Before we get started, I wanted to thank everyone who listened to my podcast last week on Spotify and Apple Podcasts.

We don’t have a new podcast this week as I have been under the weather. But if you missed last week’s episode titled “My Top Magnificent 7 Buy Right Now” you can listen to it here on Spotify and Apple Podcasts.

I learned a valuable lesson early on in my investing career.

Back in 2011, I was a junior equity analyst for a small investment research company. As anyone who was looking for work at the time can attest, it was a tough job market.

The Global Financial Crisis had just passed, and many qualified financial professionals were out of work, willing to take lower salaries. In that environment, no one was eager to hire a new graduate with little experience.

Thankfully, Casey Research took a chance on me. They had me work under a guy named Tony, who had twice been named "Portfolio Manager of the Year" by his firm and was a long-time tech analyst.

Tony taught me a lesson that has shaped my investing career ever since.

Cheaper Isn’t Always Better

Despite my economics degree from Loyola University, I was new to the market.

So, like any aspiring investor, I dove into the classics: The Intelligent Investor, One Up on Wall Street, The Interpretation of Financial Statements, etc. But none of them taught me what Tony showed me about targeting the right stocks.

Those classic books often recommended buying "cheap" stocks, meaning those with low price-to-earnings ratios and trading near their 52-week low. The idea was that by buying these "undervalued" stocks, you gave yourself a margin of safety.

I pitched a few of these "cheap" stocks to Tony. His response? "These are all garbage" or "Get me a new list."

This surprised me at first. After all, I was following the advice of legendary investors like Benjamin Graham, Peter Lynch, and Warren Buffett.

But Tony gave me this simple advice: “Focus on the most expensive stocks trading near their 52-week highs. That’s where the growth and the money are.”

And that idea has made me hundreds of thousands of dollars over the years.

The Problem With Going Cheap

In many aspects of life, you get what you pay for.

The stock market is no different. Most stocks trading at “cheap” valuations have underlying problems—slow sales growth, shrinking margins, or threats from new technologies.

The stock price reflects this reality. Every portfolio manager I worked for would immediately pull up a stock's chart. If the price didn’t align with the story I was telling (i.e., the stock was performing well), they would ask me to move on to a different company.

I didn’t fully understand this until I spent more time in the business. For example, in the mid-2010s, many were worried about stock market valuations. An investor I followed even tried to short Amazon (AMZN) because it was trading at 950-times forward earnings.

Since then, Amazon's stock is up over 1,100%.

And in the later 2010s, many predicted Tesla (TSLA) would collapse due to its high valuation. Even I subscribed to this theory until I changed my perspective and bought the stock in 2020 when it traded at 1,356-times forward earnings.

Since then, the stock is up over 700%.

So when I saw a stock that was “expensive” trading at its 52-week high in early 2024, I didn’t hesitate to buy.

Buy High, Sell Higher

As many of our over 1,000 TikStocks Portfolio members probably already know, the stock I’m talking about is Fair Isaac Corp. (FICO).

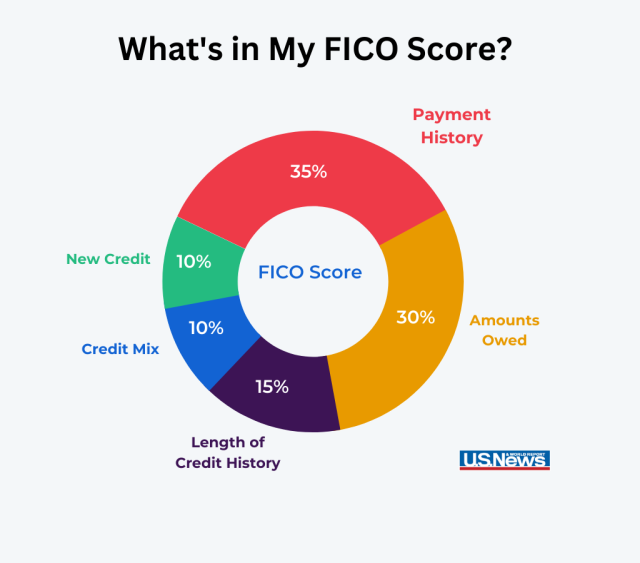

FICO is a leading applied analytics company, best known for its credit scores, which are widely used in mortgage and auto loan decisions.

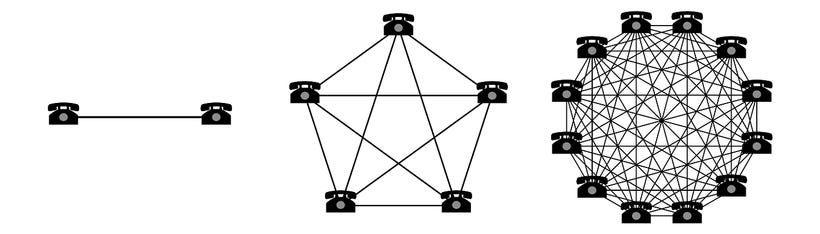

Over the last 70 years, FICO has built a reputation as the most trusted source for assessing creditworthiness. This network effect has made the company an essential tool for banks and other lenders. The more people use FICO, the more valuable its scores become.

This is similar to the telephone or social media, as the more people who use the telephone or apps like Instagram the more valuable those platforms become.

FICO’s business model is solid, allowing the company to generate strong cash flow. Because of this, the stock traded at a premium of 95-times forward earnings and was up 48% in August 2023 when I opened the position.

A novice investor might think this was a bad move. Conventional wisdom would have them buying PayPal (PYPL), which was trading near its 52-week low and at a much lower earnings multiple.

But the results speak for themselves. While FICO traded near all-time highs, its performance outpaced PYPL by a factor of 95-to-1 during this period.

Here’s the key takeaway: the best businesses will trade at a premium. This is a feature, not a flaw, of the stock market.

The Result Speak For Themselves

Valuations are important but they aren’t the most important factor in my decision-making. As Tony taught me, it’s all about the business. And a great business will trade at a premium price, the same way an expensive car or whiskey trades at a premium price.

You get what you pay for in this life. And the stock market is no different.

That’s why in November 2024, I added another position to the TikStocks Portfolio. While at the time the stock was trading at all-time highs, it’s already up another 30% since. And I expect it to go much higher.

Winners keep winning. And I plan to buy even more this week.

If you want real-time trade alerts for my buy recommendations, click here and join the over 1,000 members of the TikStocks Portfolio community.

And for everyone else, make sure to focus on the best businesses in the market rather than the cheapest prices.

Your future self will thank you for it.

Stay safe out there,

Robert