlock, which prevents significant policy changes - like altering the corporate tax code, sweeping regulatory reform, and austerity bills - that could negatively affect markets.

So overall, markets tend to go up regardless of who’s president. But if you want to tip the scales in the market’s favor, play both sides and root for a divided congress.

Stay safe out there,

Robert