What Happens When the World Stops Believing in America

With great power comes great responsibility...

Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

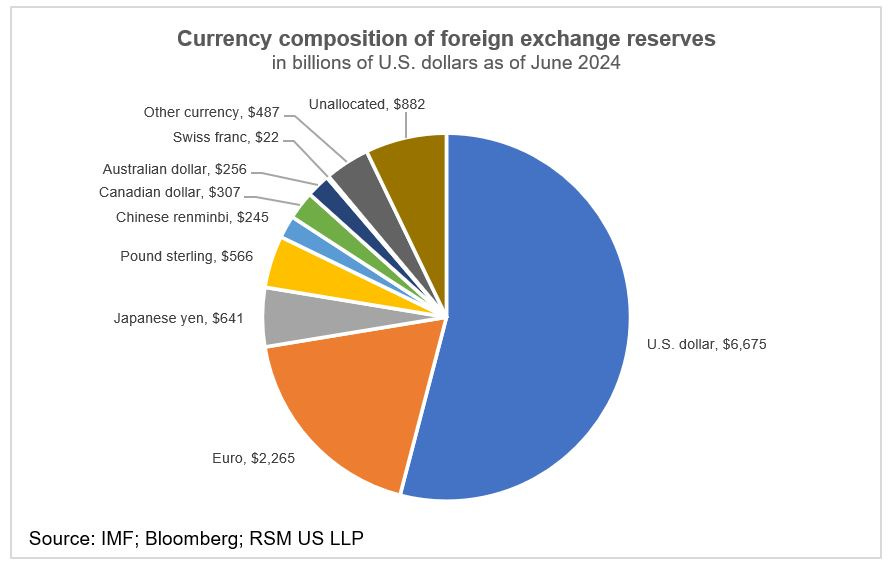

How the US dollar's role as the global reserve currency is currently being undermined

Why chaotic US economic policy may lead to a structurally "re-rating" of US stocks, bonds, and real estate

Why falling US stocks is bad for all Americans (not just rich people)

Responding to a new piece of hate mail

Preview of this week's Alphabet (GOOGL), Tesla (TSLA), and other earnings reports

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

If you’ve ever had to co-sign for someone on a loan, you know trust is everything.

Let’s say your cousin wants to lease a new car. He has a decent job, but his credit’s spotty. The dealership agrees—but only if you co-sign. Why? Because your name carries weight. Your credit, your stability, your history—they give the lender confidence.

That’s basically what the U.S. dollar is to the global financial system. We’re the co-signer for the world’s economic activity. And for the last 80 years, that trust in the U.S.—our institutions, our debt, our markets—has been the foundation of global finance.

But lately, it feels like the world’s starting to wonder if we’re still worthy of that trust.

The Dollar Isn’t Just Currency—It’s Infrastructure

The U.S. dollar isn’t just money; it’s the backbone of global trade.

Roughly 90% of all international transactions touch the dollar. Oil? Priced in dollars. Global shipping? Settled in dollars. When foreign governments build reserves, they buy Treasuries. When international businesses raise capital, they often do it in dollars.

This gives the U.S. some serious perks:

We can borrow more cheaply than anyone else on Earth

We can sanction our enemies with the flip of a switch

We can run massive deficits without triggering capital flight

We can flood the system with dollars in a crisis—and the world calls it a safety net

This setup is what French officials once called America’s “exorbitant privilege.” And it’s been central to our economic dominance.

But this privilege may be in jeopardy. See, the reason the dollar is so dominant isn’t just because of our size. It’s because of our consistency. Our institutions. Our rule of law. Our ability to act as the grown-up in the room when the world panics.

That’s what made the U.S. dollar the reserve currency—not just by default, but by design. No other country had the same mix of liquidity, legal protections, military strength, and trust. This grants US citizens amazing advantages, such as lower interest rates and products like 30-year fixed rate mortgage rates that are rare globally.

Go ask any non-American how common a 30-year fixed rate mortgage is in their country. They likely have not heard of them or - if they do - know they require a much higher interest rate to make the math work.

And with our international trust eroding, perks like a 30-year fixed mortgage may be next on the chopping block.

We’re Undermining Our Own Foundation

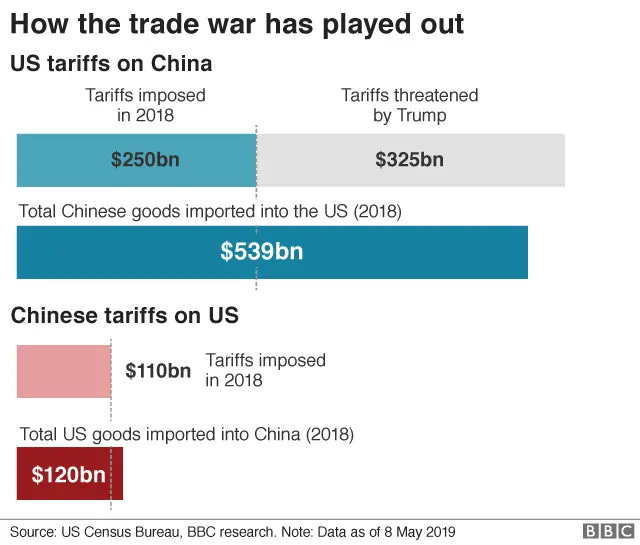

When Trump launched his “Liberation Day” tariffs last month—125% on China, 10% globally—it wasn’t just a trade war. It was a credibility crisis.

Markets tanked. The S&P 500 dropped 14% in three days. The VIX spiked past 50. Most importantly, foreign holders of U.S. debt—like Japan—began dumping Treasurys. And that’s when yields exploded higher.

The bond market staged a full revolt. That matters because if global investors no longer trust US policy and think we’re deliberately crashing our own markets to force the Fed’s hand, they’ll start demanding higher yields to buy our debt. Or worse, they’ll look elsewhere entirely.

That’s already happening. China and Japan, our two largest creditors, are cutting exposure to US assets. Global central banks are loading up on gold. More countries are settling trade in local currencies. All slow signs of a world hedging against dollar dominance.

Now before you say, “But Trump did tariffs in 2018 and everything was fine,”—you’re right, to a degree.

Back then, markets still trusted the system. Trump was negotiating from a position of strength, and the Fed was supportive. There was no bond market revolt. No VIX at 50. No dumping of Treasuries. It was chaos, but contained chaos.

This time? It feels more like controlled demolition. Crashing stocks on purpose. Freezing trade flows. Publicly pushing for a recession just to get rate cuts.

And guess what? It’s not working.

Powell isn’t cutting rates. Xi isn’t blinking. And the only thing collapsing is investor confidence in the United States.

This has born a new type of risk to US markets: The Moron Premium.

The “Moron Premium” Is Real

As we talked about on this week’s podcast (listen on Spotify and Apple Podcasts) the Financial Times recently coined the term “Moron Premium”—a discount global investors are now placing on U.S. assets due to political volatility and dysfunction.

In other words, U.S. stocks, bonds, and even the dollar itself are no longer being treated as pristine, no-brainer investments. They’re being priced with risk in mind.

That’s never happened in my lifetime. But it’s happening now.

And if it persists, it means higher mortgage rates, higher borrowing costs, and more pressure on American markets.

But don’t get me wrong, I’m not saying the dollar’s dead. And I’m not saying the U.S. is finished. I am driving home the point that once trust is lost, it’s hard to rebuild.

As Warren Buffett once said, “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently.” And in my view, we are currently ruining the America’s reputation as the premier destination for global capital.

The dollar is strong because the world believes in us—our stability, our institutions, our ability to act like adults. But if we keep blowing up our own economy just to make a point - or treat global finance like a reality show - we shouldn’t be surprised when the rest of the world starts shopping for a new co-signer.

And that means lower stocks, bonds, and real estate values for all Americans.

There is still time to turn the ship around. All hope is not lost. But if we continue down this path, the Liberation Day crash will look like a kid’s birthday party compared to what comes next.

And that will benefit no one - especially Main Street.

Stay safe out there,

Robert