We couldn’t have played the last two years any better.

In February 2023, I went on record saying we were in the early stages of a bull market.

This was despite everyone from Elon Musk to Jamie Dimon saying the US was on the verge of a massive recession (which I also debunked at the time). This is a key reason the TikStocks Portfolio finished +44% in 2023, nearly doubling the S&P 500.

At the same time, I also noted we were in the early stages of a crypto bull market. This proved prescient, as Bitcoin (BTC) is +200% since I released that newsletter in April 2023:

But I didn’t stop there. For instance, going into 2024 the average Wall Street analyst stated the S&P 500 would deliver a mere 1% return. This is another forecast I went against the conventional “wisdom” on, stating US stocks had considerable upside.

So far, this has proven correct as the S&P 500 is +24% this year…

…and the TikStocks Portfolio has done even better. In fact, tuning out the bearish narratives is why the TikStocks Portfolio is +42% in 2024 (you can join our +1,000 member community here).

Clearly, I have a nose for forecasting the markets. This makes sense since I’ve dedicated the last 15 years to learning how to make money in stock and crypto markets. That includes heading multiple investment research companies and starting my own firm in 2021.

But what matters now is what comes next for markets. And today, I’ll lay out how I see the next 6-12 months unfolding.

Don’t Fight the Fed

My base case is US stocks remain in the “Goldilocks phase” of the market cycle.

Inflation is down from 4.3% in April last year to 2.4% in Wednesday’s CPI report.

GDP growth continues to rise, with the Atlanta Fed expecting a 2.5% reading for next quarter.

The Federal Reserve is at the beginning of a massive rate cut cycle, with 200 basis points or 2% worth of cuts expected in the next 12 months.

