Why Stocks Don’t Care About War, Protests, or Chaos

These moments in history are always buying opportunities...

Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

How my investing strategy is changing due to new Middle East war

How stocks historically react to social unrest

My outlook for the US dollar in light of the Big Beautiful Bill

Update on my near-term market outlook

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

I live about five miles from downtown Los Angeles.

Most days, that doesn’t mean much. But lately, it’s felt like a front-row seat to chaos. Protesters have blocked intersections. Entire city blocks are occupied. Police in riot gear patrol the streets. Curfews have been issued. Fires lit. Drones buzz overhead. Helicopters circle. It’s like living in a dystopian movie.

Then came Thursday night. Israel launched a strike on Iran, killing several top military generals. Hours later, Iran retaliated with hypersonic missiles raining down on Tel Aviv.

The markets reacted instantly. Nasdaq futures dropped nearly 2% in overnight trading. And my phone lit up with messages from the TikStocks Portfolio Discord all asking the same thing:

“How is this going to affect the market?”

Here’s the honest answer: it won’t. Not even a little.

That may sound cold. But this isn’t a moral judgment—it’s a market reality.

And the data backs it up.

The Link Between Markets and the “Real World”

If there’s one thing that consistently surprises new investors, it’s this:

The stock market doesn’t care about social unrest or war.

Let me take you back to 1992. That year, Los Angeles exploded after the acquittal of four police officers in the beating of Rodney King. Over 60 people died. More than 2,000 were injured. The National Guard was deployed. Neighborhoods burned. It was the largest civil disturbance in modern U.S. history at the time.

And what did the stock market do? It kept going up.

The S&P 500 rose +7.6% in 1992. From the bottom of the Gulf War panic in 1991 to the end of 1993, the market climbed nearly +30%.

The same was true in 1968 during the assassination of Martin Luther King Jr. and the riots that followed. It was true in 2020 during the George Floyd protests and the COVID lockdowns. And it’s true now.

And it’s the same dynamic for military conflicts.

Buy When the Canons are Firing

The instinct during wartime is to assume markets will collapse. After all, if bombs are falling and headlines are screaming “World War III,” how could stocks possibly go up?

But historically, they almost always do.

Just look at the data. Over the past 80+ years, the S&P 500 has experienced dozens of geopolitical shock events—wars, terrorist attacks, assassinations, bombings, you name it. And in nearly every case, markets bounced back fast.

After Russia invaded Ukraine in 2022? The S&P was up 13.5% a year later.

After the U.S. pulled out of Afghanistan in 2021? Stocks rose 12%.

Even after Pearl Harbor, one of the most shocking attacks on U.S. soil, the market was higher one year later.

In fact, if you go back through every major geopolitical shock from 1940 to today, the average return 12 months later is +7.4%, and the market was higher 65% of the time.

Why? Because markets aren’t pricing morality—they’re pricing earnings, liquidity, and policy.

Unless a conflict disrupts those three things, it’s usually just noise. So yes, missiles hit Tel Aviv and Tehran. Protests are happening 10 miles from my house. But no—this won’t break the market.

If anything, history suggests it’s a buying opportunity.

Here’s What Really Moves Markets

I’m not saying what’s happening doesn’t matter. It matters deeply for people’s lives, communities, and the broader social fabric.

But for markets? These events rarely, if ever, translate into significant earnings pressure or structural breaks in the flow of capital.

Just look at what’s happening now. Trump is encouraging Israel’s war with Iran. He’s pulled embassy staff. He’s telling media outlets that “Iran will not get a nuclear weapon under my watch.” Oil prices are reacting. Defense contractors are rallying.

But the broader market? Still climbing other than some mild weakness on Friday.

Because geopolitical posturing and social unrest - no matter how serious they seem in the moment - do not move markets unless they disrupt cash flow or monetary policy.

Markets are forward-looking. They’re thinking in terms of six to twelve months ahead… not what’s happening on the news today. And unless these events change the fundamental trajectory of the economy—through regulation, capital impairment, or a monetary regime shift—they are noise.

And the truth is, many of these events get overhyped precisely because they don’t matter to markets. Financial media needs something to fill the airwaves. And if the Fed’s on pause and earnings are slow, well… unrest sells.

You Need to Get Your “Buy List” Together

The fact is stocks tend to rise even in the middle of conflict.

The Korean War? S&P rose +16% in 1951. The Vietnam War? Markets compounded nearly 7% annually throughout the entire 1960s. The Iraq and Afghanistan conflicts? From 2003 to 2007, the S&P 500 rose over +80%.

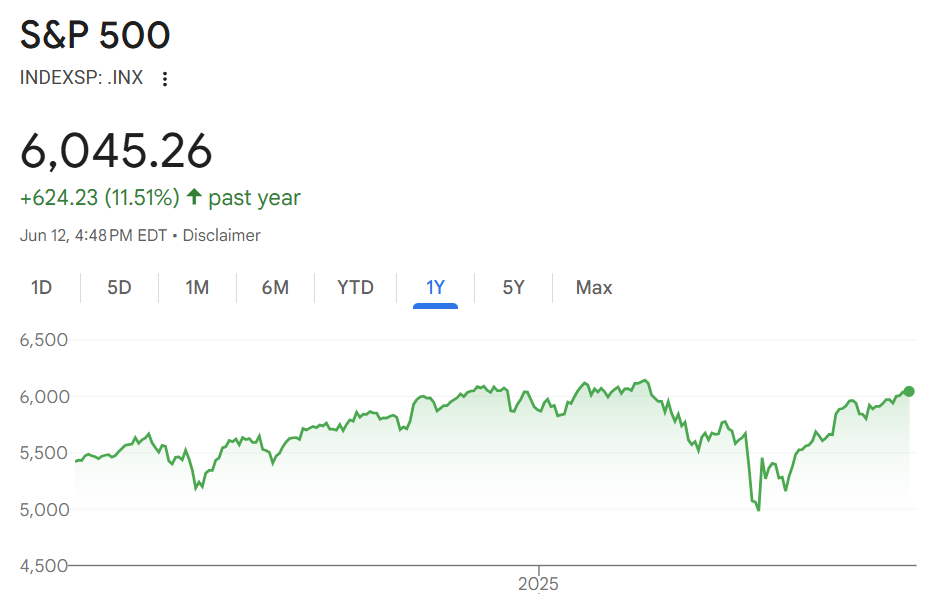

Markets don’t reward moral clarity. They reward capital discipline. And as I write this, while people are marching a few miles away from me and the headlines are blaring “World War III?” in all caps… the stock market is a hair off new 52-week highs.

This is what markets do; they climb walls of worry. They ignore the emotional. They focus on cash flows, liquidity conditions, and earnings resilience. And right now, those things remain intact.

So if you're sitting in cash waiting for “things to calm down,” I’ve got bad news for you: they never really do. The world has always been chaotic. There’s always another crisis, another tweetstorm, another war threat. Instead of sitting on your hands, you need to get your “buy list” together (if you want to see my buy list, join our 1,200 member community here).

Because the fact is the market doesn’t wait for peace. It moves ahead of it.

The job of the investor isn’t to react to headlines. It’s to stay focused on the underlying drivers that actually matter. And if you're doing that, you’ll realize something: this noise will pass, just like it always does.

The market has seen worse—and still hit new highs.

Stay safe out there,

Robert