Before we get started, I wanted to let you know the third episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Is the US heading into a recession?

Is it still a good time to add to our long-term positions?

Preview of what's to come this week

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

One of the most common questions I get is, “is it time to buy?”

It’s typically a question without a good answer. There are a multitude of factors that go into answering such a question.

How old are you?

What is your time horizon?

What is your risk tolerance?

What does your portfolio look like?

These are all standard questions I would need to know to give an informed answer.

That said, there is one scenario where it’s statistically the best time to buy.

It’s called a “VIX spike,” and we had one on April 6th.

The Third Most “Fearful” Day Ever

The CBOE Volatility Index (VIX) - also known as the “fear index” - measures how “fearful” investors are at a given moment.

Most of the time the VIX is relatively low, with a long-term average of ~15.

During these quote un quote “normal” periods the VIX isn’t as useful as compared to when we have VIX spikes. For example, the highest readings ever occurred during the Global Financial Crisis and the COVID-19 Crash, two of the most uncertain periods in US financial history. While these were some of the most uncertain times for the investment community, they were statistically some of the best times to buy.

And while I do not put the carry trade sell-off in the same category as the Financial Crisis or COVID Crash, the VIX disagrees as August 1st, 2nd, and 5th saw the third largest three-day increase in the VIX ever as the “fear index” rocketed 135% higher.

These “spikes” are statistically some of the best times to buy.

Striking While the Iron is Hot

The data on this is pretty clear.

For instance, the five other times we saw the VIX rocket 100% or more in three days the S&P 500 was positive five out of five times, although the sample size is pretty small.

But if we expand this further to the 20 largest three day VIX spikes, the S&P 500 is up an average of 18% a year later compared to only 12% during all other periods.

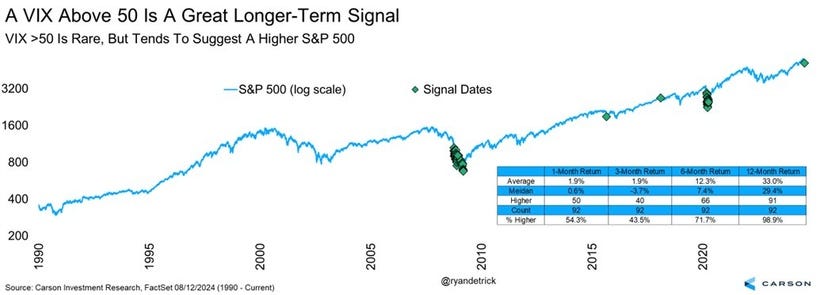

In fact, of the 92 times the VIX has crossed 50, the S&P 500 was higher 91 times a year later:

While the S&P 500 has seen more downside after these VIX spikes, they almost always come near the bottom. And since you’ll never time the bottom perfectly, “near the bottom” is still pretty good for this highly reliable signal.

Keep Your Head When Everyone is Losing Theirs

This was a key reason I was a big buyer on August 6th when most investors were losing their minds.

As Warren Buffett has famously said, “he most important quality for an investor is temperament, and not intellect.” While I like to think I have a little of both, I have grown numb over the years to these panic sell-offs. I’ve simply seen so many at this point I rarely get “freaked out” when they happen.

In fact, I get excited. That’s why I put tens of thousands of dollars to work in my personal portfolio on August 6th (you can get real-time trade alerts from here). Institutional investors did they same, as data from JP Morgan showed the big money bought $14 billion worth of securities on Monday.

And while I know everyone wants to panic sell when it seems like the sky is falling, that is the worst thing you could do. In fact, if you sold every -2% pullback in the S&P 500 and waited “until the coast is clear” to buy back, you would’ve missed out on a *third* of gains over the past 20 years.

History shows that VIX spikes often mark some of the best buying opportunities in the market. While the recent market volatility has been nerve-wracking for many, it's also a time to strike while the iron is hot.

By staying calm and following the data, you position yourself to benefit from these rare moments of fear. As the numbers suggest, those who can weather the storm and buy during these spikes are often rewarded handsomely in the long run.

And if you need help in making these high pressure decisions, I’d highly recommend joining our investing community (click here to join 850+ investors).

Stay safe out there,

Robert