Imagine it's January 2020 and you are trying to forecast what markets will do over the next four years.

Then all of a sudden, you get a message from the future that says the following events will transpire:

Global pandemic that shuts down the entire global economy

Inflation hits its highest level in 40 years

Oil prices hit their highest level since 2008

The Federal Reserve raises interest rates to their highest level in 30 years

Russia invades Ukraine and threatens nuclear war

Israel engages in conflict with Palestine, Iran, and Lebanon

Given this outlook, you might assume that stocks would be flat or even down over this period—after all, these are significant macro headwinds to face in just four years.

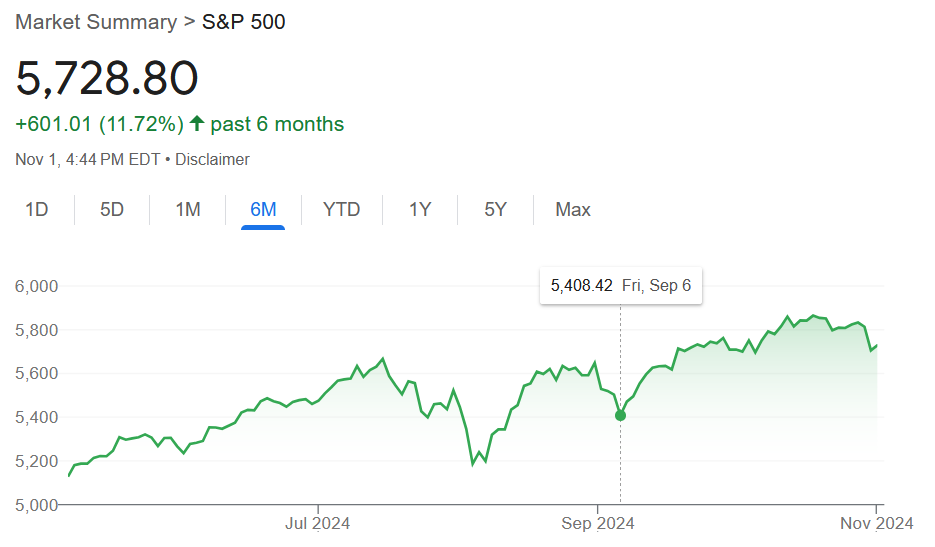

Yet, to the surprise of many, the S&P 500 has nearly doubled since January 2020.

I tell you this because I know many of you are worried about how the upcoming presidential election may impact the markets.

But while there will be short-term noise - which we'll discuss today - you should keep climbing the wall of worry.

The Market is Priced for a Trump Victory

I already revealed on my weekly podcast who I'm voting for (you can listen on Spotify and Apple).

But what I want doesn't matter. We live and invest in a world where many decisions are out of our control. Instead of complaining about what we want to happen, we need to plan and invest around what has the highest probability of happening.

And the markets have been signaling a Trump victory. Bitcoin at all-time highs, US government bond yields surging, and even a rally in Truth Social (DJT) imply the market thinks Trump has the edge.

Betting markets, like those on Polymarket and Kalshi, also give Trump the edge as of this writing:

But that has major implications on its own. A Trump victory would likely lead to a less dovish Federal Reserve, as he has openly said the executive branch should have more influence over the central bank.

Whether I think it's a bad idea or not doesn't matter. The fact is the Fed will not like having their authority challenged and they can hit back by slowing interest rate cuts in the near-term. It’s also true Trump could prevail in gaining more influence over the central bank, which likely means rates would go down even faster in the long-term.

As I've said, the Trump playbook remains long financials, energy, and crypto. We're positioned well for this environment with our positions in Berkshire Hathaway (BRK.B), Bitcoin (BTC), Ethereum (ETH), and our other crypto holdings.

But we need to have a plan for if the market is wrong as well.

What's a Few Trillion Between Friends?

We've already covered how both Kamala and Trump will keep blowing out the deficit.

Harris would continue the Democratic push for massive social programs and climate initiatives, similar to Biden’s $6 trillion budget proposal. Medicare for All and climate-focused spending, which Harris supports, would lead to further ballooning of the deficit.

From a long-term investing standpoint, that's really all you need to know as higher deficit spending is a positive for asset prices. But from a near-term investing standpoint, I'm not sure markets will be too thrilled with a Kamala victory. That's only because - according to the indicators I outlined earlier - the market thinks Trump will win. If the market is caught off guard, we will likely see a short-term pullback in stocks.

My target for this is near the September 6th low, as this is when it seems the market started to price-in a Trump victory.

But while the market may give back some short-term gains in the event of a Kamala victory, I expect this pullback to be short-lived.

Which means you need to have your buy list together.

Your 2024 Election Playbook

There’s one trade I expect to do well in the short-term no matter who wins…