Before we get started, I wanted to let you know the third episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

What is the “carry trade” and why did it tank the market?

Is the market pullback that started last week finished?

When is statistically the best time to buy stocks?

Preview of what's to come this week

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Is the stock market at the beginning of a regime change?

If you’ve never heard that term, a “market regime” is like the rules and conditions that investors play by at a certain time. And these rules are mostly set by things like interest rates, new government policies, or big technological breakthroughs.

So, if we say there's a "regime change" happening in the market, it means the rules and conditions that investors have been playing by are evolving, which naturally shifts how the market works and most importantly what investments might work.

And that has major implications for your portfolio.

Previous Market Regimes

In 2020, the “market regime” was based on how unprecedented government spending and low interest rates benefited “disruptive” technology and growth stocks like those promoted by Cathie Wood.

That persisted until we had a regime change in January 2022 when it became clear inflation was rising and the Federal Reserve would soon have to hike interest rates. This ushered in a new regime based on high interest rates and rising inflation, which caused Cathie Wood’s high-growth tech stocks to crash and shifted investor focus toward value stocks, particularly commodity-linked investments, with energy being the best performing sector by far in 2022.

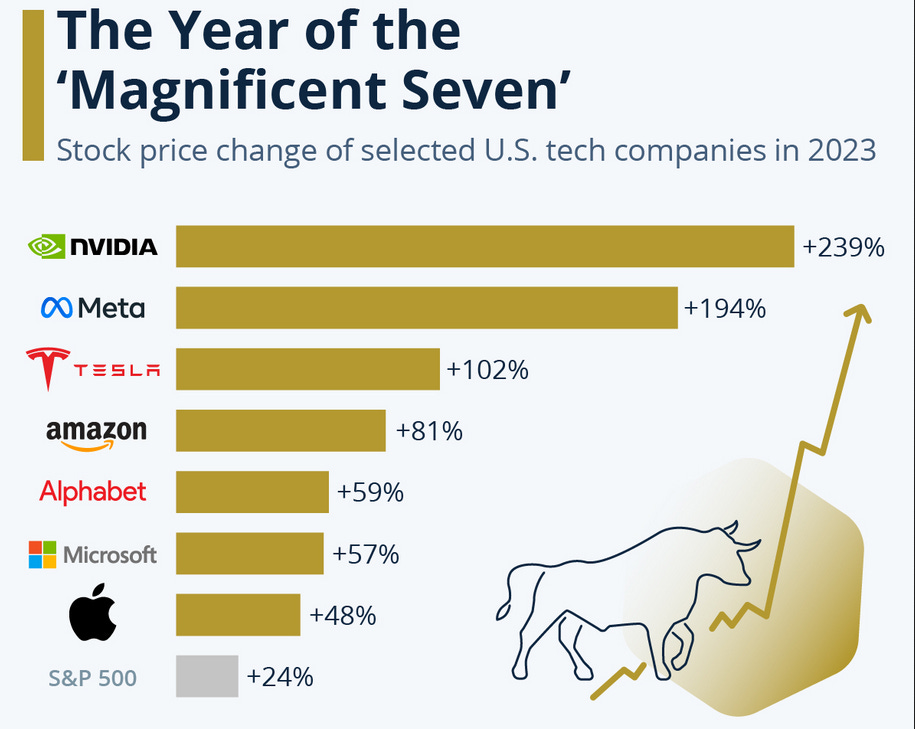

That high interest rate “market regime” persisted until October 2022 when stocks bottomed after a soft CPI report. And a month later, OpenAI released ChatGPT which kicked off a new regime: the Magnificent 7, which was typified by monstrous rallies from AI-winners like NVIDIA, Apple, Microsoft, Meta Platforms, Alphabet, Amazon, and to a lesser extent Tesla.

This “market regime” has defined markets for the last 18 months. For example, last year the S&P 500 finished the year up 19%. But the Magnificent 7 was up an average of 71%, while the rest of the S&P 500 was up a mere 6%. This means last year’s S&P 500’s gains were nearly all from the Magnificent 7. If you weren’t holding index funds or the Magnificent 7 in 2023, you had a very mediocre year.

This “regime” carried on into 2024, as the S&P 500 rose 14% in the first half of the year, with NVIDIA, Alphabet, and Microsoft accounting for 50% of that gain.

But it looks like a new “regime” is emerging.

The New Market Regime

We had a low interest rates and high growth stocks regime from March 2020 to January 2022. Then we had a high interest rate and commodity regime from January 2022 to October 2022. And after that we had a Magnificent 7 regime from October 2022 until now.

Which begs the question: what comes next?

Well, here’s what we know. Interest rates are almost certainly coming down. The Fed raised rates to a two decade high to squash inflation. While consumers are still feeling the pinch of the +25% cumulative inflation since 2020, the rate of price increases has slowed back near the Fed’s target level. This means that the Fed now has room to cut interest rates.

In fact, Federal Reserve chairman Jerome Powell recently said, “rate cuts are on the table” at the September FOMC meeting. Even prior to this statement, investors had priced in 100% odds of a rate cut at this meeting, and after the latest economic data investors have priced-in a 71% chance of a super-sized 50 basis point cut at the September meeting.

This means we’re moving from a high-interest rate regime to a low-interest rate regime. A recent note from the research team at Citi Group showed they expect the first cut to be the first of 8 cuts in a row. And the part of the market most impacted by lower interest rates are companies who depend on lower interest rates to finance their businesses.

These are not the Magnificent 7, as these companies hold a ton of cash and actually benefit when interest rates are high. For instance, Google earned $1 billion in interest income in the latest quarter just by parking their massive cash pile in Treasuries and earnings 5%.

Instead, the sector most impacted by lower rates are small cap stocks.

Small Caps are the Likely Winner

Small companies don’t have billions to park and earn interest like Google.

Instead, they rely on low rates to fund their day-to-day operations. And higher rates have really hurt these businesses. In fact, 31% of Russell 2000 - the main small cap index - had 31% of its companies report negative earnings in the latest quarter.

When rates are much lower, I expect earnings growth to significantly ramp up for small caps. This is a sentiment echoed by Stanley Druckenmiller, who’s largest position in his latest filing is call options on the Russell 2000. And while he’s a bit of a permabull, Fundstrat founder Tom Lee also expects small caps to rally +40% to close the year.

This doesn’t mean the Magnificent 7 stocks will crash and burn. Far from it. But it does mean that a new market regime is likely beginning, and if I were to guess, I’d say the new market darling will be small caps.

There are a few ways to profit from this. You can either buy a small cap index fund like the iShares Russell 2000 ETF (IWM). Or you can select individual small cap stocks, which is tough if you don’t know what you’re doing as small caps are much higher risk than large caps (like the Magnificent 7).

But if you want to see what small caps I’m buying this week, you can see my full portfolio and get live trading alerts here.

Stay safe out there,

Robert