Before we get started, I want to welcome the +33 subscribers who signed up for the “Let’s Analyze” newsletter in the last week! If you want to join our community, make sure to sign up here:

I’ve worked as an investment analyst since 2011.

During this time I’ve had the pleasure of learning from some of the world’s best and brightest financial minds including John Mauldin, Felix Zulauf, and Jared Dillian.

I’ve also spent a lot of time talking to individual investors, mainly through direct messages on my popular social media channels.

And if there’s one thing I’ve learned, it’s that new investors are terrible at assessing risk.

Are You a Risk Taker?

Every person reading this newsletter has made a risk assessment today.

For instance, let’s say that you’re driving down a busy street during rush hour.

What would you do in this situation? Your decision comes back to how comfortable you are with risk.

If you are a risk-averse driver you would slow down and stop at the yellow-turning-red light. You would then wait for the light to turn green again and be on your way. While you’ve avoided a potential $75 red-light ticket, you will be late for your meeting.

Not everyone would respond that way. Let’s say the driver in front of you decides to go through the yellow light. At that moment, you decide to increase your speed. You know that there’s a chance you could get caught by the red-light camera, but your risk-reward calculation tells you that it’s worth that risk to get to your meeting on time.

Investors make these same risk-reward calculations every day, although the options are less clear-cut than in the red-light example.

Investing is the Study of Risk

Let’s say our driver is sitting at their desk later that day. They just received their paycheck for the month, and as usual they take $500 of that check and add it to their brokerage account.

Unlike the red-light example where there were only two options—stop or speed through the light—the person now has nearly unlimited options to consider. The most risk-averse investor would take that $500 and buy something ultra-safe like US government bonds yielding around 5% per year.

A slightly less risk-averse investor would buy something with tangible value like gold or silver. Or—if they’re feeling bold—a blue-chip dividend-paying stock such as McDonald’s (MCD) that may return 8% per year.

Risk-averse investors are the type of people who would stop at the yellow light. They don’t want to assume the risk of potentially losing money on their investment, so they are compensated accordingly with lower returns. It is the same concept that motivated the driver who chose to be late to their meeting because they didn’t want to risk getting a red-light ticket.

Not everyone is that risk averse, however. An investor more tolerant of risk sees that $500 in their brokerage account and immediately wants to maximize their returns. They know Boeing Co. (BA) has struggled to keep their planes airborne, which has tanked their stock price.

While it’s possible that the stock won’t bounce back anytime soon, there’s a possibility this deep value stock could return 50% if the company repairs its reputation.

Maybe this less risk-averse investor also saw a video on social media discussing a semiconductor stock called Arm Holdings (ARM) that recently went public via an initial public offering (IPO). Though these stocks are very risky, the return could be as high as 100% in a year, so they happily take on that risk.

They may also remember that a coworker told them about a cryptocurrency called Ethereum (ETH), which could return 200% over the next year… or fall -80%.

This investor is the type of person who speeds through the yellow light and risks getting a ticket. This person is willing to potentially lose money on their investment to potentially make more money in the future.

It also means they are interested in high-risk, high-reward investments.

You Must Understand Risk to Excel at Investing

Investment risk boils down to this: the higher the chance that you lose money, the more money you can potentially make.

Said another way, the higher the risk in an investment, the higher the return, while the lower the risk in an investment, the lower the return.

For example, if you buy shares of a blue-chip stock like International Business Machines (IBM) or Johnson & Johnson (JNJ), you can’t expect to double or triple your money in a short time period. Everybody knows McDonald’s and Johnson & Johnson will be around for years to come, so there’s less risk in buying their shares.

On the other hand, you have high-risk assets like Bitcoin (BTC).

Medical Advancements Set to Transform Healthcare Industry

Sponsored By: Biostem Technologies (BSEM)

BioStem (BSEM) is revolutionizing healthcare with regenerative therapies. Unlike traditional treatments, its innovations harness the body’s natural healing abilities.

