Before we get started, I wanted to thank everyone who listened to my podcast last week on Spotify and Apple Podcasts.

We don’t have a new podcast this week as I had to evacuate Los Angeles due to the fires. But if you missed last week’s episode titled “My #1 Prediction for 2025” you can listen to it here on Spotify and Apple Podcasts.

My portfolio just completed its best two year run ever.

In 2023, the TikStocks Portfolio delivered a return of 36%, topping the S&P 500 return of 26%. And we did even better in 2024, generating a 45% gain which nearly doubled the S&P 500.

While I’m obviously thrilled about nearly doubling my portfolio in two years, I know the biggest gains are yet to come.

Because while my portfolio went from $300,000 to $550,000, I am patiently waiting for “compounding” to really kick in.

As that’s when the real magic begins.

The Money is in the Waiting

There is a misconception among new investors that the way you make money in markets is by spending a lot of time putting on high-risk directional trades. If you're right, you make a ton of money. If you're wrong, you lose a ton of money.

But that is gambling, not investing. The way you really make money in investing is using a "low turnover" portfolio. That means most of the positions you hold are long-term positions that you don't trade in and out of.

This "low turnover" strategy is how I've made hundreds of thousands of dollars for myself and millions for others in my career. But the key is to make money by waiting rather than trading.

Because your goal should be to reach the stage where you gains begin to compound.

Compounding 101

Compounding is one of the most powerful forces in investing.

It’s what happens when your portfolio’s gains generate more gains, creating a snowball effect that accelerates your wealth over time. Albert Einstein famously called compound interest the “eighth wonder of the world,” and for good reason: it can turn small, consistent returns into massive amounts of wealth if you give it enough time.

Here’s how it works: when your investments grow, you’re not just earning a return on your initial principal; you’re also earning returns on the returns you’ve already made. This process repeats year after year, and as your portfolio gets larger, the dollar amounts of those gains grow exponentially.

To illustrate, imagine you invest $100,000 and earn a steady 10% annual return. After the first year, you have $110,000. But in year two, you earn 10% on $110,000, not just your original $100,000, bringing your total to $121,000. By year three, it’s $133,100, and so on. Fast forward 20 years, and that $100,000 has grown to $672,750—without you adding a single extra dollar.

Now let’s zoom out to see the bigger picture. In the early years of compounding, the gains feel small. But over time, the snowball effect kicks in. By year 30, that same $100,000 would grow to over $1.74 million. And if you’re patient enough to wait 40 years, your portfolio balloons to $4.52 million—45 times your original investment.

The Speed of Compounding in Practice

One of the most exciting moments for any investor is when compounding truly takes off. It’s when your portfolio hits a critical mass, and the gains become so significant that they far exceed anything you could add through additional contributions.

For example, imagine you’re earning 10% annually on a $1 million portfolio. That’s $100,000 in gains in a single year—more than most people save in a decade.

This is why I emphasize the importance of time in the market. The longer you stay invested, the faster your portfolio will grow. Many investors give up too early, selling their positions during market dips or chasing the latest “hot stock” instead of letting their winners run. They miss out on the most lucrative phase of compounding: the later years, when your money starts to multiply at an astonishing rate.

