Overview

Alphabet is a holding company. Internet media giant Google is a wholly owned subsidiary. Google generates 99% of Alphabet revenue, of which more than 85% is from online ads. Google’s other revenue is from sales of apps and content on Google Play and YouTube, as well as cloud service fees and other licensing revenue.

Bulls Say

As the number of online users and usage increase, so will digital ad spending, of which Google will remain one of the main beneficiaries.

Android’s dominant global market share of smartphones leaves Google well positioned to continue generating top-line growth as search traffic shifts from desktop to mobile.

The significant cash generated from the Google search business allows Alphabet to remain focused on innovation and the long-term growth opportunities that new areas present.

Bears Say

There is little revenue diversification within Alphabet, as it remains heavily dependent on Google and the state of the search ad space.

Alphabet is allocating too much capital toward high-risk bets, which face a very low probability of generating returns.

Google’s dominant position in online search is not maintainable, as more companies and regulatory agencies are contesting the methods through which the company has been extending its leadership.

Technical Analysis

GOOGL’s technical picture is BULLISH as the primary trend is UP as the 200-day moving average is sloping upwards along with other key moving averages (15 and 50-day MAs):

Robert's Recommendation

I first bought shares of Alphabet (GOOGL) in January 2018.

My thesis was based on the idea the company would continue benefiting from internet adoption, swelling the audience for their dominant search and digital ad business. Eventually, I expected one of the company’s “moonshot” projects like Deep Mind, Waymo, or another one of their “Other Bets” segment.

The first part of the thesis alone was enough to carry the stock +200% higher since I first opened the position six years ago. But these "other bets" are starting to pay off as well, as Waymo - $GOOGL's self-driving car unit - has now over 22 million driverless hours logged and is now operating in major cities like Los Angeles and Phoenix.

I have added to this position over the years. That includes in March 2023 when I listed the stock as a "buy" in our monthly "Let's Analyze" reports.

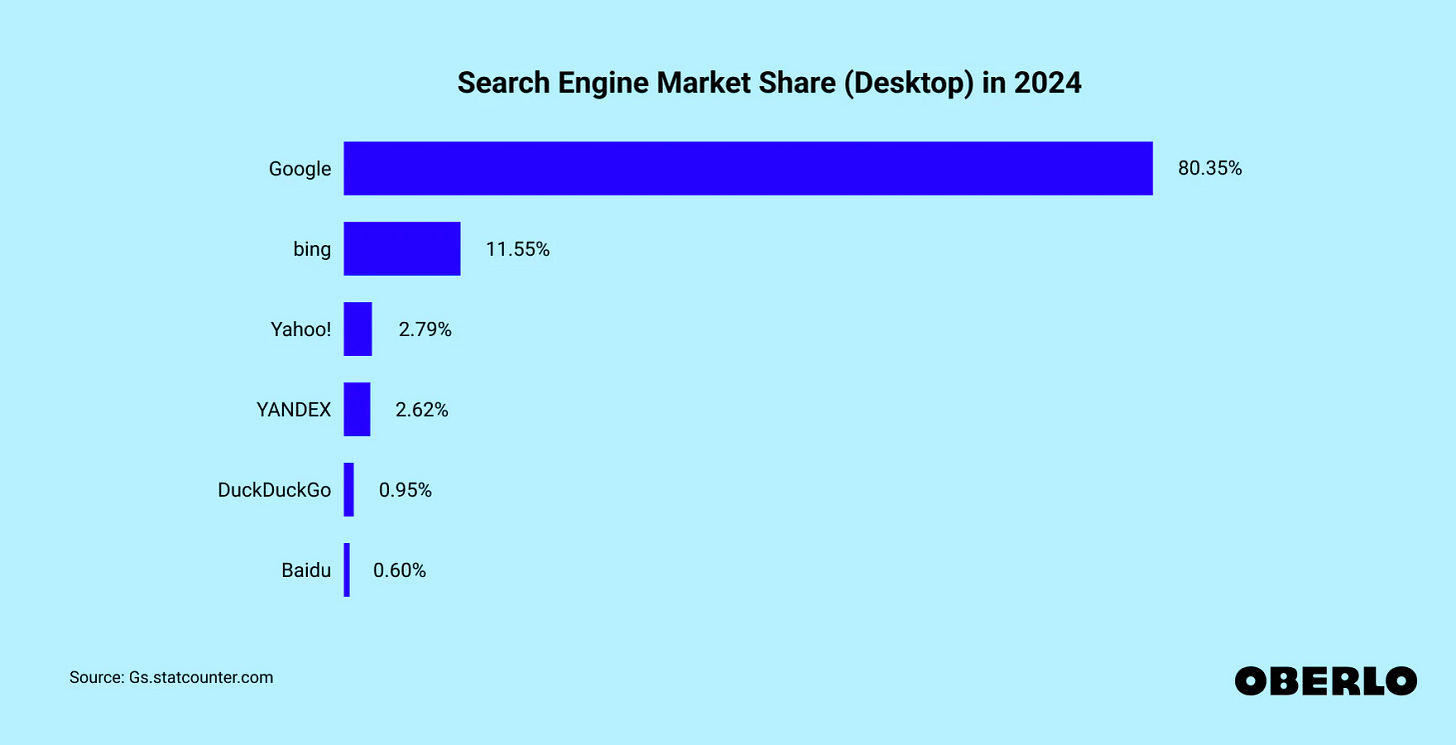

Many of the reasons for continued bullishness on $GOOGL is its search dominance, as the company has 90% of the global market (and more than 80% in the U.S.). This dominance isn't just for show—it brings in a hefty cash flow. Even with Microsoft beefing up Bing with some fancy AI tricks and Google hitting a few AI snags, I'm betting Google will keep its search crown.

Plus, let's not sleep on YouTube and cloud services; these are starting to add a significant chunk to Google's earnings.

The more we all use Google's myriad products, the stronger its ecosystem gets, making its ad services a no-brainer for advertisers and publishers alike. Google's got a treasure trove of data on what we're all searching for and which ads are likely to get us to open our wallets. It's always one step ahead, using tech innovations and AI to make our Google experiences smoother and the ad biz more lucrative for everyone involved.

Sure, the buzz around generative AI throws in a bit of a wild card, but my money's on Google using its data trove to make up for lost ground. While Google's growth might be shifting from sprint to marathon pace, I'm still seeing a steady clip of growth in ad revenue on the horizon.

And that doesn't mean this investment comes without risk. There is talk about breaking up $GOOGL into separate companies, particularly from lawmakers who claim Alphabet's dominance stifles competition and harms consumers. The latest calls for a breakup stem from antitrust concerns, with critics arguing that Google's sprawling ecosystem—from search to YouTube to cloud services—gives it an unfair advantage.

But let's not forget, these cries to break up Big Tech are nothing new. Congress and regulatory agencies have been rattling their sabers at companies like Google, Amazon, and Facebook for years, with little to show for it. Remember when they wanted to split up Microsoft in the 1990s? That led to a lot of headlines and hearings but ultimately resulted in a settlement that allowed Microsoft to remain intact—and thrive.

All that said, does this mean that $GOOGL is still a buy? Well, my answer may surprise you…