Markets hate uncertainty—and right now, they’ve got a big dose of it.

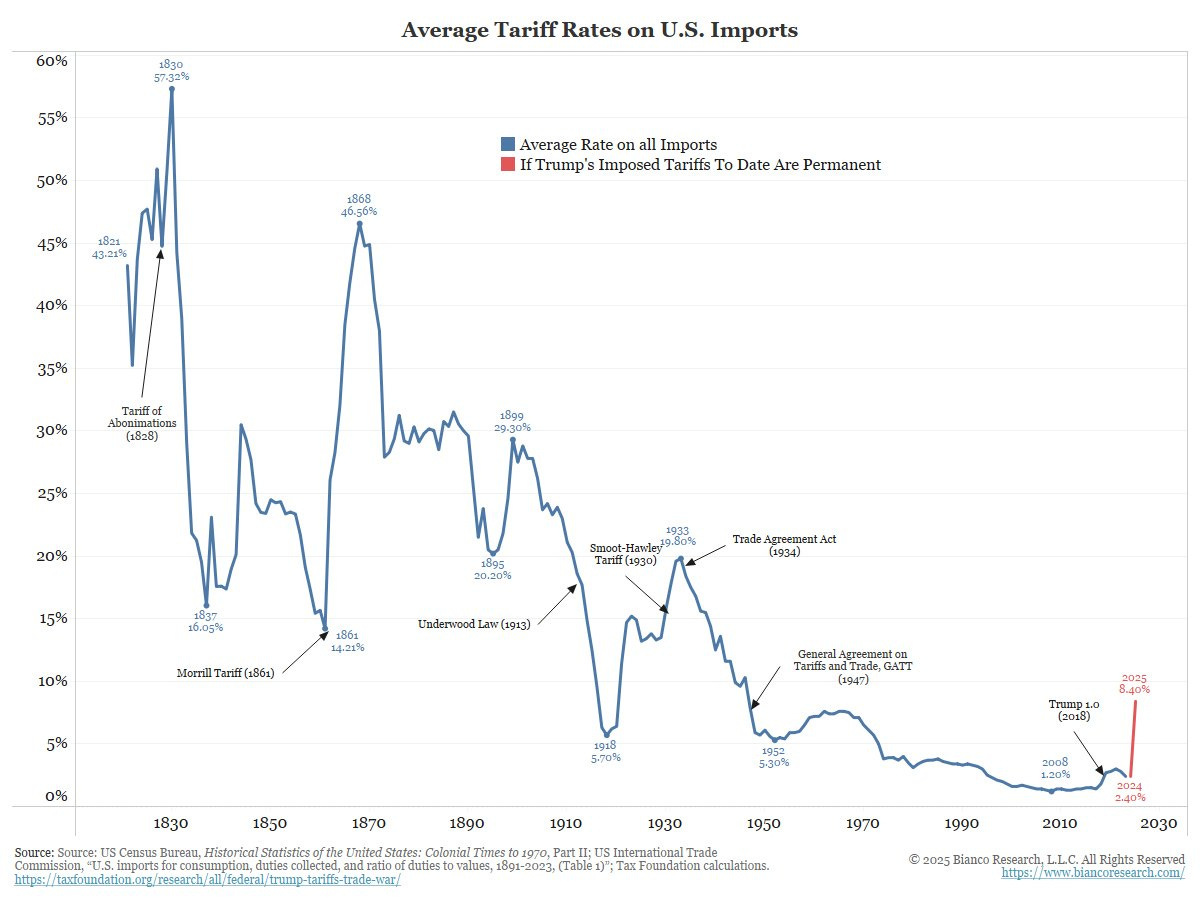

President Trump’s upcoming tariff plan—set to go live April 2, which he's calling "Liberation Day"—has stocks on edge. And it’s easy to see why. Trump’s first administration slapped tariffs on $380 billion worth of imports, mostly targeting China. Those tariffs equaled roughly 1.8% of U.S. GDP, and they rattled markets badly, causing a -20% correction in late 2018.

But this round? It’s different—and bigger. Much bigger.

Trump 2.0 tariffs will hit between $1.4 to $3.2 trillion worth of imports, according to estimates from Apollo Global Management. That’s a staggering 4.6% to 10.7% of GDP—more than twice the magnitude of Trump’s original tariff blitz. And instead of targeting rivals, he’s focusing mostly on countries we consider allies: Canada, Mexico, the European Union, Japan.

The surprise factor is off the charts. According to BofA Research, policy uncertainty is now at multi-decade highs.

Investors, who had priced in Trump’s usual market-friendly policies—deregulation, tax cuts, pro-growth rhetoric—are now scrambling to adjust expectations downward. And that means revising earnings estimates sharply lower.

But in all this chaos, there is still opportunity for those who can handle the volatility.

