Predicting the future is hard.

But when you get it right, it can change your life.

Back in 2015, I was an early investor in Apple (AAPL). In 2017, it was Bitcoin (BTC). And in 2020, I went long on Palantir (PLTR)—well before it became a retail darling.

Then in early 2022, I introduced what I called the M.A.A.N.T.A. Portfolio—my answer to the FAANG stocks that dominated the last bull market.

Since I first shared it, that basket has returned 145% on average—trouncing almost everything else in the market.

But here’s the thing: That was the last wave. My latest research points to a new set of tech stocks that I believe will lead markets through 2030.

And today, I’ll show you which names I think have the most upside right now.

My Key "Mega Trend" for the Next Five Years

We are entering an era where everything—from your phone to your fridge to the global supply chain—is becoming digital. And that transformation is creating one of the most investable trends of the next decade.

Let’s run through the numbers:

Digital Transformation: The global market for tech-enabled workflows and automation is expected to more than triple—from $911 billion in 2024 to $3.29 trillion by 2030. That’s a 23.9% compound annual growth rate (CAGR).

Cloud Computing: The infrastructure powering all this innovation is growing just as fast. Global cloud revenue is forecasted to nearly triple—from $752 billion today to $2.39 trillion by 2030 (~20% CAGR).

Artificial Intelligence: The global AI market is projected to explode to $1.5 trillion by 2030—growing at an eye-popping 37.7% CAGR.

Mobile Data Usage: On the consumer side, global mobile data usage is projected to grow from ~109 million terabytes/month in 2023 to 603 million by 2030—a 28% CAGR.

Bottom line? The world is going digital—and fast.

And that creates massive tailwinds for companies - which we'll review now - positioned to capitalize on this shift. Because not only do I expect these companies to outperform over the next five years, I expect them to be among the biggest companies in the world.

The Five Largest Tech Stocks in 2030

At the top of my list is a company we don't currently have in the portfolio: Nvidia (NVDA).

Nvidia tops the list due to its near-monopoly in AI accelerators, powering data centers for the $7 trillion AI market by 2030. I expect earnings to continue accelerating, driven by Blackwell chips and enterprise AI adoption. The company generated $30 billion in earnings in 2024, which doubled 2023 earnings of $15 billion. I do not expect earnings to grow as fast the next five years, but 25% growth per year is doable (and likely conservative).

That leaves us with 2030 EPS of $9.46. With an earnings multiple of 30, that represents a 2030 share price of $283 or a market cap of $7 trillion. Considering the stock is trading at $164 today, that represents upside of 72% over the next five years.

Second, I'm going to throw you a curve ball. While not technically a "tech company" I expect the Bitcoin (BTC) ecosystem to be one of the most valuable technology properties on the planet in 2030.

Bitcoin currently trades at $121,000 per coin has a market capitalization of $2.3 trillion, making it the fifth largest global asset on the planet:

Based on previous peaks-to-trough cycles, I expect Bitcoin to peak at $165,000 this cycle before retracing at $60,000 in 2026. From here, I expect a new cycle to begin whereby Bitcoin catapults to $300,000 per coin by the end of the next four-year crypto cycle. That would peg Bitcoin's market cap to $5.9 trillion:

Next on our list is one of the most consistent compounders in our portfolio: Microsoft (MSFT). Microsoft continues to dominate enterprise software through its trifecta of Office, Azure, and GitHub. But what really sets MSFT apart in 2025 is its strategic AI positioning. Through its deep partnership with OpenAI, Microsoft has embedded AI tools like Copilot into its entire product suite—turning every knowledge worker into a power user. Azure is gaining ground in the cloud wars, and the company’s pricing power remains unmatched. With a fortress balance sheet, reliable growth, and accelerating AI tailwinds, Microsoft still has plenty of room to run.

