All signs point to higher stocks.

I know that may come as a surprise to some of you. The S&P 500 is +57% since the October 2022 lows, with many stocks in our portfolio - like Amazon (AMZN), Alphabet (GOOGL), and Microsoft (MSFT) - up triple digits.

After a strong 2023 where the S&P 500 ripped +22% in 2023, most investors were skeptical the rally would continue into 2024. Even Wall Street had their lowest expectations in a decade for the S&P 500.

As I said at the time, history shows when Wall Street had the lowest expectations, the S&P 500 delivered the highest returns. This was one of many reasons we remained optimistic going into this year, which was the right move as the Patreon Portfolio is +18% year-to-date.

But from what I'm seeing, this rally will continue. And that means we need to make some portfolio changes today.

Despite Risks the Outlook Remains Strong

Goldman Sachs released their forecast for the rest of 2024 last week.

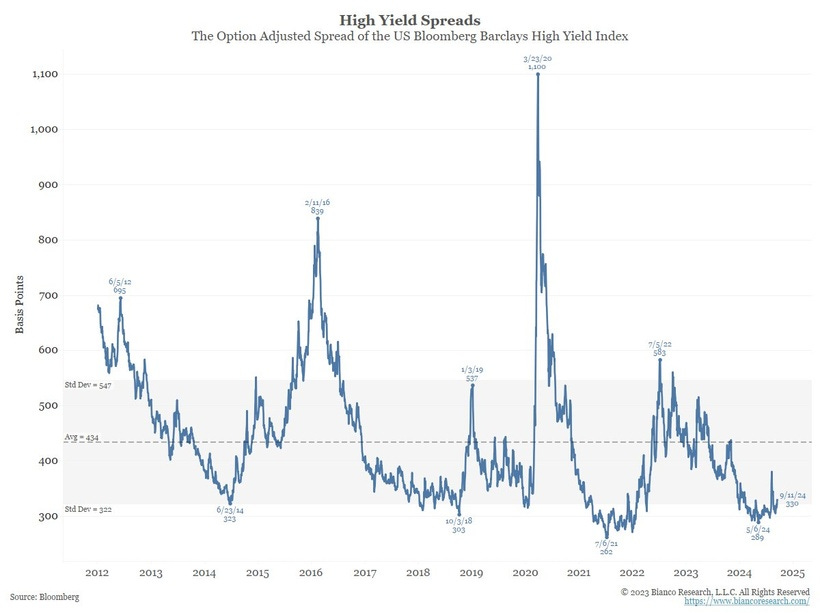

If I had to guess, I'd say the "catch up" rally makes sense for a few reasons. First, there is little sign of a recession. One of the most reliable recession indicators is are high yield credit spreads. That's because high-yield bonds, also known as "junk bonds," are issued by companies with lower credit ratings.

Investors demand higher interest rates to compensate for the extra risk. When the economy is in trouble or nearing a recession, the risk of these companies defaulting rises, which pushes the spreads (the difference between high-yield bonds and safer government bonds) higher.

As shown in the chart, the current high-yield spreads are well below their historical averages, meaning that investors don't foresee a major rise in default risk.

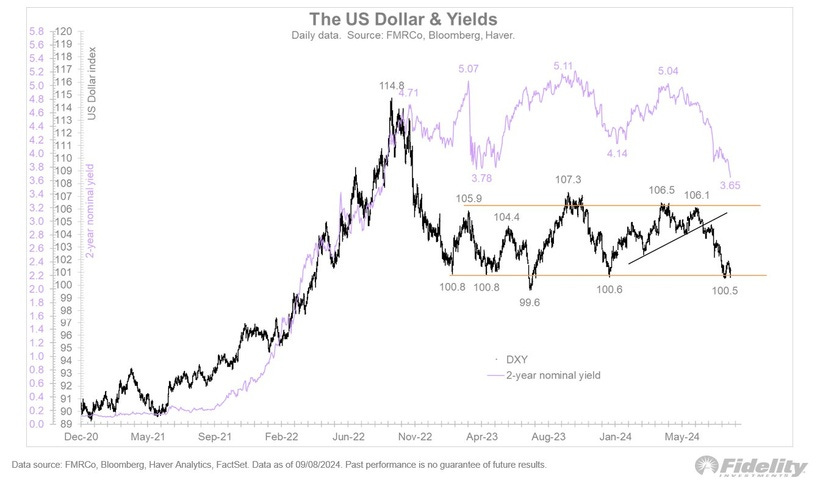

We also have a potential tailwind from a weaker US dollar. This is also good for US stocks because many large US companies - like Microsoft (MSFT), Apple (AAPL), and Nvidia (NVDA) - generate a significant portion of their revenue overseas. When the dollar weakens, the foreign revenue these companies earn translates back into more dollars, boosting their earnings.

And while this bull market has been ripping for 23 months, it is not old by historical standards as the median length of S&P 500 bull runs is 32 months:

We're also starting to see expanding "breadth." This means that it's no longer the Magnificent 7 tech stocks driving markets higher. Instead, the top 10 S&P 500 stocks continue to churn while the bottom 490 remain in an uptrend:

And from a technical perspective, we got a "bullish engulfing candle" when the S&P 500 fell 1.6%, then rallied 2.7% in the span of five hours to finish up 1.1% last Wednesday. That’s strong market action and is the biggest comeback since the early bull market days in November 2022.

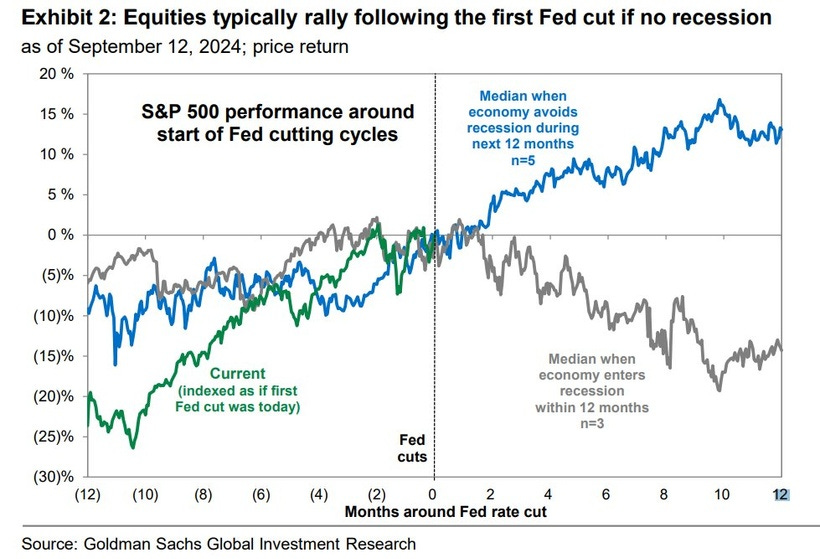

Lastly, we're very likely at the beginning of a Federal Reserve rate cut cycle with the first cut expected on Wednesday. US stocks typically rally following the first rate cut in absence of a recession:

When taken as a whole, all signs point to higher stocks broadly over the next six months. As we discussed on the Room to Run podcast last month, I don't necessarily expect the Magnificent 7 to lead during this next phase of the cycle. In fact, I expect a "regime change" which you can hear more about on the podcast (Spotify and Apple).

And that means we need to do some portfolio re-shuffling today.