Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

The similarities between the 2018 and 2025 trade wars

How much longer will this sell-off last?

Which stocks should you buy on the dip?

A preview of this week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

It's been a wild ride for investors lately.

One minute, the stock market is rallying on hopes of a trade deal with Mexico, Canada, and China. The next, it's tanking on the latest tariff announcement from President Trump. Stocks are all over the place, businesses are scrambling, and every tweet and soundbite seems to hold the market’s fate in its hands.

Tech stocks, especially semiconductors, are feeling the heat. Nvidia (NVDA) and other chipmakers are getting crushed as global supply chains buckle under the weight of new tariffs. Companies that rely on international manufacturing are warning of rising costs, and even consumer spending is showing signs of strain.

The pain isn’t limited to stocks. Bitcoin has now slipped into a bear market, while gold shines as a hedge against uncertainty. Defensive sectors like consumer staples and utilities are holding up relatively well, offering some shelter in the storm.

But it’s not just the markets. Farmers are getting squeezed by retaliatory tariffs on agricultural products. Retailers are warning of higher prices as supply chains get choked. And on Capitol Hill, politicians are playing the blame game over the economic mess we’re in.

It’s a really worrying situation. It’s starting to spill over into every corner of our interconnected world. If you’re like me, you’re wondering where this is all heading—and what you should do with your portfolio.

But before you hit the panic button, let me clue you in on a little secret: I’m not talking about the 2025 trade war.

I’m talking about the 2018 trade war.

Not My First Rodeo

Back in Trade War 1.0, I was overseeing a team of equity analysts while heading the research division at Mauldin Economics.

And trust me, it was just as chaotic then as it is now. Back then, Trump was slapping tariffs on China, Mexico, and Canada. The headlines were just as terrifying, the market reactions just as wild, and the fear just as palpable.

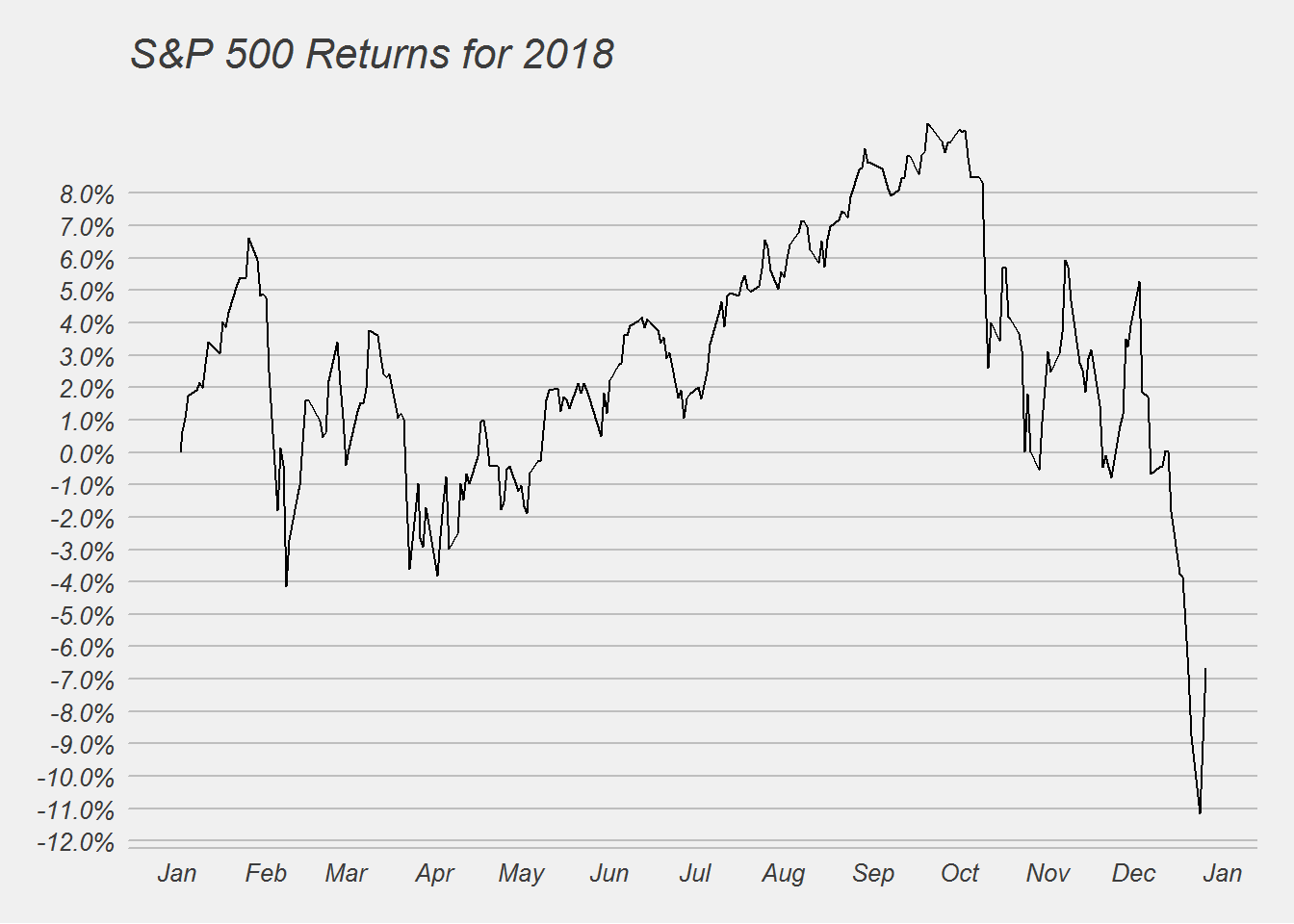

We were also dealing with the Federal Reserve raising interest rates after they’d been kept at zero in the wake of the Great Recession. This combination of trade war uncertainty and rapidly rising interest rates led to a -18% correction in the S&P 500 over a 10 month period:

This was a very uncertain period in market history, much like today.

But you know what happened next? Markets found their footing, and investors who stayed disciplined—who saw the opportunity behind the chaos—ended up in a great position.

And I expect the current correction to resolve in a similar manner.

Learning from the Past

During the 2018 trade war, the S&P 500 dropped nearly 20%.

Tech stocks, especially semiconductors, were hit the hardest as supply chains turned into collateral damage. Nvidia (NVDA) and Micron Technology (MU) saw massive declines, with semiconductor stocks plummeting as much as 30%. This was one of many reasons I warned investors to not buy the dip on Nvidia after earnings in last week’s podcast (listen on Spotify and Apple).

Industrials and consumer discretionary stocks also took a beating as tariffs drove up costs and sowed uncertainty. The auto sector was a prime casualty, with Ford (F) and General Motors (GM) warning of rising costs and squeezed margins.

But not everything was red. Defensive sectors like consumer staples and utilities held up well. Companies like Procter & Gamble (PG) and NextEra Energy (NEE) provided a safe haven for investors looking to ride out the volatility. Gold, as always, served as a classic hedge against uncertainty. As someone who’s owned gold since October 2023, I’ve been grateful to have it in the TikStocks Portfolio during this rough patch as it’s actually up 9% in 2025:

On the other hand, Bitcoin (BTC), much like now, failed to provide the safe haven many expected. This is another reason I’ve taken profits on ~25% of my massive crypto portfolio in the last two weeks.

Even though the “cycle” indicates we could have more upside, the fact is Bitcoin - and especially altcoins - are a leveraged version of the major US indexes. If the S&P 500 rises 1%, Bitcoin often rises 5%, and vice versa. So what happens if the S&P 500 falls into a -10% correction territory? You do the math. And since I am sitting on massive gains from the crypto bull run (as we turned bullish in April 2023) I have no problem taking some chips off the table.

But for stocks, here’s the kicker: despite all the fear and chaos, 2019 turned out to be one of the best years ever for the S&P 500.

The index surged nearly 30%, led by the very tech stocks that had been pummeled during the trade war. Investors who stayed disciplined and bought into the weakness were rewarded with huge gains.

And I don’t think this time is different.

Why I'm Not Panicking

The same playbook applies today. When fear is high and markets are selling off, it often creates opportunities. And based on the latest AAII sentiment survey, investors have rarely been more fearful than they are right now. In fact, 60% of all respondents were bearish, a level of pessimism we’ve only seen a few other times—August 1990, March 2009, and September 2022. Not coincidentally, all of these were at or near bear market bottoms.

Yes, tariffs, volatility, and uncertainty are unsettling. And seeing red on the screen isn't fun. But remember—markets tend to climb the wall of worry. And while things are dicey out there right now, this too shall pass, just like every other “crisis” that felt like the end of the world at the time.

If anything, now is the time to get your watchlist ready and be prepared to buy when the dust settles. As we’ve seen before, what feels like a market crash can quickly turn into the best buying opportunity of the decade.

And most of all, don’t panic sell. You will regret it.

Stay safe out there,

Robert