Before we get started, I wanted to let you know that there is no new podcast this week. However, if you’d like to check out the most listened to podcasts of 2025, they are linked below.

Hate mail from the Frontlines: 3/23/25 (Spotify and Apple Podcasts)

When It’s Time To Buy (You Won’t Want To): 3/2/25 (Spotify and Apple Podcasts)

My #1 Prediction for 2025: 1/5/25 (Spotify and Apple Podcasts)

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

A few weeks ago, a reporter asked me a simple question: “what do retail investors get wrong about investing?”

I paused for a second. Not because I didn’t have an answer—but because I had too many. Should I talk about position sizing? Risk management? The obsession with penny stocks and chasing what’s already up 300%?

Instead, I said this:”They get lured into a game that isn’t actually built for them to win.”

Because if you really wanted to design a system that ensures the majority of market participants lose money, you wouldn’t have to change much. You’d just lean into the behaviors that already dominate retail investing today.

This is basically what already happens. Most market participants lose not because of bad luck, but by design—because they adopt behaviors that favor the market makers, brokers, and algorithms.

And today, I’ll tell you how to spot these traps and avoid them.

Reminiscences of a Stock Trader

One of the most significant pitfalls for retail investors is over-trading.

The allure of reacting to every market movement can be tempting, especially with the constant influx of news and alerts. That’s especially true in years like 2025 when volatility is near multi-year highs and the market hinges on President Trump’s tweets.

