I’ve been publishing this annual list for years now, and while no one gets it right 100% of the time, last year I nailed it.

My top picks for 2024—Nvidia (NVDA), Costco (COST), and Ethereum (ETH)—delivered an average return of 97%. That’s nearly double the TikStocks Portfolio’s already-impressive 55% gain this year and far ahead of most hedge funds.

If you followed my recommendations, you’re sitting on massive profits. But the past is the past, and now I’m turning my focus to 2025.

So, let’s dive in—here are my Top Five Buys for the year ahead.

How I See 2025 Unfolding

Coming into 2024, there were a few major themes that I expected to drive the market higher.

These included investing "narratives" like artificial intelligence, crypto, and the "no recession" camp. We took advantage of these narratives via positions in Nvidia (NVDA), Ethereum (ETH), and Costco (COST).

And the results speak for themselves as the TikStocks Portfolio is up 55% in the last 12 months.

However, the themes that drove markets higher in 2024 may be very different than the themes that drive markets higher in 2025.

But I have a few in mind... and stocks to capitalize on them.

My #1 Quantum Computing Stock

Quantum computing harnesses the principles of quantum mechanics to process data in ways that traditional computers simply can’t match. Unlike classical computers, which rely on binary bits (0s and 1s), quantum computers use qubits. Qubits can exist in multiple states simultaneously, enabling calculations at speeds that are exponentially faster for complex problems.

Quantum computing has the potential to revolutionize industries like artificial intelligence, cryptography, drug discovery, and finance. It could solve previously unsolvable problems, from simulating molecular structures to optimizing global logistics.

We're still in the early stages of this boom, but if I were trying to invest in it there's one company that would be at the top of my buy list…

…Alphabet (GOOGL).

The company has established itself as a front-runner in the race for quantum supremacy. In 2019, Google’s quantum team made headlines by achieving “quantum advantage,” where its quantum computer solved a problem in seconds that would take traditional supercomputers thousands of years. Fast forward to today, and Google is pushing even further with its latest "Willow" quantum chip, which boasts 105 qubits and significantly improved error correction.

In addition, Alphabet (GOOGL) offers exposure to quantum computing, AI, and autonomous driving while remaining undervalued. And at $195, it’s the cheapest of the Magnificent Seven, trading at just 21x projected 2025 earnings. Beyond quantum computing breakthroughs, Alphabet’s diversified business includes Search, YouTube, Cloud, and Android. Its “Other Bets,” like Waymo, lead the autonomous driving race with robo-taxis in four cities—Tesla has none.

These Stocks Will Get a "Trump Bump"

President-elect Donald Trump is slated to take over the White House in a little over a month.

As we said coming into the election, while the markets overall would be fine no matter who won, certain sectors would be winners and losers.

One obvious winner will be Bitcoin (BTC). Yes, I have said repeatedly we are currently in "late cycle" for this crypto bull run. But a caveat to that is this is the most profitable leg of the crypto cycle. That means it's a good time to have exposure to "blue chip" crypto projects like Bitcoin (BTC). But I'd also want some crypto equity exposure via positions that are a "picks and shovels" play on the crypto market like Coinbase Global (COIN).

And while the stock has been on an incredible run since Election Day, I also expect Tesla (TSLA) to be a top performer in 2025 as the stock breaks out of a massive multi-year consolidation.

This Stock Combines Two 2025 Investing Themes

One thing I expect in 2025 is that small and mid-cap stocks will likely outperform their large cap peers for the first time since 2020.

Smaller companies rely more heavily on borrowing for growth and expansion. As the Federal Reserve cuts rates, borrowing becomes cheaper. That boosts their profitability and growth potential. Smaller companies are also more sensitive to changes in regulation. Since I expect a de-regulation wave to hit markets in 2025, I expect small and mid-caps to benefit more than their large cap peers.

