Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Why Wall Street is always wrong about everything

How much longer can the bull market run?

Which cryptocurrencies are buys right now?

Preview of this week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Everyone is making so much money right now.

Stocks, Bitcoin, real estate, and gold are at all-time highs. While this might come as a shock to some, it shouldn’t be a surprise to anyone who’s been reading this newsletter.

Back in February 2023, I was telling you we were likely at the start of a secular bull market—one that could last for years. And I’ve consistently reiterated this outlook over the past two years, even when the consensus was bearish.

While many bought into the doom-and-gloom “recession” narratives, I went against the grain, arguing that fears of an economic downturn were overblown. Looking back, it seems obvious—but at the time, it was a wildly contrarian call.

This is a key reason why the TikStocks Portfolio is up an incredible 55% in 2024—my best year ever.

While I’ve made hundreds of thousands of dollar for myself, I’ve made millions for our community members.

And here’s the thing: I don’t think the party is over yet.

What’s a Secular Bull Market?

A few weeks ago, my mom asked me about something she’d heard me mention before: secular bull markets.

She’s in her 70s, and while her son is a well-known investment strategist (who was even featured in MarketWatch last week), she doesn’t know much about investing.

I explained it to her like this: Imagine you’re baking a cake, and even though there are moments where the batter looks lumpy or the cake doesn’t rise perfectly at first, the end result still turns out great.

A secular bull market is similar—it’s a long-term trend where the stock market keeps rising over many years, even if there are occasional dips or rough patches along the way.

It’s not about things being perfect all the time, but about the overall direction being up. Simple, steady progress over the long haul.

And based on my analysis, we’re likely in a secular bull market right now.

Secular Bull Markets 101

A secular bull market means the general trajectory for stocks is “up.”

These rare and powerful bull markets are driven by long-term forces like earnings growth, falling interest rates, and transformational technological advancements.

While the overall path for stocks is higher during these periods, they’re not without their challenges. Bear markets, recessions, and even crashes can and do occur along the way.

But just like in the baking analogy, the “big picture” is what matters: stocks rise more often than they fall.

And based on my analysis, this dynamic is likely to persist for many more years.

A Brief History of Secular Bull Markets

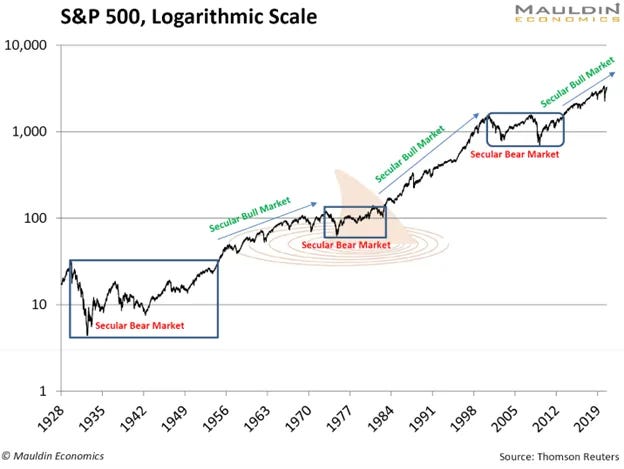

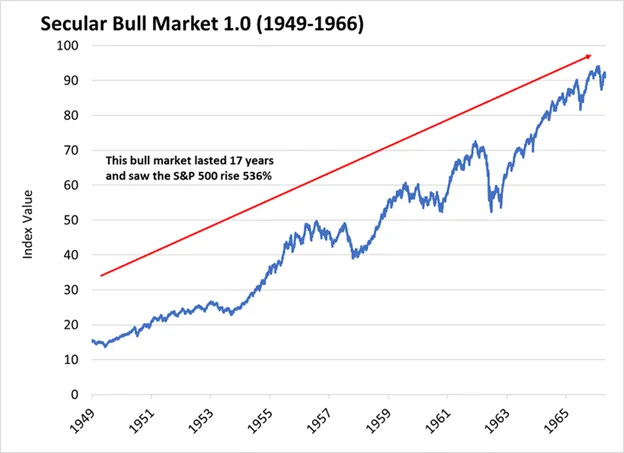

Since World War II, there have been three secular bull markets.

The first ran from 1949 to 1966, during which stocks rose 536% (an annualized return of 31%):

And it wasn’t smooth sailing. The Korean War, Cuban Missile Crisis, and the assassination of President Kennedy all created significant turbulence. Yet, despite this “wall of worry,” stocks still marched higher.

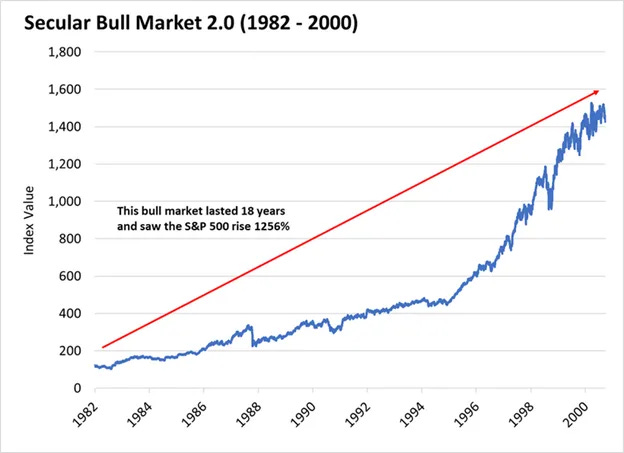

The second secular bull market was from 1980 to 2000. This era saw the S&P 500 rise a staggering 1,256%, even in the face of two recessions, the Gulf War, Black Monday (the worst single day in market history), and the Savings and Loan Crisis:

So, this brings us to the big question: how long can the current secular bull market run?

Secular Bull Market 3.0

The secular bull market is currently alive and well.

My analysis shows this secular bull market likely started in 2013 when the S&P 500 breached its previous secular bull market high:

Previous secular bull markets last between 15 and 20 years (depending on what you use for a start date). Since the current secular bull market started in 2013, that means the current secular bull market should last another 5 to 10 years at minimum.

And assuming Secular Bull Market 3.0 delivers returns like previous cycles, that means we could have between 150%-300% gains in the S&P 500 during that period:

And really, those estimates are conservative when you factors in the tailwinds the market has working in its favor:

Falling Interest Rates: Central banks worldwide are pivoting to more accommodative monetary policies, reducing borrowing costs and fueling growth. Lower rates also drive capital out of bonds and into equities.

Global Liquidity Boom: Central banks cutting rates simultaneously creates a flood of liquidity in the financial system, a proven tailwind for risk assets like stocks and crypto.

Pro-Business Environment: With a pro-business administration coming into Washington, market sentiment is high as deregulation and potential tax cuts add to the bullish outlook for equities.

Strong Fundamentals: This year’s earnings season was robust, with S&P 500 earnings growing 5.8% year-over-year. Combined with resilient GDP growth and cooling inflation, this creates an environment ripe for equity gains.

And while I know being bearish all the time is intoxicating (I used to be one), it really is a poor investment strategy.

Because if you look at the math on long-term returns for US stocks, it doesn’t make sense to have a bearish bias. Instead, your goal should be to catch secular bull markets and ride them until they end… not constantly look for the next crisis. That’s what we’ve done for years with our more than 1,000 TikStocks Portfolio members (you can join our community here).

And as you can see from our recent member testimonials…

…the results have been great:

But either way, just remember that while bears sound smart, bulls make money.

And I plan to make a lot more money.

Stay safe out there,

Robert