BioStem developed AmnioWrap2, a tissue allograft used in hospitals nationwide. Last year, revenue surged 1,355%, marking its first profitable quarter with $41.9 million in net revenue, 95% gross profit margins, and $7.9 million in adjusted EBITDA.

BSEM is preparing for an uplisting to a senior stock exchange after a rigorous two-year audit. With a market cap of $144 million, BioStem is one to watch.

Unlock potential. Click here to learn more!

*This is PAID advertising content.

Bitcoin is the world’s first cryptocurrency, a concept that has only been around for 10 years. There’s no guarantee bitcoin (or cryptocurrency in general) will exist in another 10 years. That means investors in bitcoin are rewarded with higher returns for assuming this higher risk.

But this rule cuts both ways, since there’s a greater chance of severe losses when investing in high-risk assets.

Using High-Risk Investing Strategies Safely

A common thread from my thousands of conversations with individual investors is that many people take on too much risk. While they have a general idea how to invest responsibly, they often don’t diversify their portfolio well enough or they bet too big on a risky strategy.

To avoid that, you should balance your high-risk investments with a long-term buy-and-hold investing approach.

Holding lower-risk positions is a fundamental piece of high-risk investing. The math is simply too strong to completely ignore long-term buying and holding.

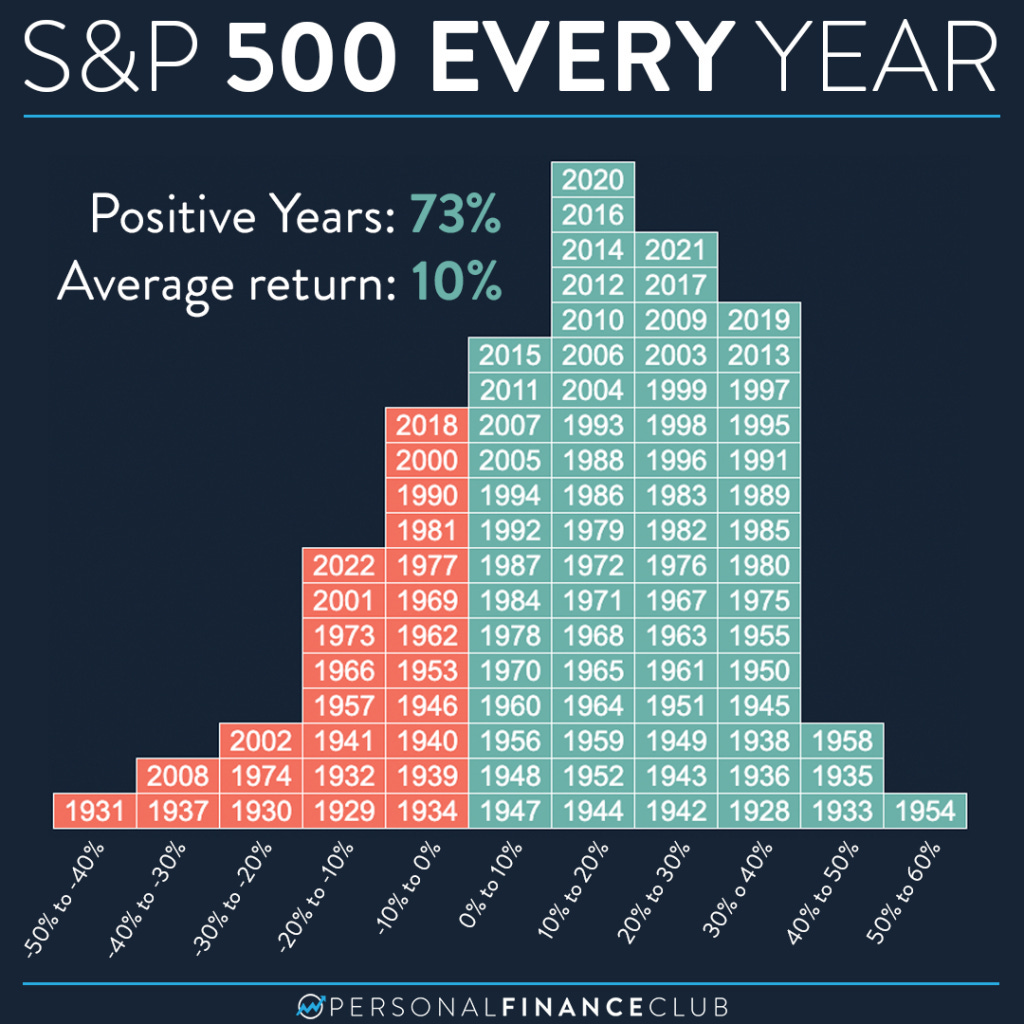

