Time to Buy Some Dips

You need to either own assets or get left behind...

We’re entering one of those rare stretches in markets that only come around every few decades.

And if I’m being honest, you need to own assets like stocks, crypto, and precious metals or get left in the dust.

Because over the next 12 months, we’ll be riding what I call the Stimulus Wave — a perfect storm of liquidity, policy support, and technological transformation. The Trump administration is openly trying to pump markets ahead of the midterms, floating ideas like $2,000 “tariff checks,” 50-year mortgages, and whatever other tricks they can come up with to “run it hot.”

As I’ve been saying for months, they’ll do anything and everything to keep stocks climbing.

At the same time, the Fed is cutting rates, which means cheaper money and looser financial conditions. Combine that with an AI capex boom unlike anything we’ve seen before, and you’ve got the recipe for an AI-driven productivity surge that’s already showing up in earnings reports.

Put it all together, and we have one of the most favorable investing backdrops I’ve seen in my career. This kind of setup - where fiscal, monetary, and technological tailwinds align - rarely happens. It’s a window where the probability of higher asset prices 12 months from now is incredibly high.

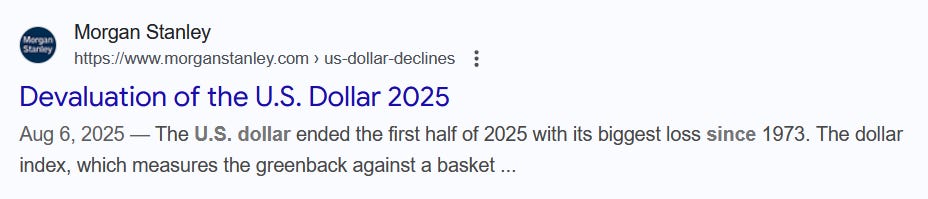

At the same time, we also have a recipe for massive money printing and a depreciating of US dollars compared to other currencies. That means the value of cash is quietly eroding — and the longer you sit on the sidelines, the more purchasing power you lose.

This is the double-edged sword of the Stimulus Wave. On one hand, it’s rocket fuel for markets. On the other, it’s a slow bleed for savers. Inflation may not be making headlines anymore, but it’s still doing its job — transferring wealth from those who hold cash to those who hold assets.

That’s why this next year is so critical. You don’t have to swing for the fences, but you do have to be in the game. Because when liquidity floods the system, it doesn’t reward caution — it rewards asset ownership.

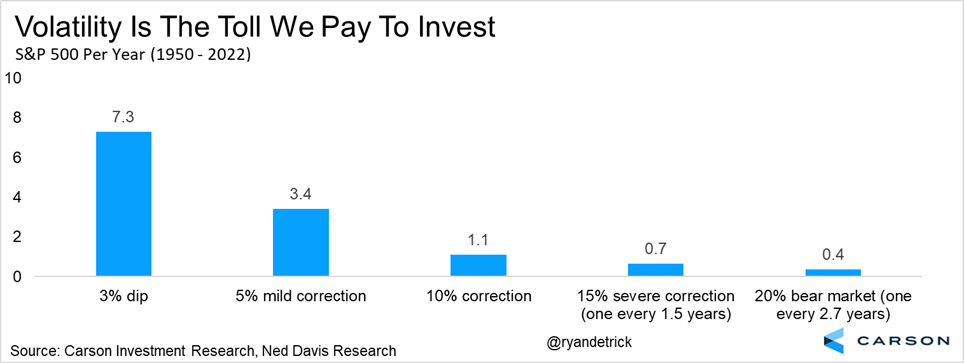

The choice is simple; let your dollars shrink or you let your assets grow. And while I expect this dynamic to drive significantly more upside for US stocks, crypto, and gold, that doesn’t mean it’ll be smooth sailing. Markets never move in straight lines. It’s always two steps forward, one step back. New investors panic during the step back. Experienced investors use it to add to high-quality positions.

And that’s what we’ll dig into today — where the best opportunities are in this market right now.

What We’re Seeing is 100% Normal

The volatility we’ve seen the last few weeks is not unusual.

For instance, last Thursday the S&P 500 fell 1.1%. That was the 25th decline of more than 1% this year.

That might seem like a lot until you realize the S&P 500 falls 1% on average 29 times per year. That means we should expect at least four more 1% declines or more over the remaining 35 trading days in 2025.

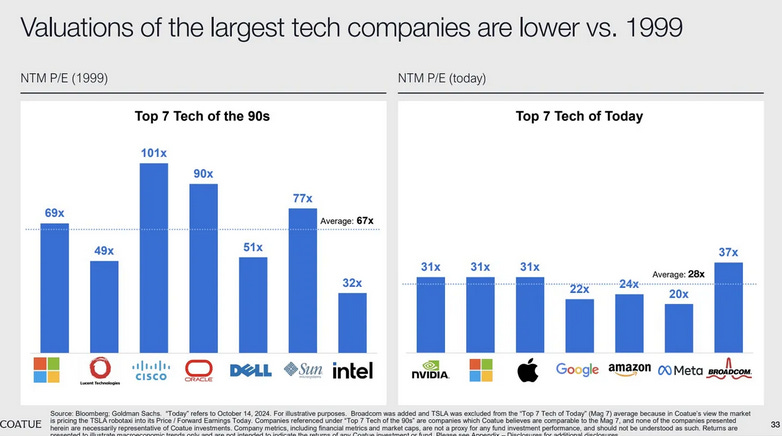

And really, the bullish signals are piling up. Earnings overall - especially for the key Mag7 stocks - were solid. We all know that earnings drive the market and are the very thing that make the current bull market not a bubble.

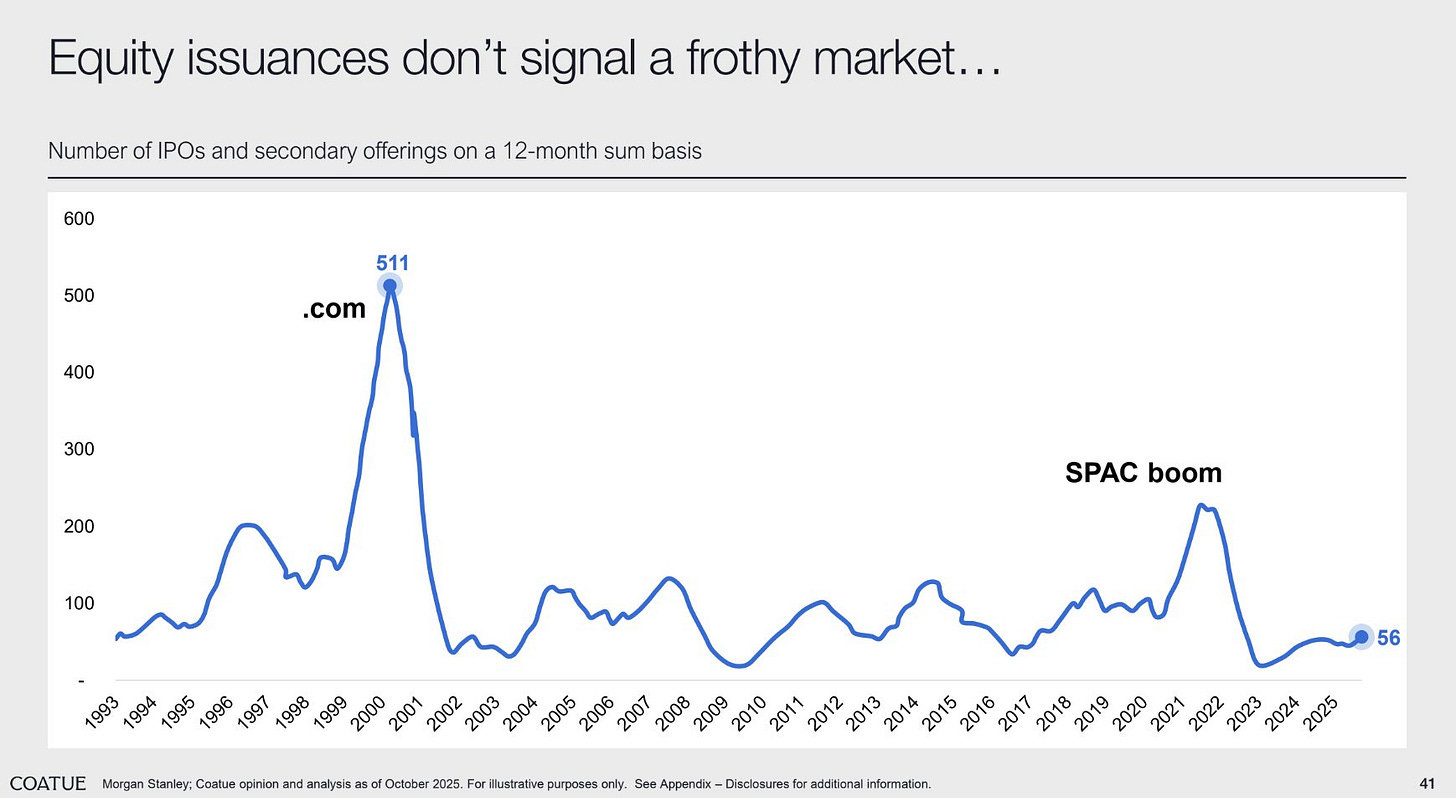

That doesn’t even mention the weak IPO market...

...reasonable valuations for tech stocks...

...and simply a lack of a “euphoric surge” as the Nasdaq is less than one standard deviation above trend:

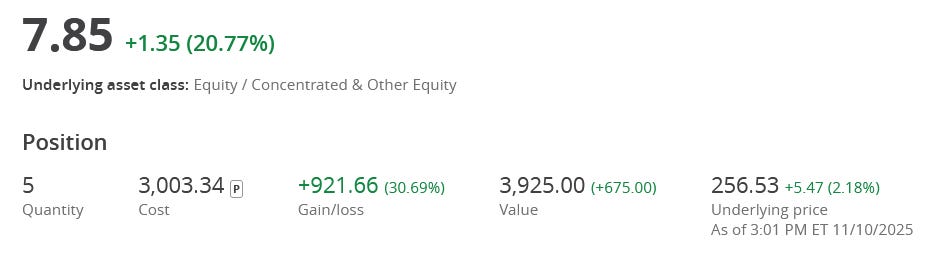

This is a key reason we re-opened one of our Premium Portfolio options trades on Friday. We are 17-for-17 on options trades since I launched the service a year ago. And if we closed the trade from Friday today, that would be 18-for-18.

Plus, that one trade alone would have covered your membership cost for the year:

If you want to join the 300+ hedge fund managers, investment advisers, and retail investors who have already made the switch to Premium and get a refund on the remainder of your membership, click this link here and use promo code 25POFF24 to get 25% off your first year.

But for everyone else, here is where I’m seeing buying opportunities right now.