Before we get started, I want to welcome the +51 subscribers who signed up for the “Let’s Analyze” newsletter in the last week! If you want to join our community, make sure to sign up here:

The stock market is hard to predict.

It takes years of understanding the factors that drive markets - like corporate earnings - to even begin forecasting the market.

But I have a pretty good track record. For instance, in the last year in this free newsletter I correctly predicted the bull market in crypto, the current US economic expansion, a continuation of the S&P 500 bull market, and even that Nvidia (NVDA) was still a buy back in February (the stock is +63% since).

I am definitely not right every time. In fact, I get things wrong all the time. But the goal with investing is to be right more than you’re wrong, and I do a good job of that evidenced by my portfolio’s +43% return in the last year (you can see my full portfolio here).

But unless you’re a professional, you probably shouldn’t be picking individual stocks on your own…

…because the odds are stacked against you.

Stacking the Odds in Your Favor

I’ve gone on record many times saying 99% of investors should only hold S&P 500 index funds.

The S&P 500 index automatically rebalances for you. Unlike if you hold a portfolio of individual stocks you picked yourself, the S&P 500 index continually adjusts its holdings to reflect the top 500 companies in the U.S. This means you always have exposure to the most significant and profitable companies without having to actively manage your portfolio.

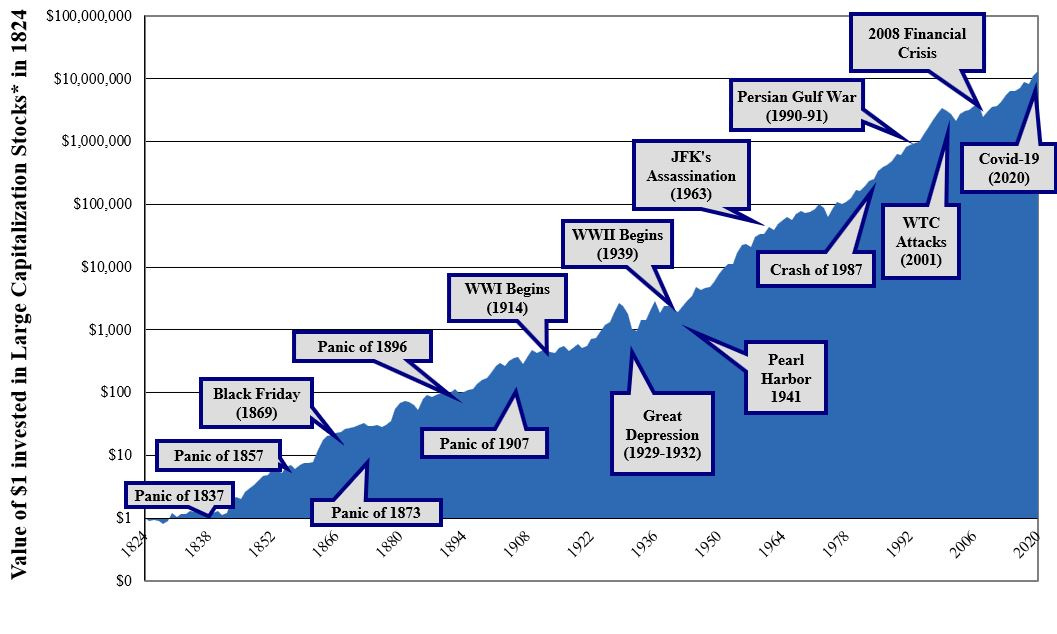

The S&P 500 index also has delivered average returns of 10% per year since 1921. And for the skittish investors, the index has also bounced back from every crash to hit new all-time highs. That includes everything from the Great Depression to World War II to 9/11.

These are all great reasons to own S&P 500 index funds and eschew individual stocks (unless you’re working with a professional).

Because most new investors don’t realize picking individual stocks is really hard.

The Challenges of Stock Picking

I get the appeal of stock picking.

Heck, I’ve made a career out of picking individual stocks and building custom portfolios from scratch. But while I’ve had plenty of success with my own portfolio and those of our members, that is the exception rather than the rule.

Research by Hendrik Bessembinder at Arizona State University reveals that a small fraction of stocks drive the market's overall gains. Specifically, just 86 stocks have accounted for half of the total wealth creation in the stock market over the past 90 years, while the remaining 96% of stocks collectively matched the returns of one-month Treasury bills. Additionally, only 22% of stocks in the S&P 500 outperformed the index itself from 2000 to 2020.

Further, a study by S&P Dow Jones Indices found that the majority of actively managed funds underperform their benchmarks over a long-term period. This aligns with Bessembinder's findings, highlighting that most stocks fail to outperform even risk-free investments like Treasury bills.

To put it in perspective, 3 stocks (.01%) have accounted for 10% of the stock market's lifetime wealth creation, while 72 stocks (.26%) have contributed to 50% of the market's wealth creation. That means if you didn’t have one of those 72 stocks in your portfolio, you would have missed out on half of the total wealth generated by the stock market.

This concentration of wealth creation means that unless you are exceptionally skilled or lucky, the odds of picking these top-performing stocks are incredibly slim.

It’s Not as Easy as it Looks

Given the difficulty of picking individual stocks and the high concentration of wealth creation among a small percentage of stocks, most investors are better off sticking with diversified index funds like the S&P 500.

That’s especially true since I expect the S&P 500 index to finish higher than its current level by the end of 2024. But either way, by investing in the S&P 500 you can ensure steady growth and avoid the pitfalls of trying to predict the unpredictable.

And if you do want to pick individual stocks, I’d highly recommend working with someone who has experience in stock analysis and portfolio construction. And if you want to see which individual stocks I hold in my own portfolio and learn my investment process, click here.

Stay safe out there,

Robert