For instance, over the last 90 years the S&P 500 grew in value in 74% of those years. That means that in nearly three-quarters of the years since 1940, investors who simply bought the S&P 500 saw their accounts grow in value!

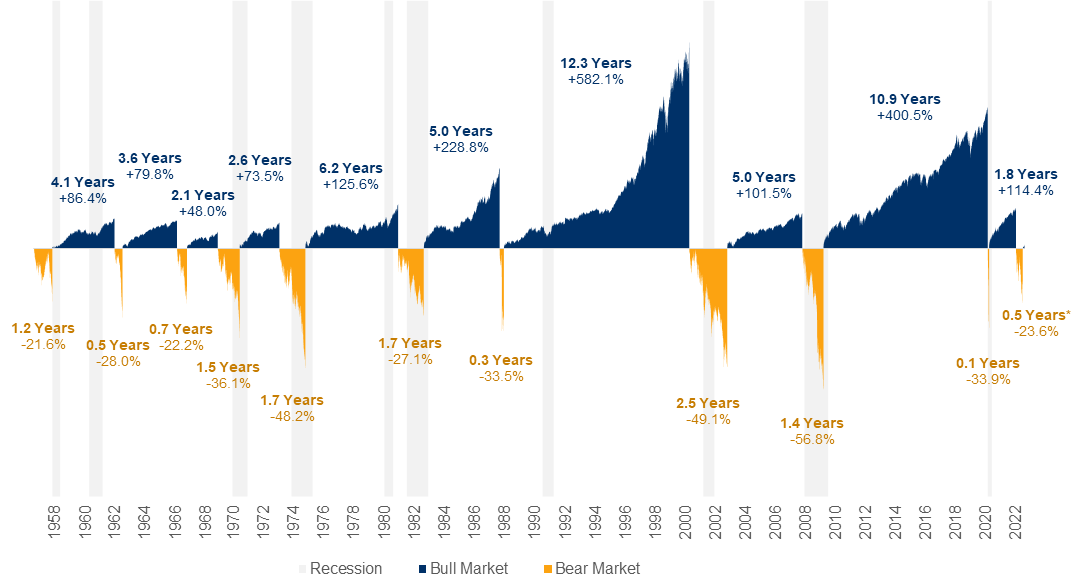

Though many in the doom-and-gloom crowd warn of imminent stock market crashes, the fact is these crashes are extremely rare. In fact, historically the S&P 500 rises for 9 years between every 30% market crash. And for all those looking to “time” the market, remember more money has been lost anticipating market crashes than in the crashes themselves.

As a rule, I keep 80% of my investment portfolio in reliable companies I plan to hold for many years. These are stocks like Alphabet Inc. (GOOGL), Microsoft Corp. (MSFT), and even “trash” stocks like Waste Management (WM) (you can see all 25+ positions in my personal portfolio here). These relatively low-risk positions provide a stable foundation on which I can employ higher-risk strategies.

It’s important to maintain a core of lower-risk, lower-return assets in your portfolio because—frankly—if you only employ high-risk strategies, there’s a good chance you could lose a significant amount of money.

Because when it comes to high-risk, high reward investing, your goal is to turn a little but of money into a lot of money. And trust me, you will be wrong a lot.

So for those who want to invest in small cap stocks, cryptocurrencies, and other high-risk investments, make sure you have a solid foundation in your portfolio.

And if you want to see how I structure my own portfolio, click here.

Stay safe out there,

Robert