Time to Buy: Why I’m Adding to These 4 Stocks Today

Don't get shaken out before the next leg higher...

"Are we selling all our stocks tomorrow or what?"

This is a message I got from a TikStocks Portfolio member on Sunday.

Yes, I get it—waking up to see futures down after President Trump slapped 25% tariffs on all goods from Canada & Mexico, plus a 10% tariff on China, can be unsettling.

But here’s the reality: volatility is the price of admission for big returns.

I’ve made the most money in my career during turbulent times. Whether it was the European Debt Crisis, the Taper Panic of 2018, the COVID-19 Crash, or the 2022 Bear Market, every single one of these events created massive buying opportunities for those who kept their cool and took action.

And this Trump tariff sell-off is no different.

This Is a Strong Market—Don’t Get Shaken Out

Honestly, if you got shaken out on Monday morning, I’m not sure what to tell you.

Because this market is showing serious strength. Think about it: The last time Trump started a trade war with China, when tariffs were much smaller, the Dow opened down -4.6% in a single session.

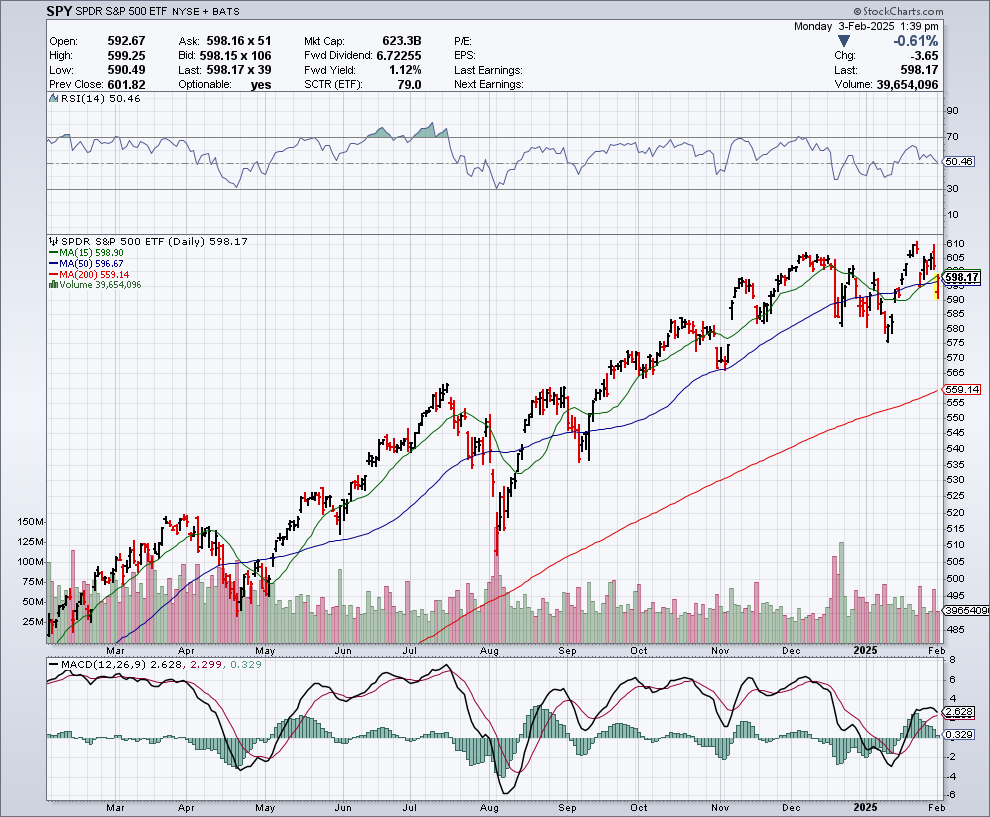

This time? We barely lost a full percentage point. That’s because the bull market is still intact. The S&P 500 is less than 2% off its all-time high, and we’ve seen strong breadth beyond just the Magnificent 7.

Even in last week’s DeepSeek sell-off, losses were short-lived. Monday was no different, as many defensive and value stocks rallied hard. The TikStocks Portfolio saw similar resilience: Berkshire Hathaway (BRK.B), Waste Management (WM), and Costco (COST) all rallied on the day, helping offset weakness elsewhere.

To the bears, I say:

While a few of our stocks hit stops, that’s why we use stops—to protect gains and free up capital for new opportunities. Yes, we've seen some blood in the altcoin section of the portfolio. But those are small, high-risk, high reward plays. So not a huge surprise there.

The key takeaway is despite the latest volatility, the long-term trend is intact. The S&P 500 is less than 2% off its all-time high with a resilient technical uptrend:

And while we still have a few more key earnings reports this week from Amazon (AMZN) and Alphabet (GOOGL), earnings across the board have been encouraging. Since earnings growth is the key driver of stock prices, the fundamental picture is clearly intact.

That means it's time to go shopping on some beaten down stocks.

Taking a +117% Gain and Adding to Four Positions

As I’ve said before, I don’t hold dead money.

One of our core holdings has compounded at 20% annually for five years—a fantastic run. Our large position in this stock was a key reason we generated a 36% gain in 2023 and a 45% gain in 2024:

And while I won't sell the entire stake, I plan to sell 25% today - which accounts for 2% of the TikStocks Portfolio - and reallocate elsewhere.

The stock I'm referring to is…