Over the weekend, I was at a friend’s Memorial Day party. Great food, great people—and like all good parties in 2025, at some point, the conversation turned to mortgage rates.

“I just got quoted 7.2%,” one guy said. “It’s insane. We might just stay in our apartment another year.”

He’s not wrong. Housing affordability is the worst it’s been in decades, and rising rates are a big part of that. But what most people don't know is that the reason rates are so high - and housing affordability so low - is due to government spending.

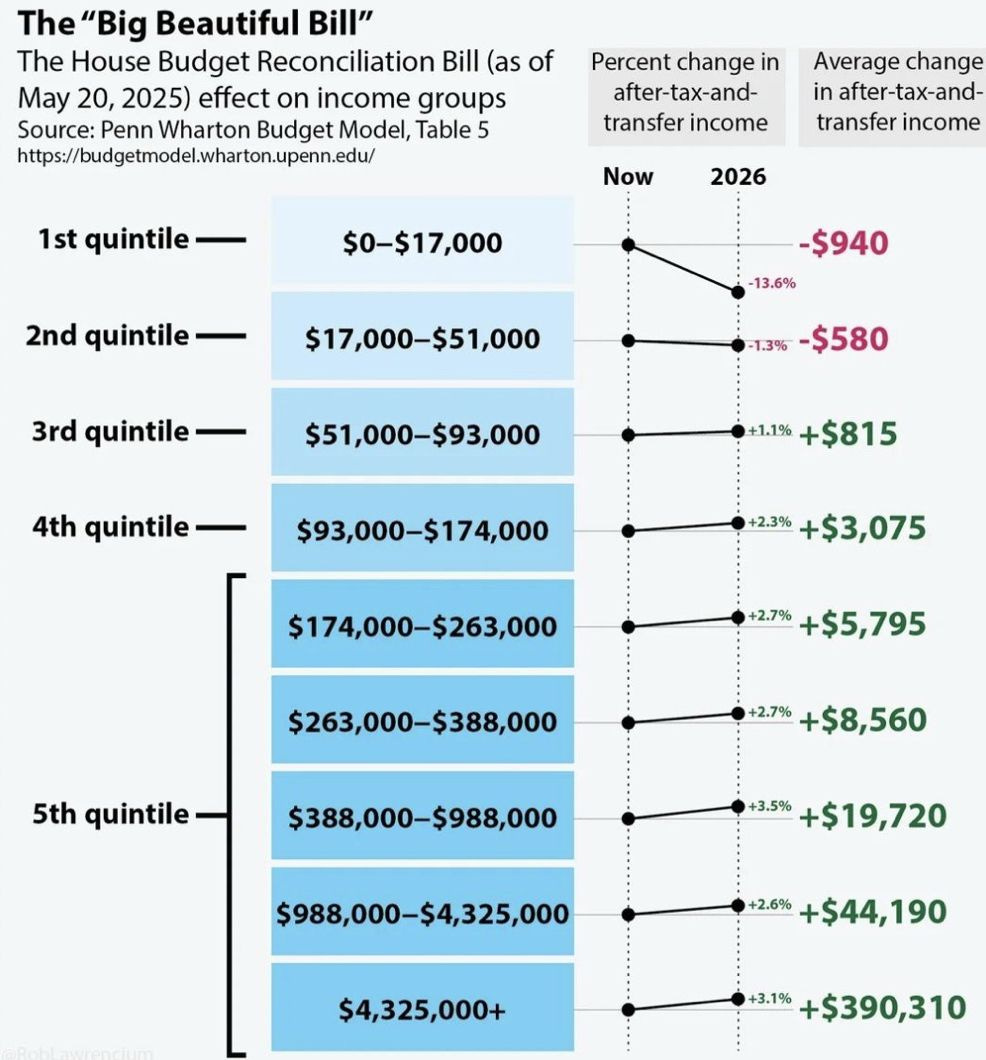

And yes, that includes the Republican "Big Beautiful Tax Bill" that passed the House of Representatives last week.

Despite all the lip service paid to Elon Musk's Department of Government Efficiency, this bill shows zero fiscal restraint. If you thought Joe Biden's Omnibus and Inflation Reduction Act spending bills were irresponsible, you should think the same for the one. It’s a full-throttle stimulus package dressed in supply-side clothing. In fact, we’re now running the highest budget deficits as a percentage of GDP outside of COVID and World War II.

And the market is reacting; yields on the 10-year Treasury have spiked from 4.0% to 4.6% in just over a month, which is why our friend's quoted mortgage rate was so high. But while rates are rising - and we discussed its impact on this week's podcast (listen on Spotify and Apple Podcasts) - the 10-year was this high exactly one year ago. In other words, the bond market has basically round-tripped over the past 12 months.

While yields are high at the moment, one fact remains: a "stimulus wave" is coming in the form of tax cuts, deregulation, and a form of quantitative easing from the US Treasury.

And there are a handful stocks that benefit from this.

Stimulus Without a Slowdown

Trump and Treasury Secretary Scott Bessent initially thought they could engineer a "controlled demolition" of the economy—cooling inflation and resetting supply chains while keeping consumer sentiment afloat.

But while we got a short-term stock market crash, the economy seems to be muddling along. That means we're heading straight into a stimulus wave without having hit a real recession first. That’s rare—and powerful. Because now we’re seeing three major pro-growth levers being pulled simultaneously.

The new tax bill slashes rates across the board, especially for the middle class and upper income brackets. Some estimates suggest it could add $479 billion to the deficit in 2026 alone. Over a decade, projections range from $2.5 trillion to $3.3 trillion in added debt.

This puts more money in consumers’ pockets, yes—but at the cost of pushing more Treasury bonds into the market. And when there’s more supply of something, buyers want a better deal. That’s why we’re seeing higher yields. The market isn’t spooked—it’s just demanding better compensation.

And guess what? We’re positioned for this. Gold and Bitcoin are up significantly since the lows in April. They tend to thrive in environments like this—where real rates are pressured and government spending runs hot.

What isn’t getting as much attention is the de-regulatory push happening behind the scenes. Quietly, the administration is taking the leash off bank balance sheets by relaxing collateral constraints, easing Tier 1 capital ratios, and juicing government-backed lending.

That means banks can lend more, speculate more, and extend more credit to businesses and consumers alike. It’s not QE by name—but it’s liquidity by function. And that’s bullish for small-cap growth names, speculative assets, and risk-on sectors that were starved of capital over the last year.

Then there’s the Supplementary Leverage Ratio (SLR) adjustment. Most people don’t know what this is, but here’s the simple version: The SLR determines how much leverage banks can use against their capital base. By loosening it, the government is effectively encouraging banks to buy Treasuries at the best possible time, helping absorb the flood of new issuance created by the tax bill.

That has QE-like effects. It soaks up bonds. It boosts liquidity. And it could cap long-term yields sooner than most investors think. So while we’re seeing short-term volatility in bonds, I believe yields have either already peaked or are close to peaking.

And that's why we're going to make some portfolio changes today.

Three Must-Hold Stocks for the "Stimulus Wave"

We spoke last week about the top five stocks on my radar right now.

That's still a solid list for anyone looking to "long" this market. That said, high-growth stocks are the ones most sensitive to changes in liquidity like we're about to see with the stimulus wave.

For that reason, I would focus on the following positions: