Is Tesla a Buy After Its Worst Week of the Year?

Sentiment extremes can often by opportunities...

Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

How I’d trade Tesla (TSLA) after the Trump and Elon divorce

Why US stocks are having trouble going down since Liberation Day

One of the most important lessons a trader can learn

Update on my near-term market outlook

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

I spend a lot of time keeping track of market sentiment.

That’s especially true when sentiment reaches extreme levels. That can be either extreme bullishness or bearishness on an individual stock or an entire index like the S&P 500.

Because “fading” - or going against - these sentiment extremes is one of the easiest ways to make money in the markets. Think of it like a boat: when everyone gets to one side, it tips. And the smart move is to quietly walk over to the other side before it capsizes.

That’s what last week felt like with Tesla.

The stock fell as much as -21% in just a few days. Everyone from retail traders to institutional managers rushed to buy puts, sell shares, and declare the “Musk bubble” officially over. It was a full-blown sentiment extreme.

But in my 15 years of tracking markets every day, those moments almost always signal opportunity—not the end.

The “Walz Bottom” Revisited

Let me take you back to earlier this year.

Minnesota Governor Tim Walz—who owns zero stocks—decided to use Tesla as a punching bag during a press conference. He pulled up a chart showing how much Tesla stock had dropped… as if it were a political prop.

When career politicians with no skin in the game start publicly mocking a stock’s performance, that’s usually a sign you’ve hit a sentiment extreme.

And sure enough, it was. Tesla bottomed shortly after, rallying more than +50% in the following weeks to the point where the investing community started calling it the Walz Bottom.

Now here we are again, with Tesla falling as much as -21% in just a few days after another very public brawl—this time between Elon Musk and Donald Trump.

The Girls are Fighting

This is where things get complicated.

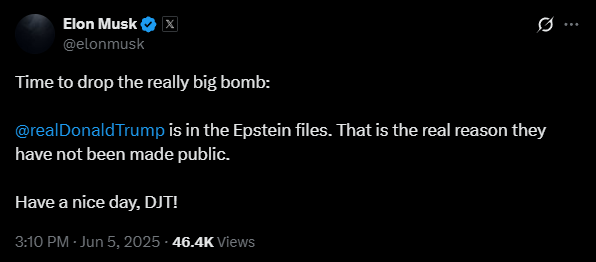

It’s not just your typical Twitter drama. Elon went nuclear, suggesting Trump had ties to Jeffrey Epstein.

Trump, in turn, threatened to cancel government contracts with Musk’s companies, which would directly hit SpaceX.

When the richest man in the world and CEO of the 7th largest company in the US is at war with the President, markets take note.

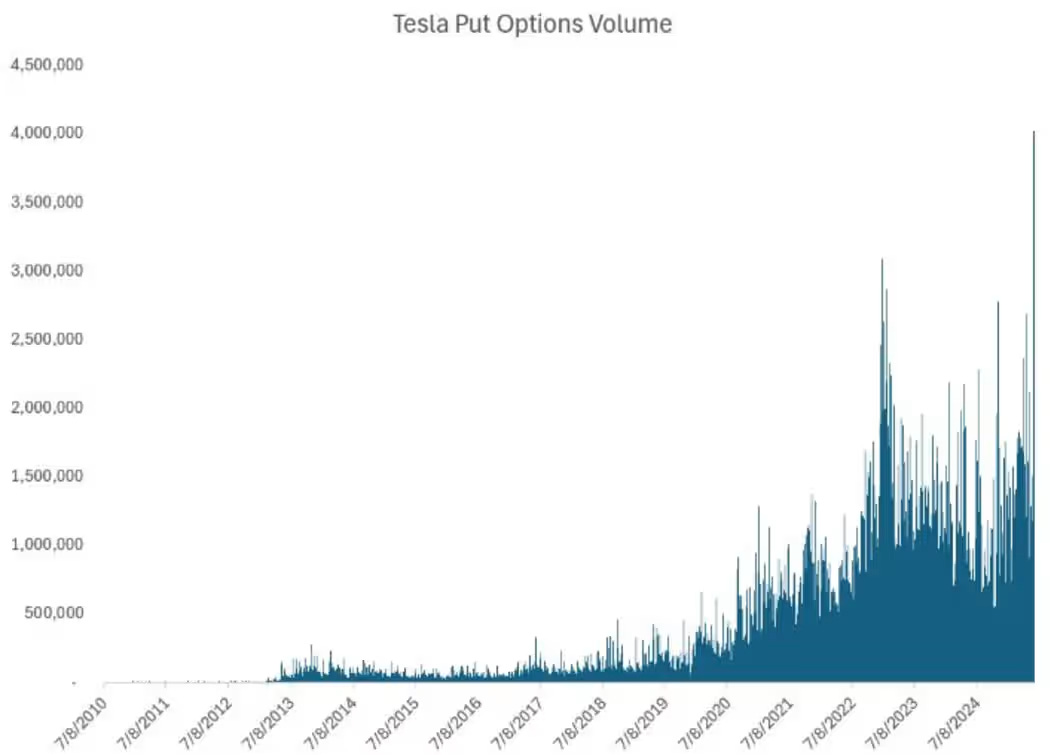

We saw a record amount of put option volume hit Tesla on Thursday. Sentiment cratered. Traders stampeded to the exits. Tesla dropped below $280 for the first time since Liberation Day.

But just like the Walz Bottom… this could turn into another one.

Why? Because when everyone moves to one side of the boat, it’s usually time to start leaning the other way.

Sentiment Extremes Usually Mark Inflection Points

We saw this exact dynamic during the Liberation Day Crash back in April.

That was a full-blown capitulation event. The VIX spiked above 50. The Nasdaq fell nearly 15% in three days. Social media was flooded with panic. And nearly every trader I follow was calling for more downside.

But then? The bounce.

The Nasdaq rallied double-digits in the following weeks. And most of those gains came in just a few trading sessions—right after the panic had peaked. That’s why you have to pay attention when fear hits extremes.

And with Tesla, fear is off the charts right now. The stock is back at its 200-day moving average—a key level it’s bounced from multiple times before. Sentiment is as bad as it’s been all year. Put option volume is through the roof.

These are the types of setups that make great entries if you have a long-term view.

That Doesn’t Mean You Have to Trade It

Here’s where I’ll throw some cold water on all of this; you don’t need to be in every trade.

That’s something I told our 1,200 TikStocks Portfolio members this week: unless you’re in Trump or Elon’s inner circle, there’s no way to predict where this goes next.

Yes, it could be another Walz Bottom. Yes, the technicals look supportive. Yes, fading sentiment extremes usually works.

But this is also a messy, ego-driven political feud with real economic implications. If Trump makes good on canceling SpaceX contracts—or pushes other agencies to pull support—that’s a very real threat to the Musk empire (you can hear more about this on my latest podcast on Spotify and Apple Podcasts).

And if that’s the case, then this isn’t just a sentiment issue. It’s a fundamental one.

So what do we do?

We stay disciplined. We don’t chase. We keep risk defined. And if we do get involved, we size accordingly. Because when sentiment hits an extreme, and technical support lines up with it? Those are the moments that make for attractive risk-reward setups—if you’re thinking long-term and not trading headlines.

And if not? That’s okay too. Sometimes the smartest thing you can do in investing is nothing at all. Just sit back, watch the drama unfold… and wait for a cleaner setup as there are plenty of easier trades out there right now (you can get my real-time trade alerts here).

Because in markets, patience is a position too.

Stay safe out there,

Robert