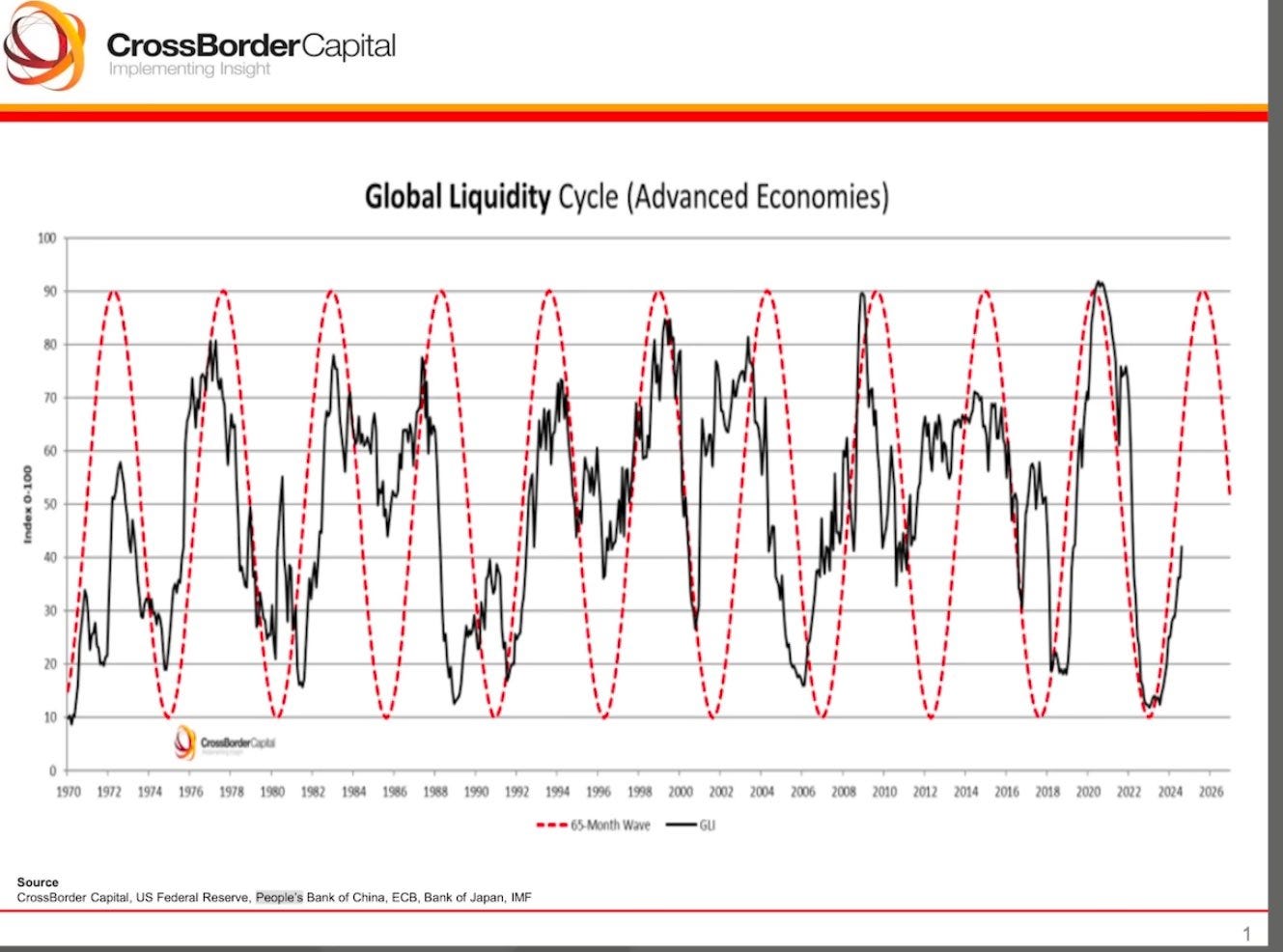

When you consider that central banks globally are also cutting interest rates, this tells me the global liquidity boom we’ve talked about all year continues.

That is good news for risk assets, but especially Bitcoin and crypto assets as they are much more sensitive to changes in global liquidity.

But this liquidity tailwind isn’t the only reason to remain optimistic.

The AI Boom Isn’t Going Anywhere

Companies that consistently grow their earnings often see their share prices follow suit.

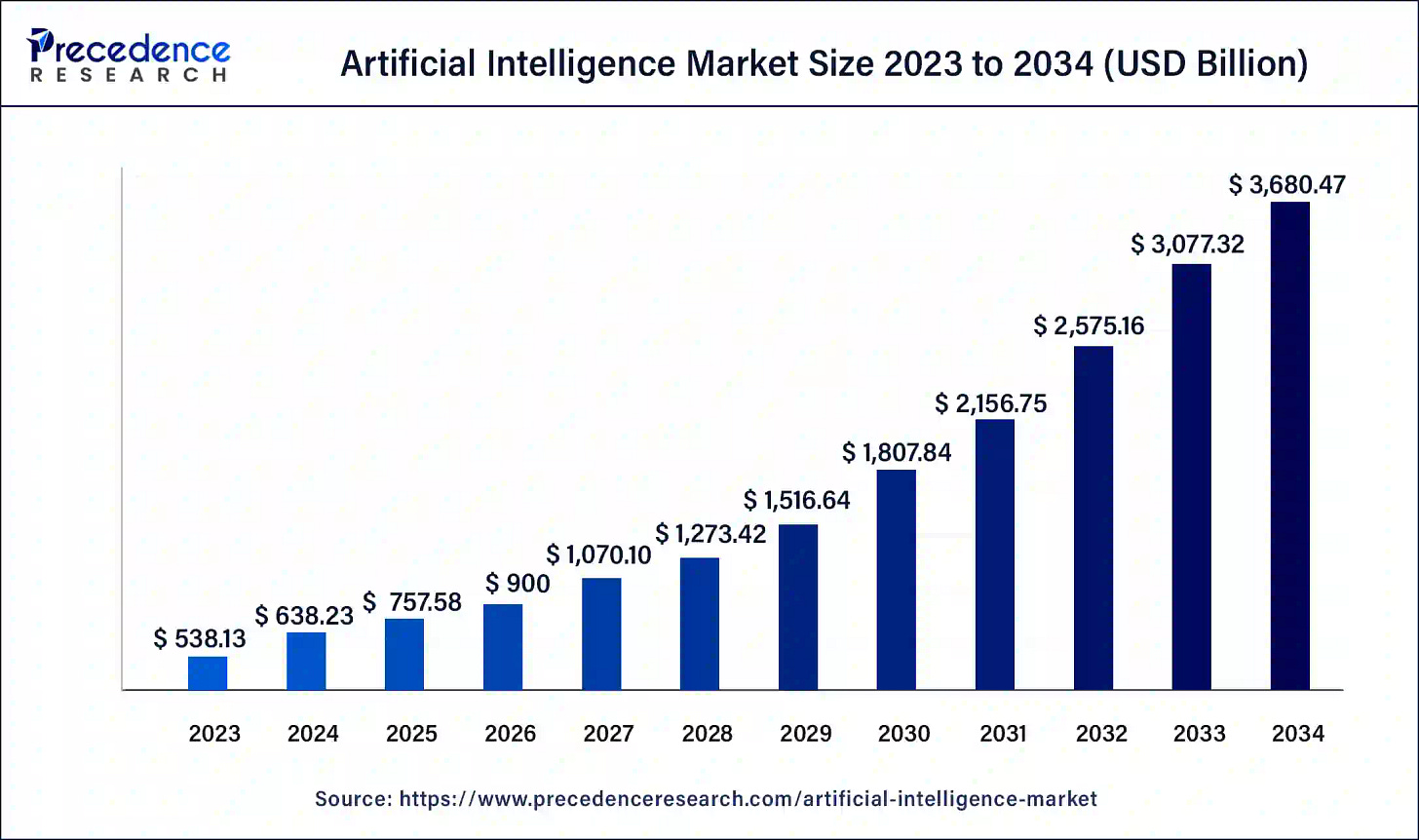

And right now, artificial intelligence (AI) is poised to supercharge earnings growth across industries.

The AI revolution isn’t a passing trend—it’s the biggest productivity boom since the internet. Companies like Nvidia (NVDA), Microsoft (MSFT), and Alphabet (GOOGL) are pouring billions into AI, developing tools that will redefine how businesses operate.

This productivity boom isn’t just a tech story. AI adoption is expected to add $15.7 trillion to the global economy by 2030, according to PwC. From healthcare and logistics to retail and manufacturing, companies are using AI to streamline operations, reduce costs, and unlock new revenue streams. This trickles down into higher profit margins and earnings growth—exactly what the market rewards.

The takeaway is clear: The AI-driven earnings growth story is just beginning, and companies leading in this space remain critical holdings in your portfolio. This is a key reason I stated Nvidia (NVDA) was still a buy back in February (the stock is +78% since).

While we’ve discussed both of these tailwinds before, there’s a new catalyst for higher stocks over the next two years we’ve yet to discuss.

The US Deregulation Boom is Beginning

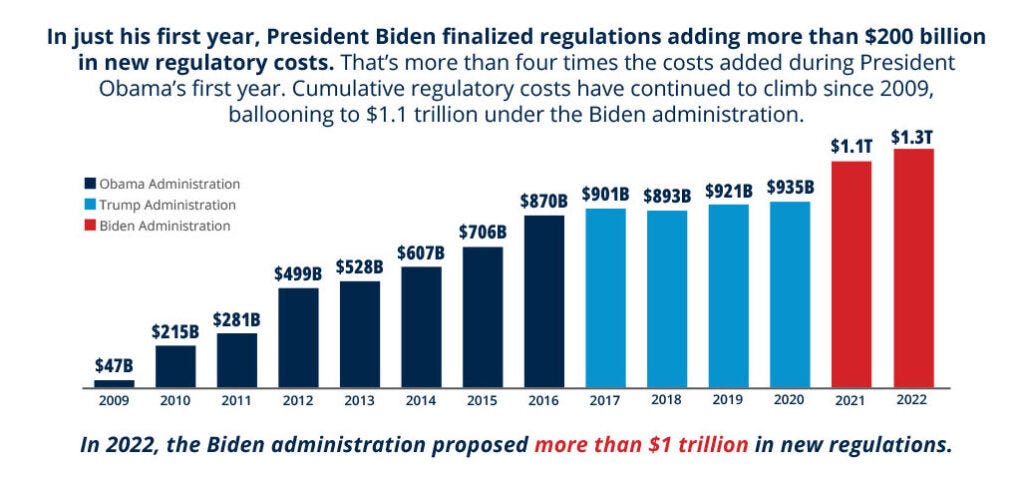

President-elect Donald Trump has made it abundantly clear that his administration will prioritize dismantling large parts of the U.S. regulatory apparatus.

Whether you think that’s a good idea or not is irrelevant. That fact is it is about to happen. And as investors, that’s good news.

Less regulation often translates to higher profits, as companies spend less on compliance and face fewer barriers to expansion. This shift can significantly benefit industries like financials, energy, and technology, which have faced heavy scrutiny and compliance costs over the past few years.

Take, for example, the tech sector. Lina Khan’s departure from the FTC is likely to lead to a rollback of antitrust scrutiny on big tech companies like Alphabet (GOOGL), Amazon (AMZN), and Meta (META). These firms could regain the freedom to pursue major acquisitions and business expansions without facing regulatory roadblocks, setting the stage for new growth opportunities.

Meanwhile, the financial sector is also poised to thrive. Trump’s first administration was marked by efforts to roll back Dodd-Frank Act provisions, and we could see a similar playbook this time. Banks, especially regional ones, could experience fewer compliance costs and higher profitability.

The combination of deregulation, global liquidity, and the AI productivity boom creates a trifecta of bullish forces for the next 6–12 months. We’re entering a market environment with enormous potential, and I’m positioning the TikStocks Portfolio to capitalize on it.

And if you want to see how I’m positioning to profit from this, you can join the +1,000 TikStocks Portfolio community members who already rely on my investing analysis for their own portfolios.

Stay safe out there,

Robert