Earnings: The Pain is Real

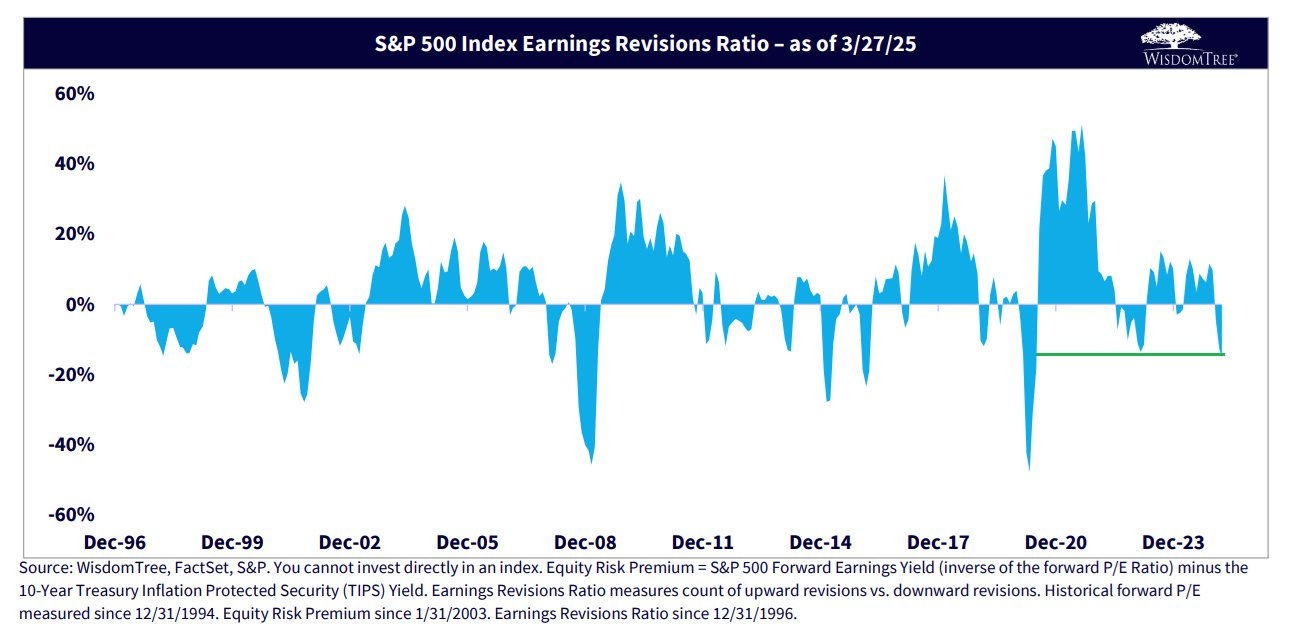

S&P 500 earnings estimates for 2025 have already dropped 6% since Trump took office.

That's the worst downward revision since the March 2020 COVID-19 Crash:

And unfortunately, many on Wall Street firms see further downside. Tariffs act as a direct tax on earnings. They boost costs, squeeze margins, and make supply chains less efficient. And while U.S. companies can absorb small disruptions, tariffs this massive create substantial economic friction.

The best-case scenario right now is that we've already priced out the favorable Trump policies. That makes sense, given that we’ve completely given back the pre-election and post-election rally gains. The market has essentially hit "reset," waiting to see what the reality of Trump's second term looks like.

But the worst-case scenario? The tariffs spark a recession. Historically, recessions lead to a -25% drawdown in the S&P 500—roughly the same magnitude we saw in 2022.

Tariffs of this size, combined with a slowdown engineered through Trump and Treasury Secretary Scott Bessent’s austerity measures—shrinking government via initiatives like DOGE and intentionally cooling economic activity—could tip us into recession territory.

The Long-Term Game: Power, Not Markets

So why is Trump doing this?

Simply put, he believes he can afford to. We’re still two years away from the 2026 midterm elections. Trump’s thinking politically, not economically. His team calculates that he can afford some economic pain now if it means delivering lower inflation, smaller deficits, and lower bond yields—his stated policy goals.

In short, he’s "Volcker-ing" the economy. Reagan and Volcker famously endured a sharp recession in the early '80s to break inflation's back, and Trump seems willing to use tariffs and austerity in a similar fashion, even if it risks near-term economic pain.

He knows tariffs disproportionately impact wealthier Americans, who own 94% of U.S. stocks and drive about half of consumer spending. A downturn in markets hits these groups hardest, curbing inflation by dampening consumer demand. Trump’s bet? This short-term pain is politically tolerable—as long as it happens early enough in his term. Here’s the key: Trump’s ultimate goal is political survival. If market turmoil begins hurting his polling numbers, he’ll pivot.

We saw a version of this in Trump 1.0. Each time markets wobbled dramatically, the administration softened its rhetoric, delayed tariffs, or offered concessions. The market’s violent corrections were always eventually followed by recoveries, driven by Trump backing down and shifting to pro-growth messaging.

There’s no reason to believe Trump 2.0 will be different—if anything, the political stakes are even higher this time around. Losing Congress in 2026 would be catastrophic for Trump’s agenda. That’s when markets become a critical barometer again.

Adding to a High-Conviction Position Today

History shows the indicators flashing red right now are almost always seen near market bottoms.

The average S&P 500 bull market returns 192%. Since the October 2022 low, we’ve seen a 58% rally. If this is the end of the bull run, it would be historically short and weak. It’s more likely we're experiencing a sharp correction, reminiscent of 2018—not a prolonged 2022-style bear market.

And investors are bearish: a recent Allianz survey found that a shocking 51% expect a full-blown market crash. When most investors fear disaster, they tend to miss opportunities. We’re seeing similarly extreme pessimism readings in the AAII sentiment survey, put/call ratios, and CNN’s Fear & Greed Index. Historically, such widespread panic signals market bottoms—not tops.

While the technical setup still gives me pause as the S&P 500 and Nasdaq are below their 200-day MAs, there are plenty of opportunities elsewhere. One we opened last week is already starting to work, and I want to increase my position in it today.