Before we get started, I want to welcome the +27 subscribers who signed up for the “Let’s Analyze” newsletter in the last week! If you want to join our community, make sure to sign up here:

The bears are getting increasingly vocal again.

And their concerns are not entirely unwarranted; there are valid reasons to approach the current bull market with skepticism. Chief among these concerns is rising inflation, as there are some signs prices are picking up again (we'll gain further insight with this week's CPI release on Wednesday).

As we learned in 2022, heightened inflation tends to coincide with elevated interest rates, typically signaling trouble for both stocks and crypto.

In addition to inflationary pressures, ominous forecasts of an impending recession, mounting geopolitical tensions, and an upcoming election cast a shadow over the stock market.

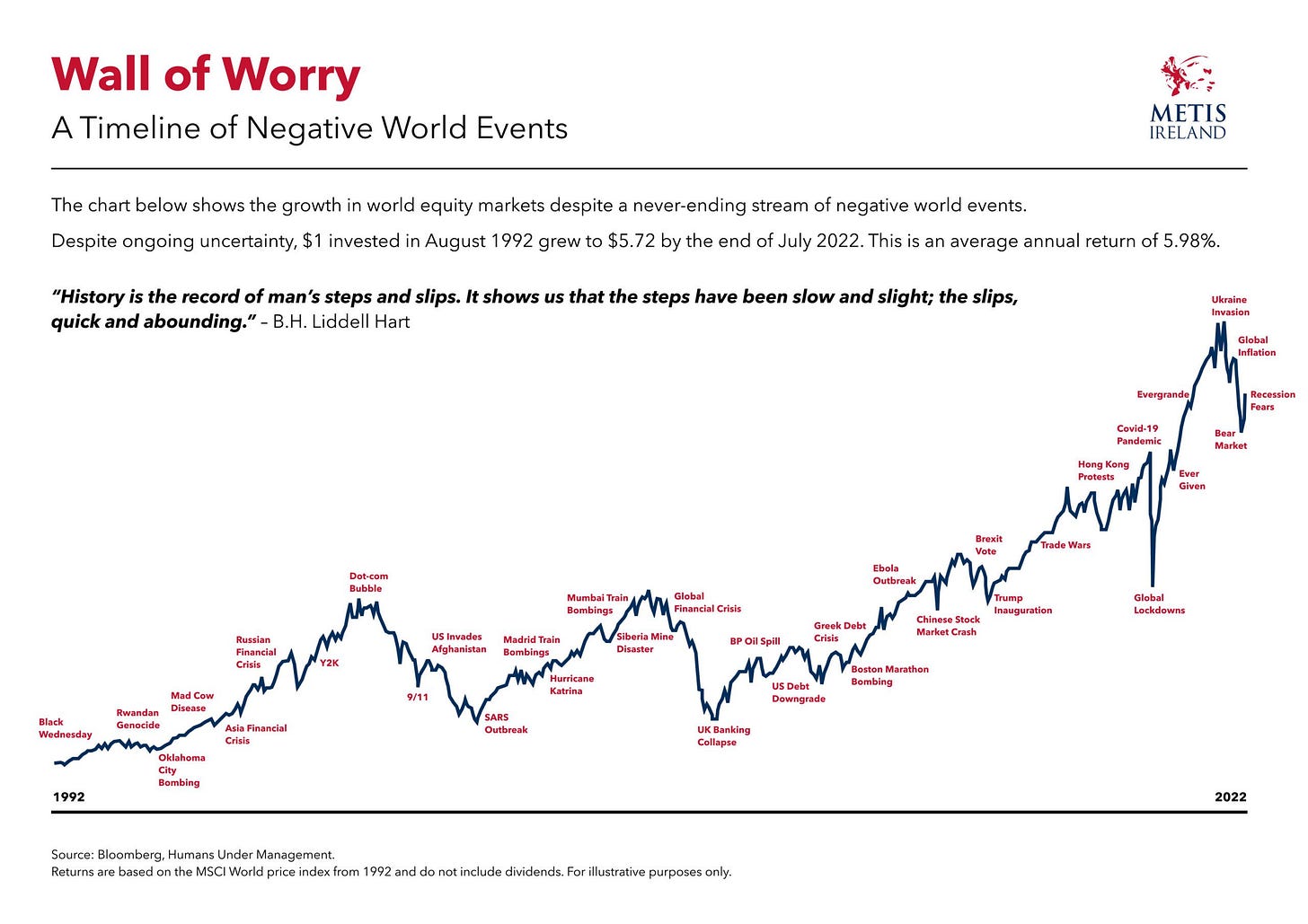

However, as we've reiterated before: there will always be things to worry about. This state of affairs is the market's natural equilibrium, and there will never be a time when everything aligns perfectly.

