Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Why the market setup right now is similar to right before 2019’s +29% rally

Review the “mega bull” case for stocks over the next year

Should investors sell stocks like Palantir (PLTR) after the latest rally?

Update on my near-term market outlook

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

There’s one rule that separates great investors from everyone else.

Never. Panic. Sell.

Seriously—write that down. Frame it on your office wall. Tattoo it to your inner eyelids so you see it every time you close your eyes. Do whatever you have to do to remember it.

Because when markets are falling apart and headlines are screaming recession, tariffs, war, or some other form of economic apocalypse… that’s when most people do the exact opposite of what they should.

The Liberation Day Crash Revisited

Let me take you back to April 2, 2025—Liberation Day.

It was one of the ugliest trading weeks I’ve seen in my career. The VIX - Wall Street’s fear gauge - spiked above 50. Markets were in full-blown liquidation mode. Stocks, crypto, small caps—everything was getting sold regardless of the price.

It was a true capitulation event where people are selling everything indiscriminately.

And then? The bounce.

Since then, we’ve rallied hard. But here’s the thing most investors don’t realize: 90% of the market’s gains since the April lows came from just four trading sessions:

When the administration paused the blanket reciprocal tariffs.

When the China reprieve was announced.

When the EU tariffs were delayed.

And when the trade court ruled against the retroactive tax clawbacks

Miss those four days, and you missed the rally.

That’s not just a one-off, either. This happens all the time.

This Is Why You Never Panic Sell

The psychology around panic selling is interesting.

You are not being physicallyharmed by anything. Instead, you are being mentally tortured by the market. This is why I often told our 1,200 TikStocks Portfolio members to not even look at their portfolios during this period. Because if you understand why you own your positions and have a long-term view, a sell-off doesn’t really matter. Yes, it’s still stressful, but it helps.

One reason I tell people “just don’t look” is the odds of you doing something stupid - like panic selling near the lows - rise dramatically during volatile periods.

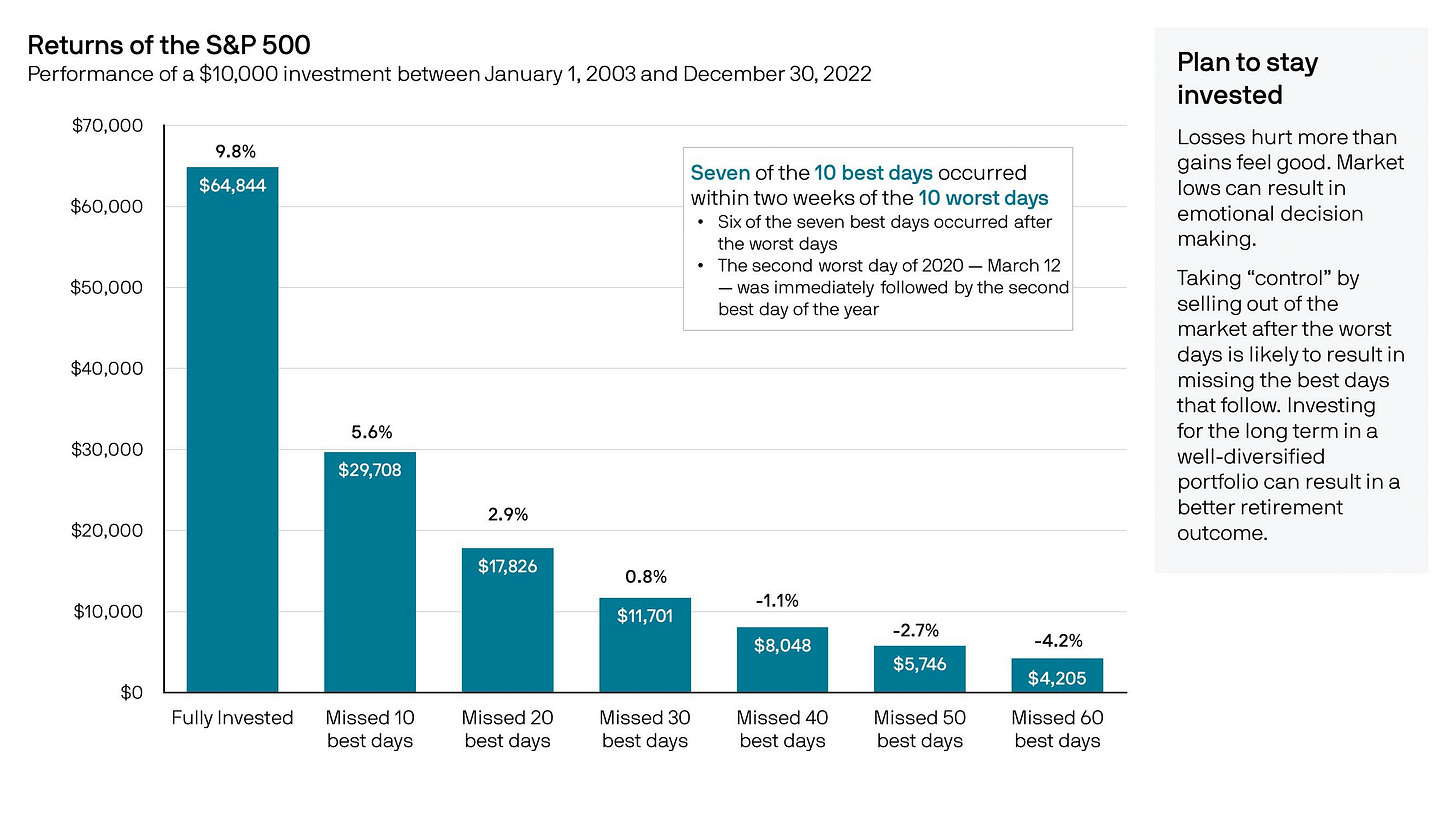

And doing so can really harm your long-term returns; a JPMorgan study showed that if you missed the 10 best days in the market over any 20-year period, your returns would be cut in half. Miss the top 20 days? You’d barely outperform cash.

Let me say that again: your entire investing outcome often comes down to just a handful of trading days per year.

And those days? They almost always happen during or immediately after a panic.

It Pays to Have Diamond Hands

During the Liberation Day Crash, I was doing my best to keep our 1,200 members calm.

But there’s only so much you can do as people get very emotional about money. Even so, I kept reminding people that “capitulation events” like we saw in early April happen near major bottoms.

And most importantly, I sent a trading alert on April 9th stating “the bottom was near” which turned out to be the exact bottom and the day we bought the most stocks in the last four years.

We were big buyers during this volatile period. But importantly, we held onto our long-term positions as well. That meant we didn’t miss any of those largest up days of the year, and it’s why the TikStocks Portfolio is well in the green in 2025:

Because the big “up days” for the market don’t happen after the dust has settled or after the headlines turn optimistic again. They happen when it still feels like the world is falling apart.

That’s why panic selling is such a killer. No one rings a bell at the bottom, and the bounce is always faster than you think. Plus, it almost always happens while you’re still feeling scared.

Which brings us to the point of this week’s update.

The VIX is Your Friend

Lots of things in the stock market are hard to reliably measure.

That includes market momentum, risk tolerance, and market conviction.

But the VIX - also known as the “fear index” - is one of the best at empirically measuring how scared investors are. It’s one of the best panic meters we have. And when it spikes above 40 or 50 like it did in April? That’s not your cue to run. It’s your cue to lean in and hit that buy button.

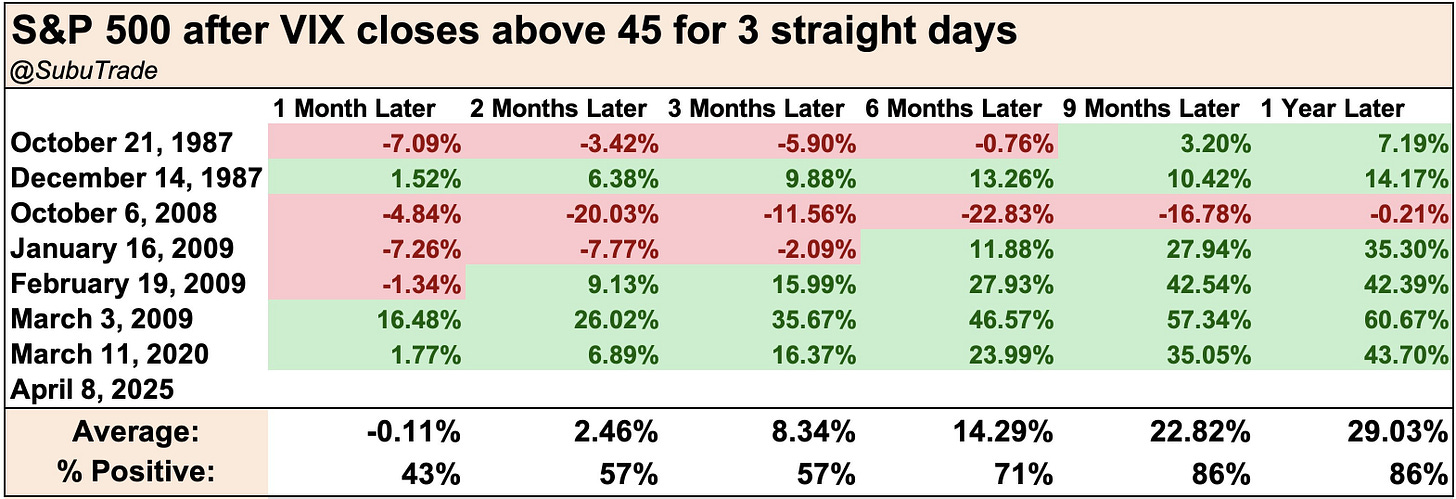

That’s why at the market bottom on April 9th, I reminded investors that the last seven times the VIX was over 45 three days in a row, the S&P 500 was up 29% on average a year later.

And since the S&P 500 is already up +19% from the April 9th lows, I’d say this statistic is about to have another supporting data point.

It’s counterintuitive, but those moments of “peak fear” - like when the VIX is over 45 for three straight days - are when the best opportunities emerge. But only for those with the discipline to act.

I’m not saying you go all-in during a crash. It’s also much easier said than done to buy during periods when the VIX is that high. But if you’re sitting on cash, and the VIX is flashing red? History says that’s when you should be putting some of it to work.

We did exactly that in April. We added to high-conviction positions. We stayed patient. We didn’t puke out our portfolio. And now me and our 1,200 members are reaping the rewards (you can get three months free when you join our investing community by clicking here).

Because again, you don’t make money by timing bottoms. You make money by having a plan and sticking to it.

We’re not out of the woods yet. The TACO Trade drama isn’t over. Trade wars could still escalate. But panicking will never be the right strategy. Having a rules-based process will be.

And the next time the VIX spikes over 50?

You’ll know what to do.

Stay safe out there,

Robert