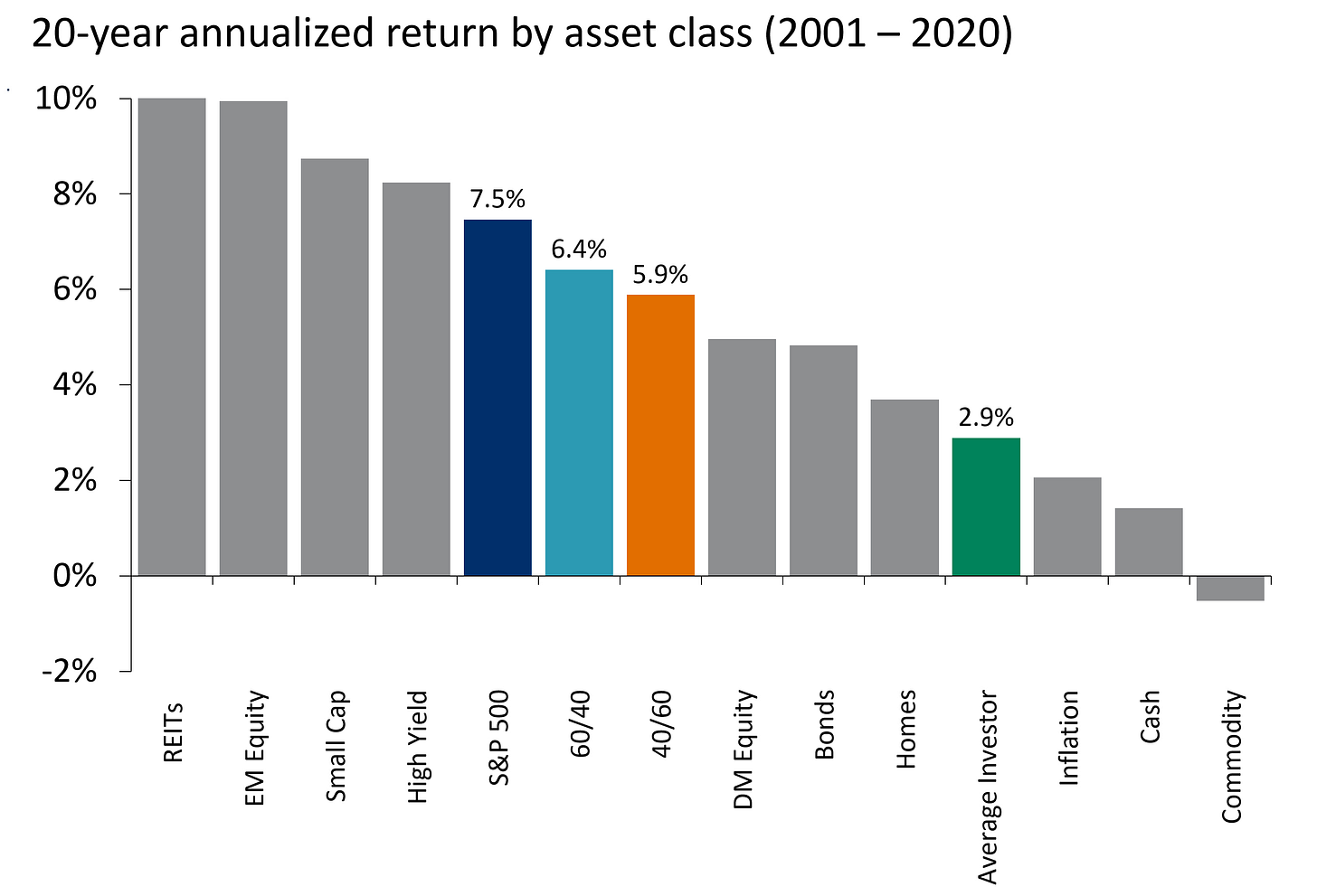

However, data indicates that excessive trading correlates with diminished returns. For instance, a study revealed that the average individual investor underperforms a market index by 1.5% annually, while active traders underperform by a staggering 6.5% each year.

This underperformance is often exacerbated by increased transaction fees and potential tax implications.

The lesson here? Holding positions long-term - like the largest position in my portfolio - is how to generate real wealth. Not with actively trading. For instance, in the 1960s, the average holding period for stocks was around seven years. Today, that duration has plummeted to less than a year.

This shift towards short-termism can be detrimental. Long-term investing not only allows for the potential benefits of compound growth but also provides a buffer against the market's inherent volatility.

But there’s more pitfalls the average investor falls into on a daily basis.

Chasing the Mirage of Quick Profits

The dream of rapid wealth accumulation leads many to chase high-flying stocks or the latest market trends. However, this approach often results in buying at peaks and selling at troughs.

Research from JPMorgan Chase indicates that a 10% gain in the stock market can lead to increased investment flows between 4% and 15%, suggesting that many investors are influenced by recent performance rather than underlying fundamentals.

Now that doesn’t mean it’s bad to buy stocks that are going up. In fact, it’s much better to buy stocks already going up than going down. However, you need to pair that with a long-term perspective and risk management techniques to mitigate your downside if you’re wrong.

Speaking of which, proper risk management is foundational to successful investing.

Yet, many retail investors overlook this, making concentrated bets without adequate diversification. The consequences can be severe. A study analyzing over 5 million trades found that retail investors experienced negative abnormal returns ranging between 4% and 4.4% annually . This underscores the importance of diversification and disciplined risk assessment.

But the most important thing any individual investor must do it tune out the noise.

The Impact of Information Overload

In our digital age, investors are bombarded with a deluge of information. While staying informed is crucial, there's a fine line between being informed and being overwhelmed.

A study highlighted that high investor attention can lead to increased net buying, but this effect diminishes over time, often resulting in suboptimal returns. This phenomenon, known as "availability bias," can cloud judgment and lead to impulsive decisions.

Lastly, it’s essential to recognize that the financial system, in many ways, is structured to benefit institutional players. High-frequency trading algorithms, for instance, capitalize on minute market inefficiencies at speeds unattainable for human traders.

Brokers may benefit from increased trading volumes through fees and spreads. This environment can make it challenging for the average investor to compete on equal footing.

The fact is that brokers like Robinhood and others want you to trade more so they can make more money by selling your order flow. Wall Street is designed to take your money, not give it to you. And these “commission free” brokers are a key part of that strategy.

There is No Free Lunch

Understanding these challenges is the first step toward navigating them effectively.

Embracing a long-term investment strategy, prioritizing diversification, managing risks diligently, and filtering out market noise can tilt the odds in favor of the retail investor. While the system may have its biases, informed and disciplined investors can still achieve their financial goals by adhering to time-tested principles.

While the market's design may inherently favor certain players, retail investors are not without agency. By recognizing common pitfalls and adopting a strategic, long-term approach, they can navigate the complexities of the market and work toward sustainable financial success.

Stay safe out there,

Robert