During times like these, it’s important to keep an eye on what really moves markets.

Because these metrics are telling me the bull market is alive and well.

#1. Corporate Earnings Keep Growing

Stocks are priced based on their earnings.

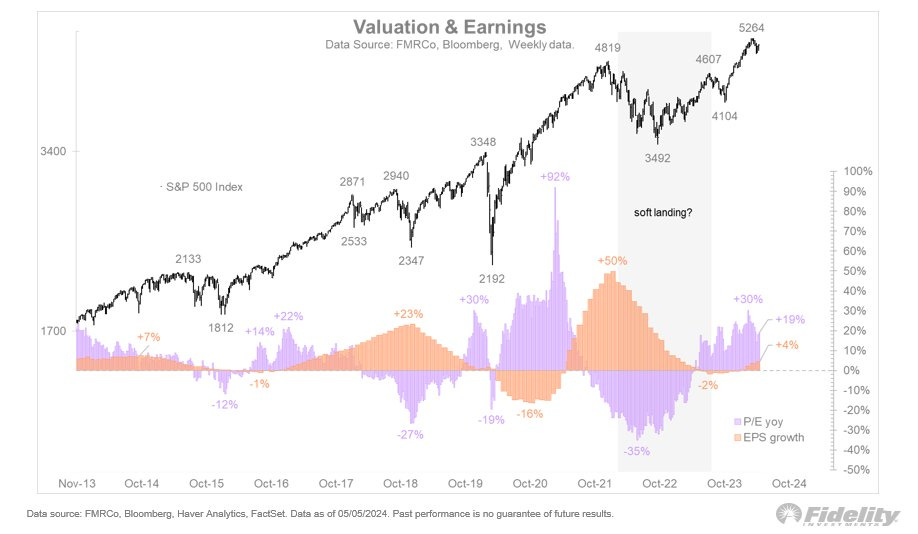

Whether it's the anticipation of future growth or past performance, earnings and the corresponding "earnings multiple" are pivotal in understanding the drivers of stock market returns.

Note the emphasis on "expected" earnings growth. In investing, past achievements should take a back seat to future prospects. Thus, attention should be directed toward where a company is headed.

On a broader scale, the earnings outlook for the entire S&P 500 appears robust. Of the 500 companies in the index, 401 have reported earnings, with a remarkable 79% surpassing estimates by an average margin of 8.7%.

And while some are saying the market is overvalued after the latest run, most are missing the fact that 2024’s gains have almost all come from earnings growth…

...as opposed to multiple expansion, which drove stock prices higher in 2023. As long as earnings, particularly from the "Magnificent 7" stocks, continue on an upward trajectory, the bull market will stand on firm ground.

#2. No Sign of Recession

Rumors of an impending recession are resurfacing.

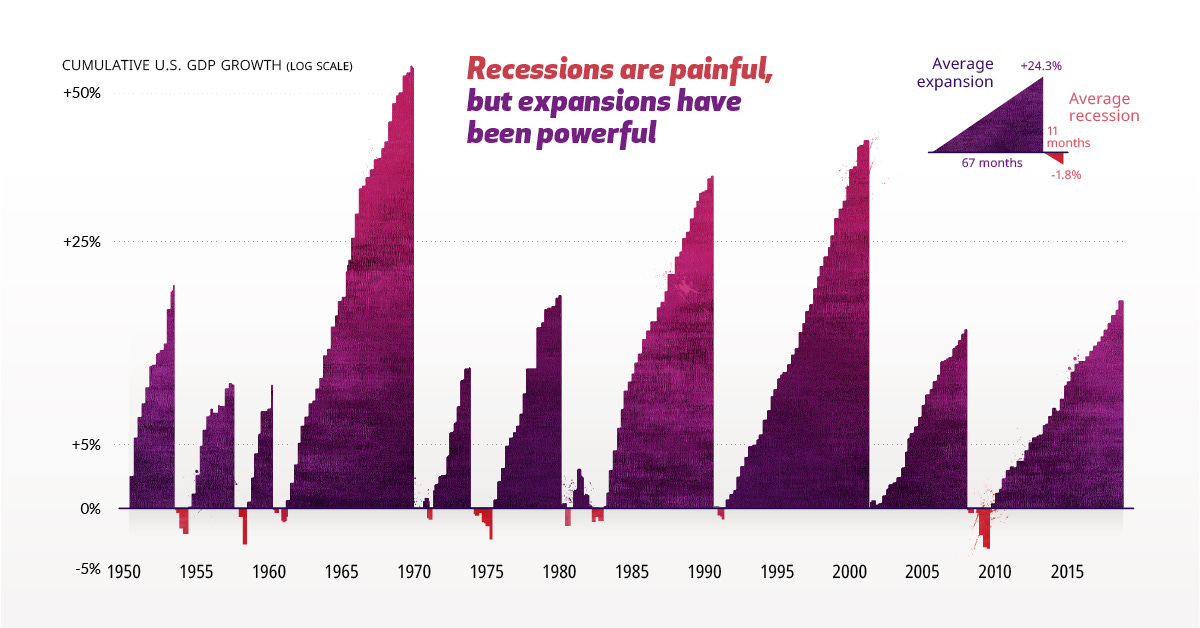

Whenever I hear pundits prophesying another recession, I'm reminded of economist Rudi Dornbusch's assertion that "economic expansions do not die of old age; they are murdered."

Consider this: the last three recessions were triggered by external events such as the COVID-19 pandemic, the Global Financial Crisis, and the Dot Com Bubble...

...prior to those, catalysts included the Iraqi invasion of Kuwait (followed by an oil price shock), historically high interest rates in the 1980s, and the Arab Oil Embargo in the 1970s.

This challenges the notion that recessions, much like secular bull markets, simply fade away with time. I align with Dornbusch's perspective, suggesting that an external event is required to precipitate the demise of an economic expansion.

So while an inverted yield curve, deficits, or inflation can leave the economy more vulnerable to an economic “murder,” recessions are inherently unpredictable as they hinge on unknowable factors (i.e., what will trigger them).

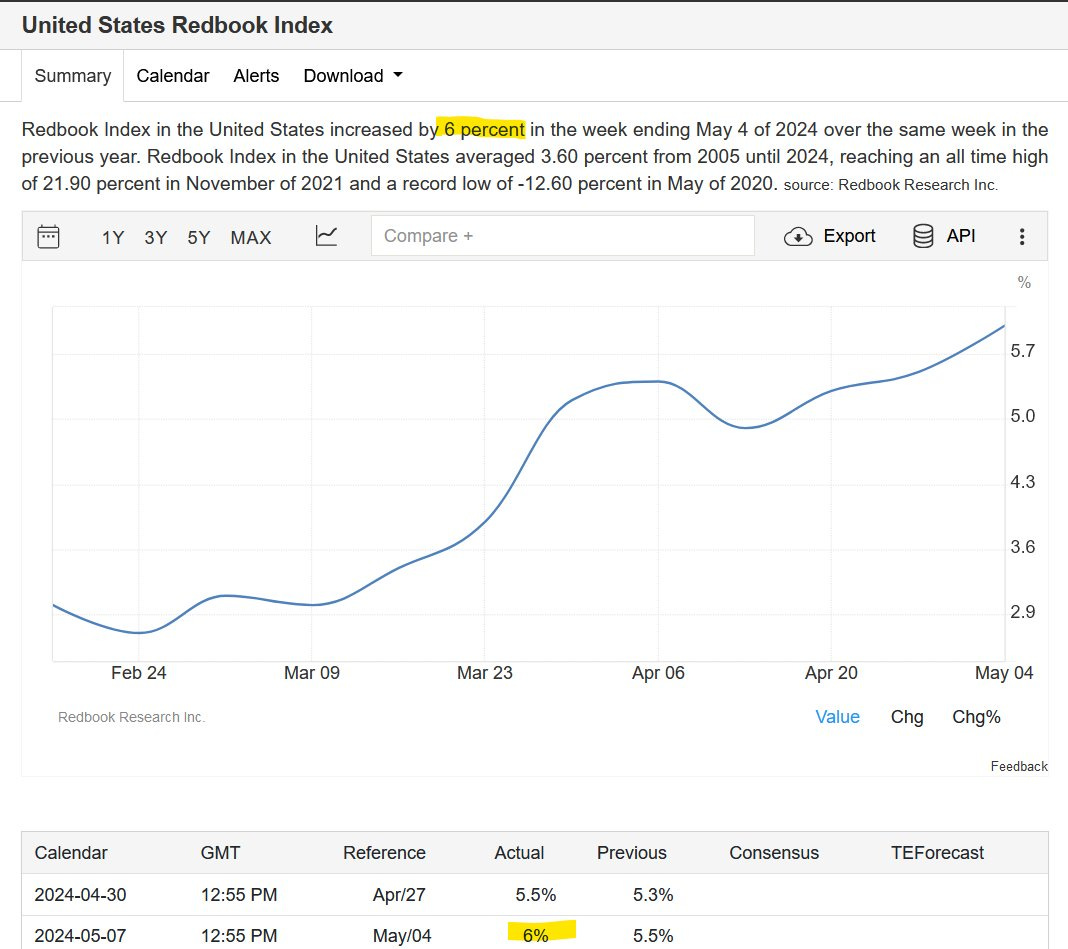

And at present, we have an Atlanta GDP forecast of 4.2% for the second quarter…

…consumer spending continues to come in strong…

…the US housing market is still on solid footing as mortgage delinquencies remain at all-time lows:

…not to mention the unemployment rate is still below 4%:

Just as I stated in June 2023 (and was proven correct over the last year), I reiterate my belief that the US is not on the brink of recession. While a recession is always a possibility, the fundamental backdrop suggests that the likelihood of an economic downturn is relatively low.

#3. The Market’s Technicals Remain Constructive

Two weeks ago, I released an updated my 2024 Market Outlook.

In it, I reviewed three factors I used for assessing the trajectory of markets:

Fundamentals: financial health of the market and economy (e.g. corporate earnings growth, US consumer market, US government fiscal policy, Federal Reserve policy)

Technicals: statistical trends gathered from trading activity (e.g. volume, relative strength index (RSI), or moving average convergence divergence (MACD))

Sentiment: overall attitude of investors toward a particular market (e.g. VIX, fear & greed, social media sentiment, seasonality)

And right now, the technicals look encouraging for the S&P 500. On the daily chart, we see that the index is now back above the 50-day moving average (blue line)…

…while the 200-day moving average (red line) continues to slope upwards. This implies the market is in a short-term uptrend.

Zooming out further on the weekly chart, we see a similar pattern whereby the 15-week, 50-week, and 200-week moving averages are also trending upwards…

…which implies the long-term trend for markets is also “up.”

That said, we are entering a relatively weak period in the Presidential Election Cycle.

I don’t usually put too much emphasis on seasonality, however the S&P 500 has followed the presidential election cycle extremely closely over the last two years.

When an incumbent is running for re-election, that year typically sees weak returns from January - May with May being the weakest month. However, this is historically followed by a summer rally, with August being the strongest month.

With both trends in the market’s favor over the next six months, the technicals are telling you the bull run will likely continue higher.

Don’t Get Shaken Out on Every Pullback

Despite some market volatility, robust earnings growth in the S&P 500, the underlying resilience of the US economy, and positive technical indicators all point to the continuation of the bull market.

It's crucial to remember that markets regularly face periods of uncertainty and correction, but these do not necessarily presage a downturn. With corporate earnings showing resilience, particularly among major tech companies, and key economic indicators like consumer spending and job growth holding strong, the fundamentals are in place for continued market growth.

Moreover, technical indicators reinforce this outlook, with major indices comfortably positioned above critical moving averages, signaling the potential continuation of the upward trend.

As we navigate through the seasonal ebbs and flows, it's important for investors to maintain perspective and not be swayed by temporary pullbacks. Staying informed and focusing on long-term investment strategies will help in making the most of the opportunities that lie ahead in the dynamic landscape of the stock market.

So, brace yourself, stay vigilant, and remember—every market dip presents an opportunity for those prepared to seize it.

Stay safe out there,

Robert