Taking a Quick +15% Gain + Is Meta Platforms (META) a Buy?

The Patreon Portfolio continues to march higher...

The Patreon Portfolio continues to deliver.

While I've grown more cautious in the near-term, the saying I keep coming back to is, "when the music is playing, you need to keep dancing."

And we've been doing just that. In fact, the Patreon Portfolio is already up a whopping +17% in 2024...

...including a +49% gain for the crypto portfolio:

So that begs the question: what comes next for stocks and crypto?

A Good Time to Be Cautious

First, I want to make clear I believe we're in a secular bull market that will last many more years.

So I have no plans to "sell everything."

But in the short-term, the "sentiment signals" are starting to pile up. For instance, the S&P 500 has closed higher in 16 out of the last 18 weeks. That hasn't happened since 1971.

Stocks going up in a straight line like they have for months is not normal. Nor is it sustainable.

And while it's anecdotal, a few notable "perma-bears" have either closed their funds or folded their investment products in the last two weeks (I won't name names out of respect).

While the S&P 500 and Nasdaq technicals remain bullish, a few "key names" in the index are showing weak technicals. That include Apple (AAPL), which has fallen below the 200-day MA on strong volume...

...and Alphabet (GOOGL) which is right at the closely-watched 200-day MA:

As I told our Patreon discord members yesterday, I am not looking to sell either of these positions any time soon. And if I were going to buy one of the other, I'd pick $GOOGL as it's arguably the greatest business ever created.

I'm Making Three Portfolio Changes Today

But with sentiment frothy, leaders extended, and new setups dwindling, I will move to a cautious posture. With that in mind, I will make a few minor portfolio changes today.

First, I will close my position in Coinbase Global (COIN) for a quick +15% gain. This is a trading position, and with ~25% of the portfolio invested in cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), we have plenty of crypto-related upside here.

With that in mind, I will close my position in Coinbase Global (COIN) in the next 24 hours.

Second, I will raise my stop loss on Nvidia Corp. (NVDA) to $775. This will "de-risk" this position, limiting our total downside to 0%.

Third, I will re-open my position in Denison Mines (DNN). The stock hit our protective stop loss on February 21st. But with the stock right back at its 50-day MA and the MACD troughing, I like the technical setup.

With that in mind, I will allocate 1.5% of my portfolio to Denison Mines (DNN). I will place a protective stop loss to sell my entire position at $1.50, limiting my downside to -17%.

This is a high-risk, high-reward opportunity. There is a good chance you will lose money, so do not invest more than you can afford to lose and make sure to use a stop loss or another risk management technique to limit any potential downside.

Long term I am still bullish, but short term it's starting to look like we may either get a market pullback, or a rotational (stealthy) pullback, stock by stock.

As for crypto, I laid out my 2024 bull case in Sunday's "Let's Analyze" newsletter. I remain bullish and will continue to hold my positions.

Keep Your Eyes on the Long-Term Prize

The stellar performance of the Patreon Portfolio, especially the +49% surge in our crypto holdings, speaks volumes about the opportunities that lie within both stocks and crypto. Yet, as the recent market signals suggest, a breather might be on the horizon.

While our long-term outlook remains as bullish as ever, acknowledging the near-term signals is crucial for navigating the waters ahead.

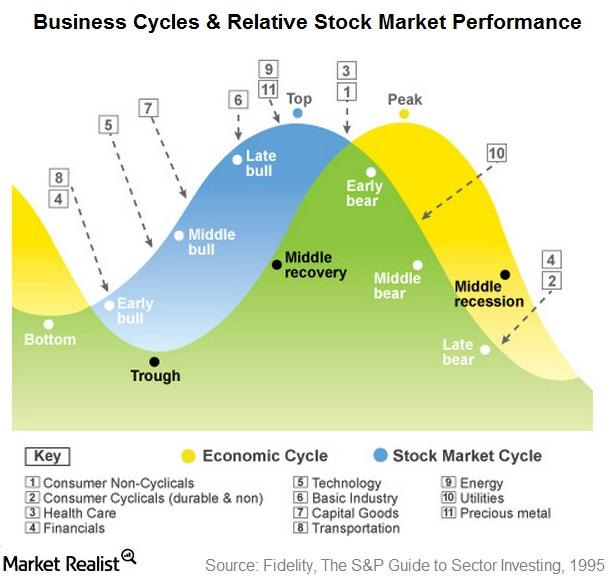

But do not confuse my caution with pessimism. Markets ebb and flow, and a potential pullback or rotation is merely part of the cycle—a cycle that, in the grand scheme, is trending upwards.

Therefore, while we might tighten the reins slightly and watch the market's signals more closely, our conviction in the long-term potential of both stocks and crypto remains unshaken.

In the end, our strategy is clear: stay the course, remain vigilant, and be ready to adapt.

Stay safe out there,

Robert

Is Meta Platforms (META) a Buy?

Overview: Meta Platforms (META), formerly known as Facebook, operates as a technology conglomerate, focusing on social media, virtual reality (VR), and augmented reality (AR) products. It owns major platforms like Facebook, Instagram, WhatsApp, and Oculus, connecting billions globally, driving digital advertising, and innovating in immersive technology experiences.