In the last 12 months, Microsoft earned $96 billion in earnings ($12.94 EPS). I expect $MSFT to grow earnings 13% per year over the next five years, giving the company a conservative 2030 EPS of $23.83. As an earnings multiple of 25, that implies a $4.4 trillion market cap. That pegs the 2030 shares price to roughly $600 meaning the stock only has 19% upside over the next five years. That means while $MSFT will remain one of the largest tech companies, it has some of the weakest expected growth over the next five years.

Next on our list is one of the largest companies in our portfolio: Amazon (AMZN). Amazon stands out for its powerful blend of retail dominance, cloud leadership, and growing AI monetization. The company’s AWS segment remains the backbone of the internet, and with the rise of AI, demand for cloud infrastructure should only accelerate. Meanwhile, Amazon’s cost-cutting and ad business are boosting profitability.

In the last 12 months, Amazon earned over $60 billion in earnings ($6.13 EPS)—more than double what it posted just two years prior. I expect earnings to grow ~15% annually over the next five years, driven by AWS, ads, and AI.

Those conservative estimates imply a 2030 EPS of $12.33. With an earnings multiple of 30, that implies a 2030 market cap of $4 trillion, which represents upside of 67% of the next five years.

Next on our list is another tech titan with AI tailwinds at its back: Alphabet (GOOGL).

Alphabet remains a dominant force in online advertising, search, YouTube, and cloud services. And while regulatory noise continues to swirl, this outlook assumes the company is not broken up between now and 2030—a scenario that could actually unlock more value, not less. Google Search is still the internet’s gateway, YouTube is the world’s second-largest search engine, and Google Cloud is gaining ground in the AI arms race. Meanwhile, Alphabet’s deep investments in AI models like Gemini position it well to monetize the next wave of enterprise and consumer AI applications. Plus, you have Waymo which is the gold standard for autonomous vehicles.

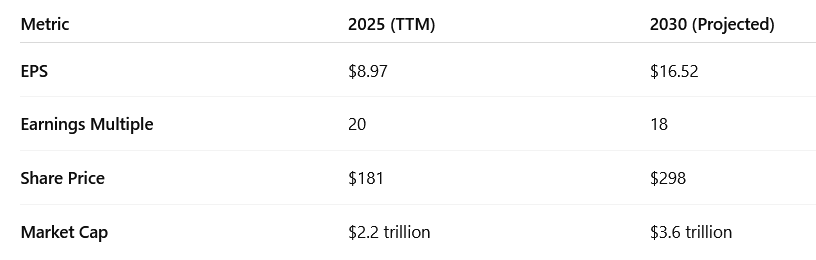

In the last 12 months, $GOOGL generated a staggering $111 billion in earnings (EPS of $8.97). I expect earnings to grow 13% per year over the next five years, meaning the company will generate roughly $16.52 per share in 2030. At a conservative multiple of 18-times earnings, that gives us a share price of $298. That's a market cap of $3.6 trillion, or upside of 63% from here.

A few other stocks that came close to cracking the top five largest tech stocks in 2030 are Apple (AAPL), Meta Platforms (META), Tesla (TSLA), and Taiwan Semiconductor (TSM).

Earnings Season is Picking Up

Now let's switch gears and head back to July 2025.

Earnings kickoff in earnest this week with US blue chip stocks like JP Morgan (JPM) and Johnson & Johnson (JNJ) along with high-flying tech stocks like Netflix (NFLX) later this week.

We don't own any of these, but with stocks extended to the upside any whiff of an earnings miss or less-than-stellar guidance will likely cause markets to pullback. However, we are still in a strong uptrend so dips should be bought until further notice.

We also had inflation data this morning, which came in slightly above expectations. While certain goods are seeing price increases, particularly those most affected by tariffs like home furnishings, overall impact on prices has mostly been muted. The tepid market reaction to the slightly hot inflation print affirms this outlook.

The TikStocks Portfolio is performing extremely well. We were right to build a position in Microstrategy (MSTR) as crypto and crypto stocks are rallying heavily. At present, this position is up 32% since we opened it in April:

My list of "market leading" stocks continues to evolve, but right now the ones at the top of my list are: