There are times when the market feels totally disconnected from the headlines.

For instance, we've got missiles flying in the Middle East, protests flaring up in major U.S. cities, and Treasury yields pushing higher again. We even have the sitting US president all but confirming the US has entered the war between Israel and Iran:

And yet... stocks refuse to break down. If anything, they’re pressing higher. That’s not to say the risks don’t matter—they absolutely do. But as we talked about on my latest Room to Run podcast (listen on Spotify and Apple Podcasts), headlines don't move markets. Liquidity and earnings do.

While it's a bit chaotic out there, it doesn't necessarily matter from an investing standpoint. No better evidence of this than the S&P 500 being flat since last Monday. But with everything going on, it's a perfect time to review our portfolio positions, lean into the chaos, and put some more of our cash to work.

Let’s get into it.

Core Portfolio (SPY, QQQ, etc.)

After one of the sharpest rebounds in modern market history, the S&P 500 and Nasdaq are both looking increasingly bullish—not just in price, but in structure.

Only five other times since 1950 have stocks been up more than 20% in such a short window. And in every single one of those cases, the market continued higher. Now there's no guarantee history repeats, but it's a strong historical precedent—and it’s a big reason why I remain constructive on equities in the second half of the year.

We're also seeing broad market participation. All 11 sectors of the S&P 500 are now trading above their 50-day moving averages. That’s a healthy sign. When defensive sectors like utilities and consumer staples are rallying alongside tech, financials, and industrials, it tells me this is more than just a short-covering bounce or a rotation-led blip. It’s a sign that a new primary uptrend may be forming—and you can see that visually, with both the S&P 500 and Nasdaq’s 200-day moving averages beginning to slope upward again.

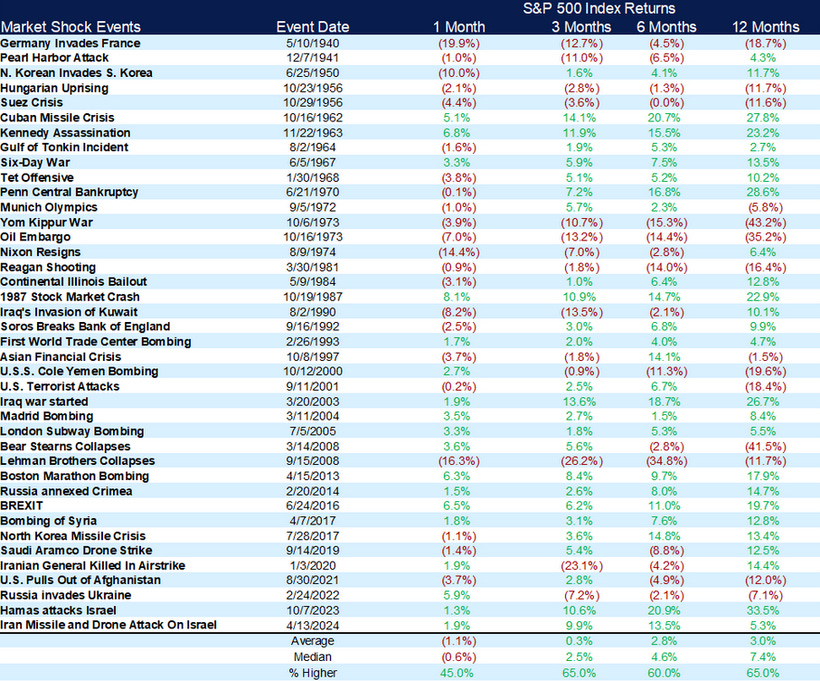

And yes, I know the headlines are ugly. War has broken out in the Middle East and the US appears to be supporting it. But here’s the thing—wars like this historically do not break the market. In fact, they’ve often been buying opportunities. Whether it was the Gulf War, Russia-Ukraine, or Israel-Gaza conflicts over the years, stocks have tended to rally within months of the initial escalation.

Why? Because war shocks don’t usually damage the earnings power of the companies driving these indexes. And unless earnings or liquidity are impaired, the market just doesn’t care for long.

If we see a sharp dip in response to short-term geopolitical panic, I may look to increase exposure. But for now, I’m holding our positions steady. No changes this week.

New Members: Allocate 3% of your portfolio to the SPDR S&P 500 ETF (SPY) and 3% to the Invesco QQQ Trust (QQQ).

Mega Cap Tech Holdings

Like we did last month, let's run through the Magnificent 7 tech stocks and see which ones are buys, holds, and sells.