Bulls Say

Meta commands the leading position in the social network space, offering the broadest audience and richest data for online social network advertising, thanks to its unparalleled user base and engagement levels.

The rising ad revenue per user at Meta underscores the increasing value advertisers find in partnering with the company, reflecting positive market sentiment.

Leveraging AI technology across its platforms and introducing VR products, Meta is poised to enhance user interaction significantly, which, in turn, is expected to catalyze additional growth in advertising income.

Bears Say

Meta's reliance on online advertising as its primary revenue source poses a significant risk if the sector stops expanding or if advertisers increasingly prefer competitors like Google or Snapchat.

Even with its fast-paced user expansion, Meta faces the challenge of sharing its customer base with other social networks, including Snapchat and TikTok, necessitating constant efforts to retain user engagement and time on its platforms.

The potential introduction of regulations that restrict data collection and use, or limit corporate acquisitions, could impact Meta's ability to leverage user information and hinder its growth trajectory.

Technical Analysis: META’s technical picture is BULLISH:

Robert’s Conclusion: Meta's dominance in social networking, exemplified by Facebook's 3 billion monthly users, offers unparalleled advertising appeal due to its vast user base and engagement levels. The shift of advertising dollars online, coupled with Meta's innovative features and apps, enhances user interaction, data accumulation, and targeted advertising capabilities.

Despite privacy concerns, Meta's growing ad revenue per user demonstrates advertiser confidence. The company's strategic focus on online, social network, and video advertising, integration of AI, VR, and AR technologies, and expansion into e-commerce positions it for sustained revenue growth from advertising, capitalizing on its extensive reach and technological advancements.

From a technical perspective, the stock is in a solid technical uptrend. The 15, 50, and 200-day MA are all sloping upwards. And while shares are overbought on the 14-day RSI in the near-term and MACD is rolling over, investors would be wise to add to their positions or open news ones on weakness. That’s especially true considering $META shares are trading at a below-market forward price-to-earnings of 21-times earnings.

My models imply META has a 12-month target price of $570 (upside of +17%). That makes META a BUY!

Ross Investment Research Disclaimer and Disclosures:

Thank you for subscribing to Ross Investment Research. Our team works hard to deliver useful commentary three times per week. Together we offer an independent view on Market Strategy, Technical Analysis, Sector Rotation, and Bottoms Up stock picking. These commentaries, analyses, opinions, and recommendation represent the personal and subjective view of the authors, and they are subject to change at any time without notice. Our goal is to assist the provide educational content directly to clients and advisors, without any Conflicts of Interest. We understand how hard you work to make good investments. Please note the following risk factors:

We Are Not Licensed Financial Advisors or Registered Broker/Dealers. Nothing in this communication constitutes a solicitation, endorsement, promotion, of any particular security, transaction, or investment. We do not earn a fee or commission from your portfolio. Our goal is to provide educational information that helps readers better understand investing and stock market psychology. As a result, Ross Investment Research does not recommend that you buy or sell any security. The information provided in this report comes from sources the author deems reliable. Investments may not be appropriate for all investors and is provided without respect to individual investor financial situation, time horizon, or risk tolerance.

Readers Should Consult Their Financial Advisors, before making an investment decision. These licensed professionals help with retirement planning and investment management. They have a Fiduciary responsibility to employ a strategy that is consistent with the client's Investment Policy Statement. This document spells out appropriate asset allocation, diversification, suitability of securities, Growth and Income objectives, and treatment of any concentrated positions. They make sure everything is done by the book. If you are a Do-It Yourself Investor, please conduct your own research and due diligence, including carefully reviewing any prospectus and other public filings of an issuer. The biggest risk is emotional. Can you stay invested through the 2-3 Bear markets that hit in a career, without panic selling? If you like to buy stocks, understand the risk involved. You could lose money. That may not be a risk worth taking if they knew the chances of losing money.

Futures and Options Trading can involve substantial risk and the loss of any funds invested. Both use leverage to increase potential returns with a minimal upfront investment. They are trading vehicles used by professional investors to reduce risk. You could be easily be down 50-70% with high risk strategies. Before trading options, a person should review the document Characteristics and Risks of Standardized Options, available from your broker or any exchange on which options are traded. Options trading is generally more complex than stock trading and is not suitable for many investors. The security used in this example for illustrative purposes only. The calculation used to determine the return on investment "ROI" does not include the number of trades, commissions, or other factors used to determine ROI.

Past performance should not be indicative of future results. The biggest trick up Wall Street’s sleeve is to show a security with a three-year track record and imply that same return will be available going forward. Investors would find out later that the dividend was unsustainable. It helps to see future and determine if the conditions are right for investment in a certain Sector or Stock. At any given time, the stock market can fall 20%. Valuations can be disconnected from the economy for years. There is a chance of losing money. All information provided are for educational purposes only and does not apply, express, or guarantee future returns.

The Author and Ross Investment Research do not guarantee or otherwise promise any results that may be obtained from using this report. Nothing in this report should be viewed as a recommendation to purchase a specific security. Each investor has their own personal financial situation and risk tolerance. Its helps to be knowledgeable about the investment process or turn over the responsibility to an experienced Financial Advisor. I do not receive a fee for advice or a commission for a trade. My goal is to provide educational and informational content to help you become a better investor and stock picker.