Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Will US stocks only rise 1% per year over the next decade?

Is Tesla a buy after their latest earnings?

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

There is a funny misconception among new investors.

Many think the way you make money in markets is by spending a lot of time putting on high-risk directional trades. If you're right, you make a ton of money. If you're wrong, you lose a ton of money.

But that is gambling, not investing. And for 99% of the people, it makes sense for you to run what’s called a “low turnover” portfolio. That means you mostly hold long-term positions that you don't trade in and out of.

Because as Jesse Livermore - one of the greatest traders ever - once said, “the big money is made in the sitting and the waiting - not the thinking.”

That doesn't mean I don't take short-term strategic bets on high-risk, high-reward stocks and cryptocurrencies. I mean, I did write a book for the world’s largest publisher on this topic (see for yourself here).

But most of my big wins, like my Apple (AAPL) investment in 2015, Bitcoin and Ethereum investments in 2017, and Palantir (PLTR) investment in 2020, all have come from making strategic bets and holding them for many years.

And one of my more recent positions falls into this category.

My Top Performing Stock in the Last Year

The stock I’m talking about is Fair Isaac Corp. (FICO).

The company is a leading applied analytics company primarily known for its FICO credit scores.

People get their FICO credit score checked when they are applying for a loan, such as a mortgage or an auto loan. Lenders use FICO scores as a tool to assess the creditworthiness of borrowers.

So if you're in the market to buy a new house. You've found the perfect home, and now you need to secure a mortgage to finance the purchase. When you apply for a mortgage, the lender will request your FICO score from one or more credit bureaus. They use this score, along with other factors like your income, employment history, and debt-to-income ratio, to evaluate how risky it would be to lend you money.

FICO has what’s known as a deep economic moat. This means they have some sort of competitive advantage that builds a “moat” around the business protecting it from outside competition.

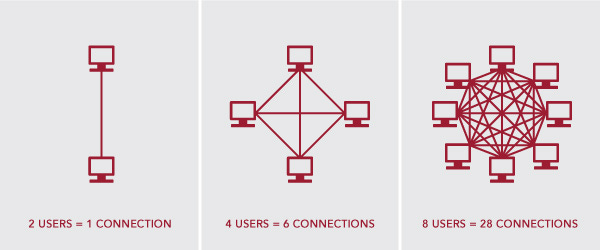

And FICO definitely fits that bill; the company is in the "trust" business and over the last 70 years has built a reputation as the most trusted source for assessing the creditworthiness of borrowers. This has created a network effect for FICO. The company is the key to determining whether banks and other institutions should lend you money. And the more people that use FICO's advice, the smarter and more helpful FICO scores become.

This is similar to the telephone or social media, as the more people who use the telephone or apps like Instagram the more valuable those platforms become.

But while FICO’s fundamentals are solid, its technicals are even more appealing.

One of the Strongest Stocks in the Market

FICO also had - and still has - a very bullish technical picture as the stock is in a clear uptrend.

The 200-day moving average - or primary trend - is upward sloping. And with the 15-day and 50-day moving average also in uptrends and strong momentum…

…I’m comfortable saying this chart is just as compelling of a buy as it was in August 2023 when I originally recommended it.

In fact, it has the same pattern when I recommended it to our nearly 1,000 Patreon Portfolio members last year. Since I recommended FICO to our 1,000 Patreon Portfolio members, the stock is up +125%, which has more than quadrupling the S&P 500 return.

While I believe Fair Isaac Corp. is still a great buy, I’m adding another position that has a strikingly similar fundamental and technical setup to our 1,000 member investing community (you can see this stock here).

And while I won’t hesitate to sell if my thesis changes, I am staying long Fair Isaac Corp.

Stay safe out there,

Robert