The Roaring 2020s are alive and well.

As I've been saying for the last two years, we are in a secular bull market in US stocks. You've likely made a lot of money even if you partially believed in my outlook and followed my portfolio structure.

I also told you repeatedly we were in the early stages of a crypto bull market. This has also proven correct, with Bitcoin - our largest portfolio position - up 230% since I first revealed this outlook in April 2023.

I am maintaining this optimistic outlook for stocks. And for crypto, it looks like we're entering "alt season."

And I have one altcoin I'm putting some money behind today.

My Outlook Remains Bullish

We've covered reasons to be bullish over the next few years ad nauseam, but I'll do a quick review here:

Global Liquidity Boom: central banks - including the Fed - are all cutting interest rates simultaneously

AI Productivity Boom: AI adoption is expected to add $15.7 trillion to the global economy by 2030, and since markets are forward looking much of which will be priced in over the next 12 months

Demographic Tailwinds: Millennials are entering their peak earnings years and will soon be inheriting trillions in assets from the Boomer parents, plus Boomers are entering retirement where they are spending their savings

Trump 2.0 Deregulation: Less regulation often translates to higher profits as companies spend less on compliance and face fewer barriers to expansion.

But there's also reason to be bullish in the near-term. For one, earnings season is mostly finished as 95% of companies have reported. And it was a good quarter as S&P 500 earnings grew 5.8%, which was the 5th straight quarter of year-over-year earnings growth for the index.

Earnings growth is one the main reasons stocks go up and down, so steady earnings growth is a good sign the bull market is underpinned by solid fundamentals:

No more earnings reports also means fewer event-driven downside catalysts. And other than unforeseen geopolitical issues or a more hawkish Federal Reserve at the Dec. 17-18th FOMC, we are entering a time of year with few potential surprises.

And while it's about a month away, we also have the Santa Rally coming late December.

But while stocks are setting up nicely, crypto is also on the launch pad.

"Alt Season" is Heating Up

As I wrote in Monday's update, my analysis shows we are likely in the top of the 7th inning of this crypto bull market.

I know that spooked some people. But what you must keep in mind is this is the most profitable leg of the cycle. Retail is pouring into the crypto market. I see this in my indicators and in my personal life as I am getting inundated with calls and texts from friends and family asking if it's "too late" to buy crypto.

This tells me the easy money has been made. Considering we've been long crypto the entire cycle, we have already made a lot of that easy money. But it also looks like we may be entering "alt season" where altcoins begin to outperform.

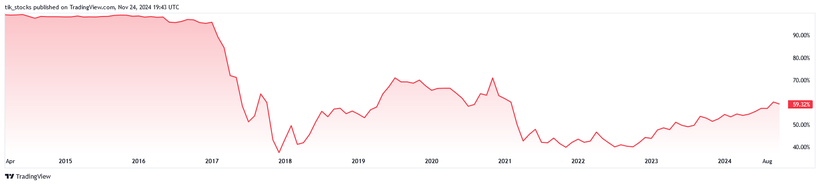

Here's why: Bitcoin dominance, which measures BTC's market share relative to the rest of the crypto market, is at its highest level since February 2021.

Historically, when Bitcoin dominance peaks, it signals a shift in capital flows. Investors who've ridden Bitcoin's meteoric rally start reallocating their gains into higher-risk, higher-reward altcoins. This creates a "ripple effect" (pun intended) across the market, with smaller-cap tokens rallying hard as they play catch-up.

Adding a New Altcoin Trade Today

I already hold a lot of altcoins via positions in Ethereum (ETH), Solana (SOL), and Chainlink (LINK). I’ve also had a lot of success this year, as my crypto portfolio has doubled in the last year and is +365% in the last two years:

Clearly, I have a lot of crypto portfolio exposure. But with alt season upon us, I want to add a high-quality altcoin position that fits the following criteria:

Hot Narratives: AI, quantum computing, DeSci, and other tokens often pump due to speculative hype, regardless of fundamentals

New Merchandise: altcoins that are new to retail will pump more than altcoins retail is familiar with from previous cycles

Strong Technicals: I am looking for altcoins that have rallied hard post-election and have held their gains

With that in mind, here are five altcoins I'm watching and one I’m adding to my portfolio today: