Before we get started, I wanted to let you know the third episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Do stocks really tank when the Federal Reserve cuts interest rates?

Should you buy the crypto dip?

Big Tech earnings preview

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

There is a lot of bad information out there lately.

And if you don’t have a discerning eye, listening to this information can lose you thousands of dollars. For instance, are you familiar Dr. John Hussman?

He’s famous for calling the peak of the Dot Com Bubble.

In fact, he predicted in March 2000 that the Nasdaq would crash -83%, as that was the point where the market’s valuation would be back near the historical trend. And he was right on the money. In fact, the Nasdaq proceeded to crash -83% between March 2000 and October 2002.

And now, Hussman is back with another prediction.

The Biggest Bear on Wall Street is Back

Here’s what Hussman had to say in June 2024:

“Barring a wholesale shift in the quality of market internals, which are quickly going the wrong way, any further highs from these levels are likely to be minimal. In contrast, current valuation extremes imply potential downside risk for the S&P 500 on the order of 50-70% over the completion of this cycle.”

Hussman is saying that the current AI-fueled bull market driven by stocks like Nvidia (NVDA) and Microsoft (MSFT) rings eerily similar to the crash he accurately predicted in 2000.

On the surface, the parallels between the Dot Com Bubble of the 1990s and the AI Bubble of the 2020s seem obvious.

Companies, like NVIDIA, are being valued at sky-high levels based on potential profits from artificial intelligence technology, similar to the excessive speculation seen with Internet stocks like Cisco in the late 1990s.

As Hussman has consistently warned, valuations detached from fundamentals can lead to significant market corrections.

But the keyword here is consistently. I’m fond of saying that a market prediction without a time frame is useless. Market crashes - or a decline in the S&P 500 of -50% or more - can and do happen. However, much to the surprise of many, they are extremely rare. In fact, they’ve only happened three times in history: 1929, 2000, and 2008.

Yet when it comes to Hussman, he is seemingly always calling for these ultra-rare market crashes.

The Fund Manager Who Cried Wolf

Back in 2009 after the S&P 500 had already collapsed -50% during the Global Financial Crisis. Yet Hussman proclaimed the market was still overvalued and predicted further declines, Instead, the S&P 500 doubled within three years.

A few years later in 2012, Hussman claimed the Federal Reserve’s quantitative easing program would lead to weak stock market returns. Instead, the S&P 500 surged +64% over the next three years.

But there’s more. In March 2017, Hussman said the S&P 500 would return no more than 1% on average over the next decade and that S&P 500 would soon plunge -60%. Instead, the S&P rose 20% over the next two years.

And I’m not done yet; in 2020 after the COVID Crash, Hussman once again predicted a prolonged period of weak returns for the stock market. But as many of you know, the S&P 500 bounced back to all-time highs within six months, erasing the losses of the COVID crash.

More recently in October 2023, Hussman once again called for a 50% market crash right before the S&P 500 went on one of its strongest rallies in history. And in June 2024, Hussman once again called for a -50%-70% market crash.

Permabears 101

In the investment community, Hussman is known as a “permabear.”

This means they are “permanently bearish,” always predicting some sort of crash and having an overall pessimistic view of the market. Michael Burry, Jeremy Granthem, and Robert Kyosaki are also in this “permabear” camp.

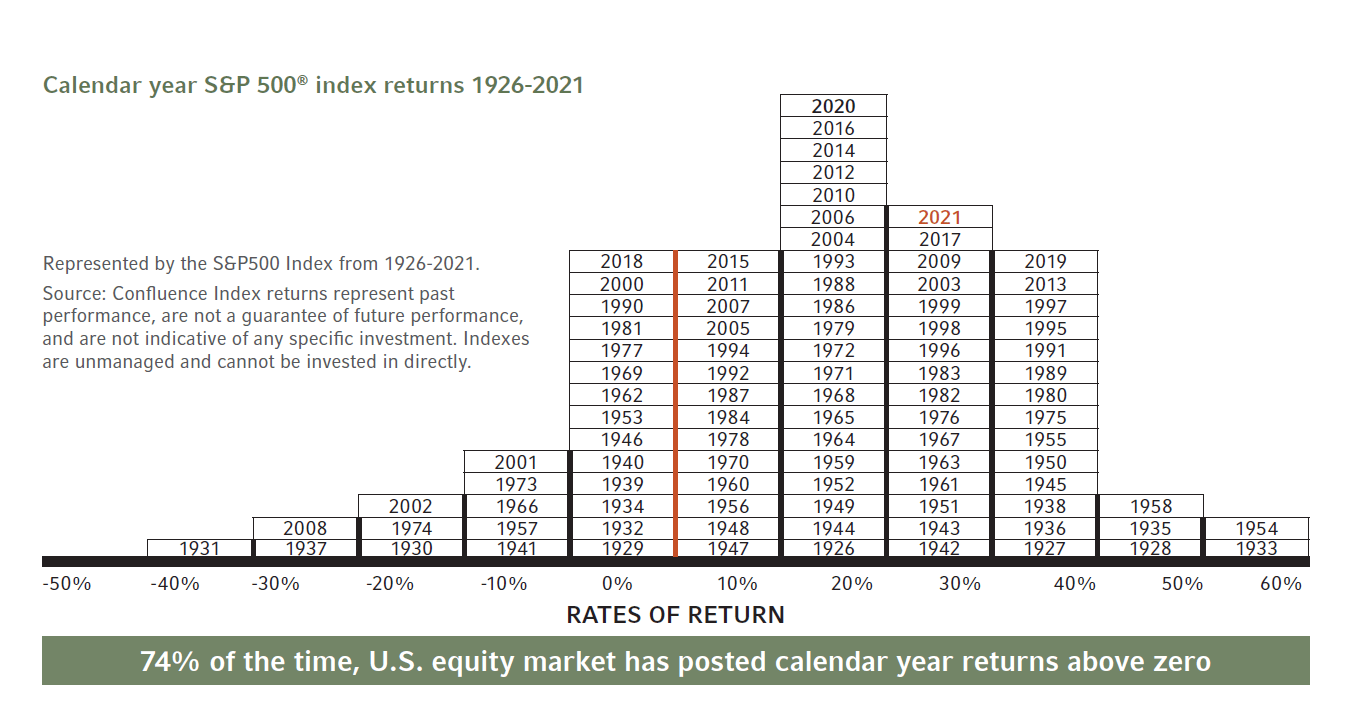

The problem with being a permabear is stocks tend to go up most years. In fact, the S&P 500 has finished in positive territory 75% of the time since 1921.

And while bear markets do happen, they are historically much shorter than bull markets. In fact, since World War II, the average bull market has lasted about 5.8 years, while the average bear market has lasted only about 1.4 years. This means that investors who constantly bet on a market crash often miss out on significant gains during the long bull market periods.

And Hussman and his investors have definitely missed out. In fact, Hussman’s main investment fund known as the Strategic Growth Fund, ticker HSGFX, is down -50% since November 2009, which is hilarious considering the S&P 500 is +322% over the same period.

You could have sat in cash, watched inflation eat your purchasing power, and you still would have outperformed Hussman’s hedge fund since 2009.

So, the next time you hear someone whose claim to fame is predicting a market crash, just keep swiping and remember even a broken clock is right twice a day.

Stay safe out there,

Robert