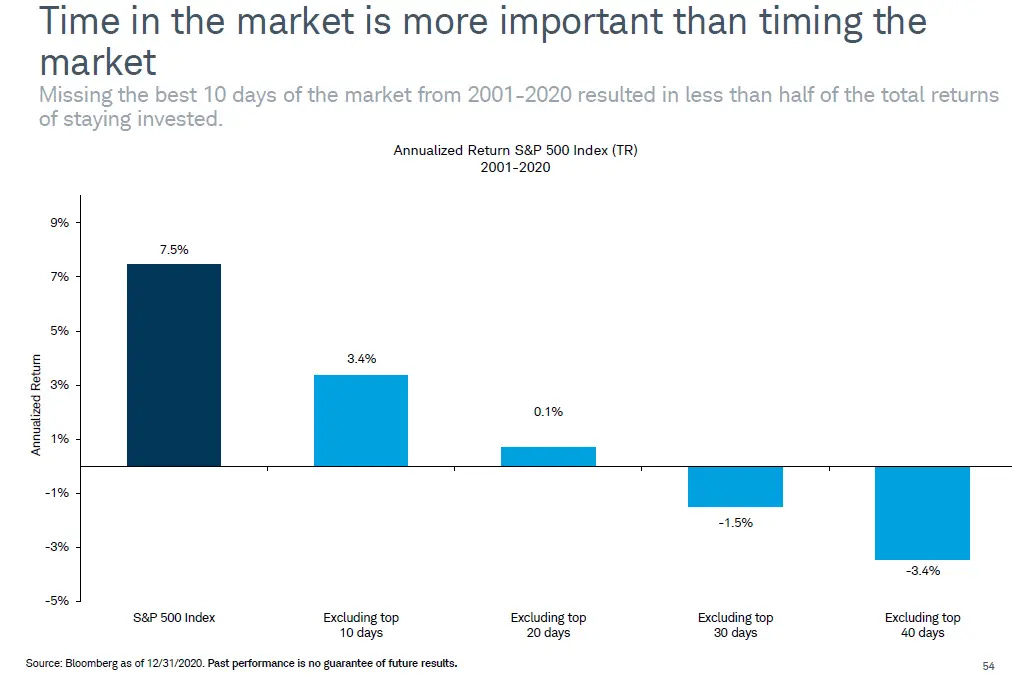

Plus, by trying to “time” the market by selling before red days and buying back before green days, you run the risk of missing the best days for the market. And if that happens, you severely limit your long-term upside.

To give you an idea, look at the S&P 500. If you invested $10,000 in the index in 1980 and simply held it, reinvesting all dividends, your investment would be worth over $1.5 million today. That’s a 15,000% return—driven almost entirely by the power of compounding over time.

But here’s the kicker: if you missed just the 10 best days in the market over that same period, your returns would be cut almost in half. Instead of $1.5 million, you’d have closer to $750,000. That’s how much those few critical days can impact your long-term wealth.

And here’s the crazy part—those best days often occur during the most volatile periods, when fear is at its highest and most people are sitting on the sidelines. This is why trying to time the market is such a dangerous game. Missing even a handful of those key days can be the difference between life-changing wealth and a much smaller nest egg.

When Compounding Clicks

The real beauty of compounding is that it rewards patience and discipline, not constant activity. Once your portfolio hits that critical mass where compounding begins to dominate, your wealth grows faster than you ever thought possible.

In the TikStocks Portfolio, we focus on building a base of high-quality, long-term holdings specifically for this reason (you can join our over 1,000 members by clicking here).

These are the positions you want to hold through market cycles, because they’re the ones that will drive compounding over time. Stocks like Apple ($AAPL), Amazon ($AMZN), and Microsoft ($MSFT)—companies that generate massive cash flow, dominate their industries, and reinvest profits into high-growth areas—are ideal candidates for this strategy.

The hard part, of course, is staying invested. Compounding works best when you’re willing to ride out the inevitable market volatility. Even during a market correction or bear market, your focus should remain on the long-term potential for exponential growth.

Compounding isn’t just a concept; it’s a mindset. It’s the difference between chasing short-term wins and building generational wealth. And when you truly understand how it works, you’ll realize that the real money isn’t made in the trades you place today. It’s made in the years and decades you allow your portfolio to grow uninterrupted.

So, the next time you feel tempted to jump in and out of the market, ask yourself: are you chasing quick wins, or are you planting seeds for the compounding snowball that will change your financial future?

The choice is yours—but the rewards for patience are unmatched.

Stay safe out there,

Robert

Then why invested in crypto stocks?