Before we get started, I wanted to let you know the third episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Why do stocks historically perform poorly in September?

Portfolio changes I’m making to “hedge” my tech stocks in September

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

“AI will be every bit as impactful as the internet”

That’s a quote from Stanley Druckenmiller, arguably the greatest hedge fund manager of all-time. He was also one of the first major hedge fund managers to invest heavily in Nvidia - the poster child for the AI revolution - back in early 2023 when he made it his largest position.

Now, sometimes investors want to “talk their book” to influence the market in their favor by publicly promoting an investment they already own, hoping to drive up its price by getting others to buy in. But based on the spending from “hyperscalers” like Microsoft, Meta, Amazon, and Alphabet, the world’s largest tech companies believe the AI revolution is real.

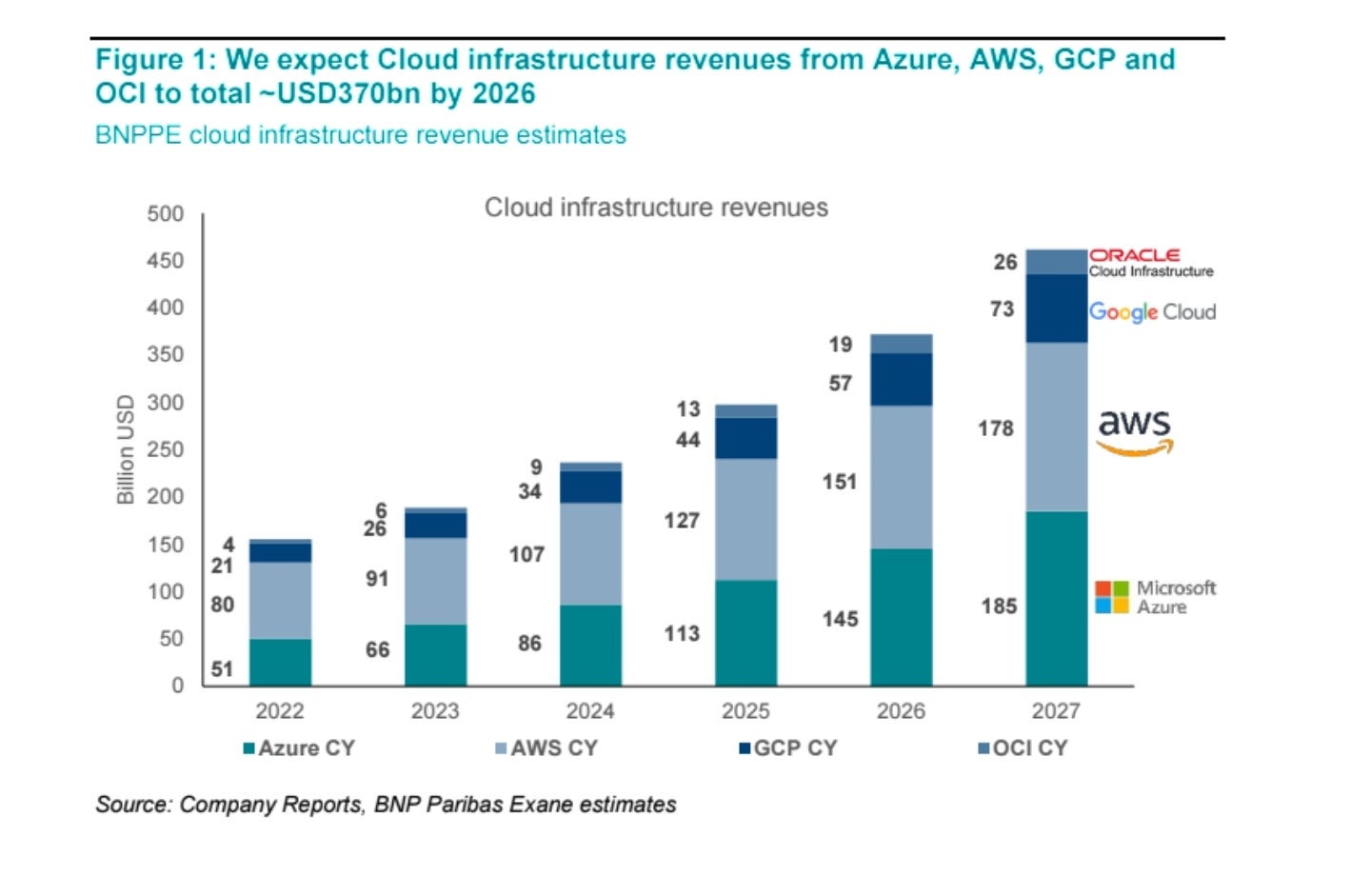

The $400 Billion Dollar Bet

These hyperscalers, which is a fancy word for large cloud computing companies, will invest $400 billion combined on their cloud infrastructure to build out the capability to support these new AI processes in the next 18 months.

To put that into perspective, that’s equal to the entire capital expenditure spending for the S&P 500 in 2010. But instead of 500 companies spending $400 billion, it’s only four companies.That’s how big of an opportunity this is in the eyes of Silicon Valley’s best and brightest.

For instance, Meta founder Mark Zuckerberg recently said, “Our long term vision is to build general intelligence, open source it responsibly, and make it widely available so everyone can benefit."

That seems to be the key here; these companies are all trying to create something called artificial general intelligence, or AGI, which is a machine that can understand, learn, and apply intelligence across a wide range of tasks, just like a human can.

Unlike the AI we have today, which is really good at specific tasks like recognizing faces or playing chess, AGI would be able to think, reason, and solve problems in any situation. Imagine a computer that could learn new skills, understand complex ideas, and even figure out how to tackle problems it has never seen before—AGI aims to achieve that level of intelligence.

And there’s a key way to invest in the birth of AGI.

A “Winner-Take-All” Market

AGI will change everything.

Imagine if you could have personalized drugs that fit your genetic makeup and medical history. Or have a lifelong tutor from the time you’re a child. Or detect cybersecurity attacks before they happen.

Now, imagine you own the “rails” on which AGI functions. That is nearly unlimited value for any company that gets to it first. Former Meta executive John Carmack claims AGI will become a trillion dollar industry in the 2030s.

He notes we already have computers exceeding the “exascale” threshold, meaning they can perform as many calculations in a single second that would take a human 31.6 billion years. While some are less optimistic, with MIT roboticist Rodney Brooks believing AGI won’t arrive until 2300.

But clearly, many Silicon Valley elite think we’re getting close, hence the $400 billion in spending. This is why Google CEO Sundat Pichai said, “The risk of under-investing in AI is greater than over-investing."

And that begs the question: how do we invest in this?

This Should Be in Every Investor Portfolio

Nobody truly knows when this technology will be fully developed and sold. A subscription-based AI tool from a company like Meta or Alphabet is at least years away.

One thing you could do is own all of these Mag7 tech stocks individually. However, most investors do not have time to keep up with so many individual names.

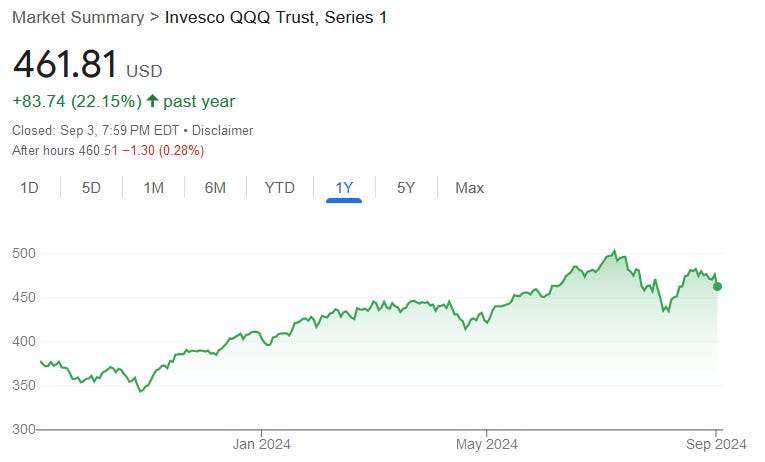

The best path for 99% of retail investor to capitalize on AGI would be to own the entire Nasdaq index via an index fund like Invesco QQQ (QQQ). Because while the company that gets to AGI first will be a major weighting in QQQ.

But also, remember the productivity and earnings growth we’ll see from the entire tech sector when this technology is released will be enormous.

You will want to own the AGI winner. But you will also want to own the entire tech complex in the US. Because AGI won’t only benefit the company who gets to it first, it will benefit the entire market, which is one reason QQQ is one of my largest personal portfolio positions.

And if you want to see the rest of my portfolio, you can join the 850 investors who follow my personal investing portfolio by clicking here.

Stay safe out there,

Robert