Are we having fun yet?

After the post-Election Day rally, the TikStocks Portfolio is now up 44% in 2024. That comes on the back of a monster 37% return in 2023.

Yes, it's easier to make money in bull markets. But to say it's been "easy" to stay invested and climb the Wall of Worry over the last few years is only true in hindsight.

For instance, we added heavily to positions during some of the most volatile periods of the last two years, including the October 2023 sell-off and the Yen Carry Trade panic in August 2024. Both were highly uncertain times, but we chose to stick to our secular bull market thesis and not only hold our positions, but add to them. This is a key reason we're on pace to top the S&P 500 again this year.

But as always, I'm not looking to rest on my laurels. That's why I'm adding two new position today, in addition to reviewing our portfolio.

Core Portfolio (SPY, QQQ, VB)

The investing community was bearish heading into 2024.

Going against the grain and taking the other side of that bet is a key reason we are currently trouncing the S&P 500 performance this year:

And I don't expect the upward trajectory to stall any time soon since we're in the early stages of the following tailwinds:

Global liquidity Boom (read more here)

Global AI productivity Boom (read more here)

Boomer Spending Boom (read more here)

Millennial Peak Earnings Years Boom (read more here)

Trump 2.0 Deregulation Boom (read more here)

And with the technicals for both the S&P 500 and Nasdaq still looking strong with the 200-day MAs rising, I am happy to increase my positions here.

With that in mind, I will continue holding my positions.

New Members: Allocate 5% of your portfolio to a long position in the SPDR S&P 500 ETF (SPY) and 5% of your portfolio to a long position in the Invesco QQQ Trust (QQQ).

Big Tech (AAPL, MSFT, AMZN, GOOGL, NVDA)

The tech sector is about to get a boost from Trump 2.0.

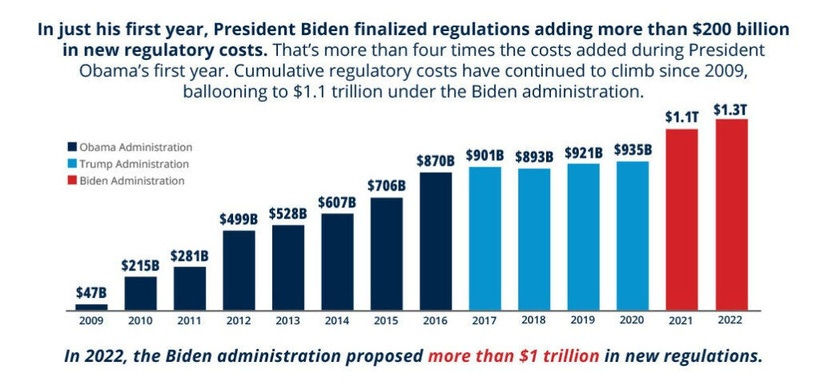

Less regulation often translates to higher profits, as companies spend less on compliance and face fewer barriers to expansion, which has the potential to affect the tech sector more than others.

For instance, Lina Khan - head of the Federal Trade Commission (FTC) - has blocked multiple acquisitions since 2021. This shift can significantly benefit industries like financials, energy, and technology, which have faced heavy scrutiny and compliance costs over the past few years, including:

Amazon's attempted acquisition of iRobot (IRBT)

Microsoft's acquisition of Activision Blizzard

Nvidia's attempt to acquire Arm Holdings (ARM)

This deregulation boom has the potential to reinvigorate Mag7 shares, which have been trading sideways since summer.

If I were adding to any positions here, I would focus on Nvidia (NVDA) and Amazon (AMZN) as both have bullish technical market structure. However, I would continue to avoid Microsoft (MSFT) as shares are trading below its 200-day MA.

While Microsoft (MSFT) is struggling, there are two positions on my watchlist I've been waiting to buy all year…