Before we get started, I want to welcome the +23 subscribers who signed up for the “Let’s Analyze” newsletter in the last week! If you want to join our community, make sure to sign up here:

Stocks are back to all-time highs.

But this isn’t a surprise to me. Despite the S&P 500 pulling back ~6% since its last all-time high on March 25th, I did my best to remind you that this was completely normal.

I even gave you three reasons last week why the bull market will likely continue.

However, I left out probably the most obvious reason this bull run has legs…

…but I’ll tell you about it today.

Bull Markets Historically Last Longer

I write these free newsletters because there is so much bad investing takes out there.

As this longtime reader says, I am often the “voice of reason” in a world full of doom and gloom grifters.

And to no one’s surprise, I’m going to once again be the voice of reason today. That’s because I still think this bull market potentially has years to run.

For instance, the current bull market is only 12 months old. On average, bull markets last around 60 months, or five years. This means that, historically speaking, we’re just getting started.

Not to mention, the S&P 500 is currently up only +48% from the October 2022 lows. Considering the average two-year return off the bear market low is +58%, we could see markets play “catch up” over the next few months.

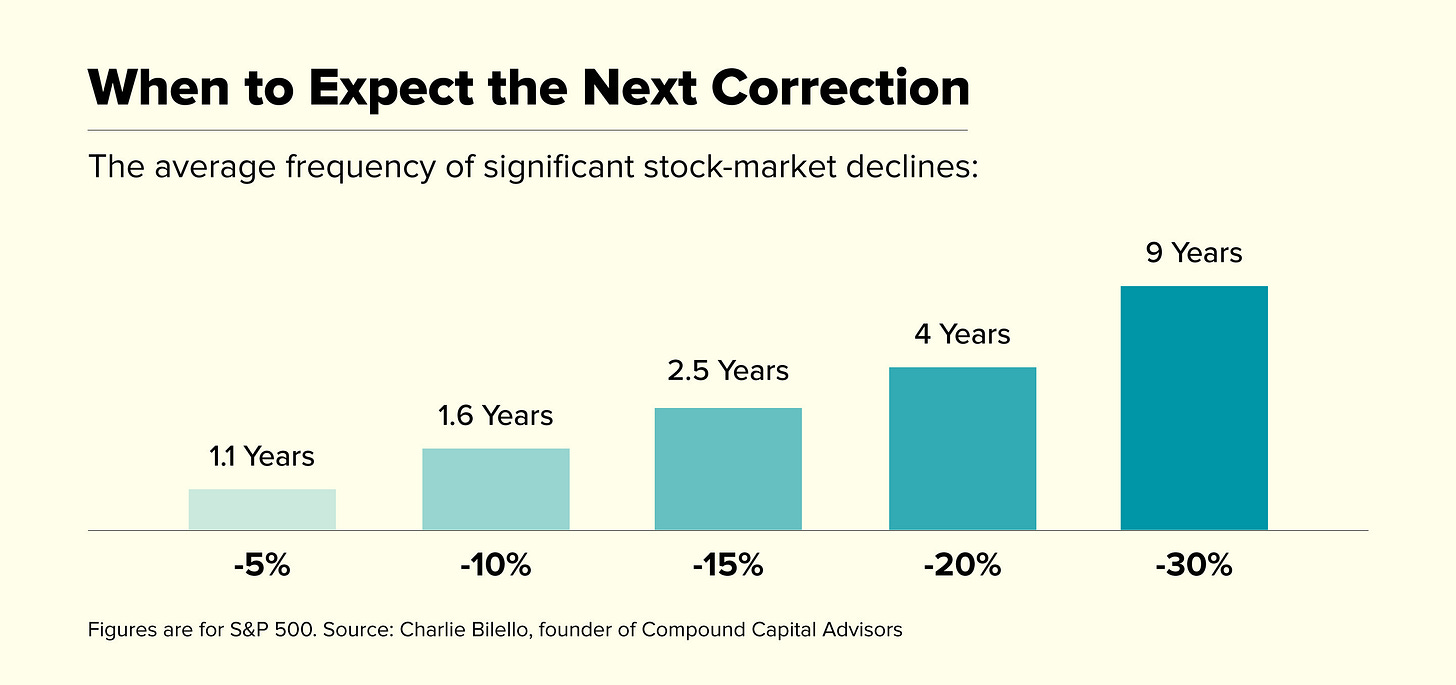

That doesn’t mean there won’t be pullbacks… and you should expect them.

However, bull markets often endure through various challenges. For instance, the bull market that began in 2009 lasted for over 11 years, navigating through multiple corrections and crises like the European debt crisis, the taper tantrum of 2013, and the trade war tensions between the U.S. and China.

The market’s resilience is a testament to the underlying strength of the economy and the companies that drive it. Just as turbulence in a flight doesn’t stop the plane from reaching its destination, market pullbacks don’t derail a bull market. They are merely pauses in a longer journey.

Now I know some of you may say that a bear market could still be around the corner, and it’s true. However, the average bear market has only lasted around 11 months. So even if we do have a downturn, it will likely be short-lived.

And considering the S&P 500 typically rises about 114% on average in bull markets and falls approximately 34% during bear markets, the math is in the long-term optimists' favor.

Plus, from everything I’m seeing, this bull has lots of room to run.

This is a Time for Optimism

The U.S. economy is recovering from the pandemic-induced recession. With robust GDP growth, strong corporate earnings, and improving employment rates, the economic fundamentals are supportive of a continued bull market.

Companies are not only recovering but thriving, as evidenced by the strong earnings growth we’ve seen over the last two years:

Also, the Federal Reserve’s recent dovish comments imply the central bank is still open to interest rate cuts in 2024. Historically, such policies have been conducive to prolonged bull markets.

Lastly, we’re in the midst of a technological revolution. Innovations in artificial intelligence, renewable energy, biotechnology, and other sectors are driving economic growth and creating new investment opportunities.

These advancements have the potential to fuel the market for years to come.

Staying the Course

It’s easy to get caught up in the noise and the short-term market fluctuations.

But remember, successful investing requires a long-term perspective. The key is to stay the course, keep your emotions in check, and trust in the historical trends that show markets tend to rise over time.

As I mentioned earlier, this bull market is still in its infancy. There will undoubtedly be bumps along the way, but those are just part of the journey. The important thing is to remain focused on your long-term goals and avoid making impulsive decisions based on short-term market movements.

While we can’t predict the future with certainty, historical data gives us a valuable perspective. The current bull market, being only 18 months old, is young by historical standards. With strong economic fundamentals, supportive monetary policy, and ongoing technological innovation, there’s a good chance that this bull market has many years left.

So, next time you hear the doom and gloom from the naysayers, remember to look at the bigger picture. Stay invested, stay focused, and let the bull market do its work.

Stay safe out there,

Robert