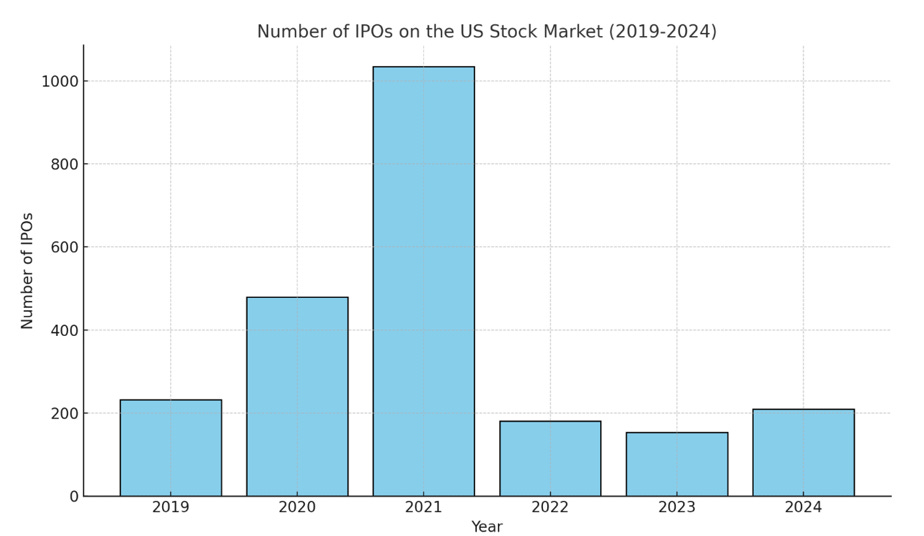

In addition to small-and-mid cap outperformance, I also expect a boom in IPOs next year. The IPO market has been a snoozefest since 2022. In 2021, there were over 1,000 IPOs in the U.S. And those came on the heels of 480 IPOs in 2020. But the IPO market hasn’t done much since. U.S. markets saw a mere 181 IPOs in 2022 and a lackluster 154 in 2023.

And in 2024, we had just 210 IPOs.

But I expect that to change in 2025. After two years of great S&P 500 returns, investor sentiment is bullish and the appetite for risk-taking is growing.

Bull markets tend to create favorable environments for companies to go public, as valuations are higher and capital is more readily available. Second, private equity and venture capital firms are eager to cash out. Many high-growth startups have been waiting on the sidelines since 2021. They’ve avoided public markets due to economic uncertainty and volatile market conditions. But with strong market momentum and lower interest rates, these firms will push their portfolio companies to IPO so they can finally realize returns on their investments.

Lastly, pent-up demand from delayed IPOs will play a big role. Many companies that postponed their public debuts - like Stripe, SpaceX, Klarna, and Databricks - during the market slowdown of the past two years are now well positioned to capitalize on improving conditions.

To profit from both smaller company outperformance and the IPO boom, I like Nasdaq Inc. (NDAQ). The company operates one of the largest stock exchanges in the world and earns significant revenue from IPO listings, trading volumes, and associated services. They also have an established track record of attracting tech and growth companies. An IPO surge would boost listing fees and trading volumes.

And with the stock in a strong technical uptrend, I am happy to own this one as the fundamenatls, technicals, and sentiment are all bullish.

With that in mind, I will allocate 1% of my portfolio to Nasdaq Inc. (NDAQ) in the next 24 hours. I will place a protective stop loss at $73 to limit my downside to -9%.

Closing Our $GDX Position, Plus Looking Ahead

Our VanEck Gold Miners (GDX) position hasn't worked out as expected. And with the stock peeking below the 200-day MA today, I am happy to cut this one and reallocate elsewhere.

With that in mind, I will sell my VanEck Gold Miners (GDX) position for a -5% loss in the next 24 hours.

If 2024 taught us anything, it’s that identifying the right narratives early can lead to outsized gains. From AI and crypto to strategic plays on economic policy, we captured these themes and delivered results, with the TikStocks Portfolio up 55% this year.

As we head into 2025, I believe the opportunity for smart, forward-thinking investors has never been greater. Quantum computing, small-cap outperformance, the IPO resurgence, and the “Trump bump” are just a few of the major catalysts on my radar.

This isn’t the time to sit on the sidelines—2025 has all the makings of another historic year.

And I intend to take full advantage of it.

Stay safe out there,

Robert