Before we get started, I want to welcome the +36 subscribers who signed up for the “Let’s Analyze” newsletter in the last week! If you want to join our community, make sure to sign up here:

“I’m tired of living through history.”

That’s what my fiancé told me after she heard the news former President Donald Trump was found guilty of 34 felony counts of falsifying records.

Naturally, this story led to proclamations of the collapse of the republic…

…along with questions from our Patreon Portfolio community about what this means for the markets:

And something tells me some of you won’t like what I have to say.

The Media’s New “Current Thing”

Have you noticed how the 24 hour news cycle works?

Companies like MSNBC, CNN, and Fox News need things to talk about… 24 hours a day.

Yet, there are often not enough things to talk about! That means they must blow any event out of proportion and discuss it endlessly to keep you hooked and engaged.

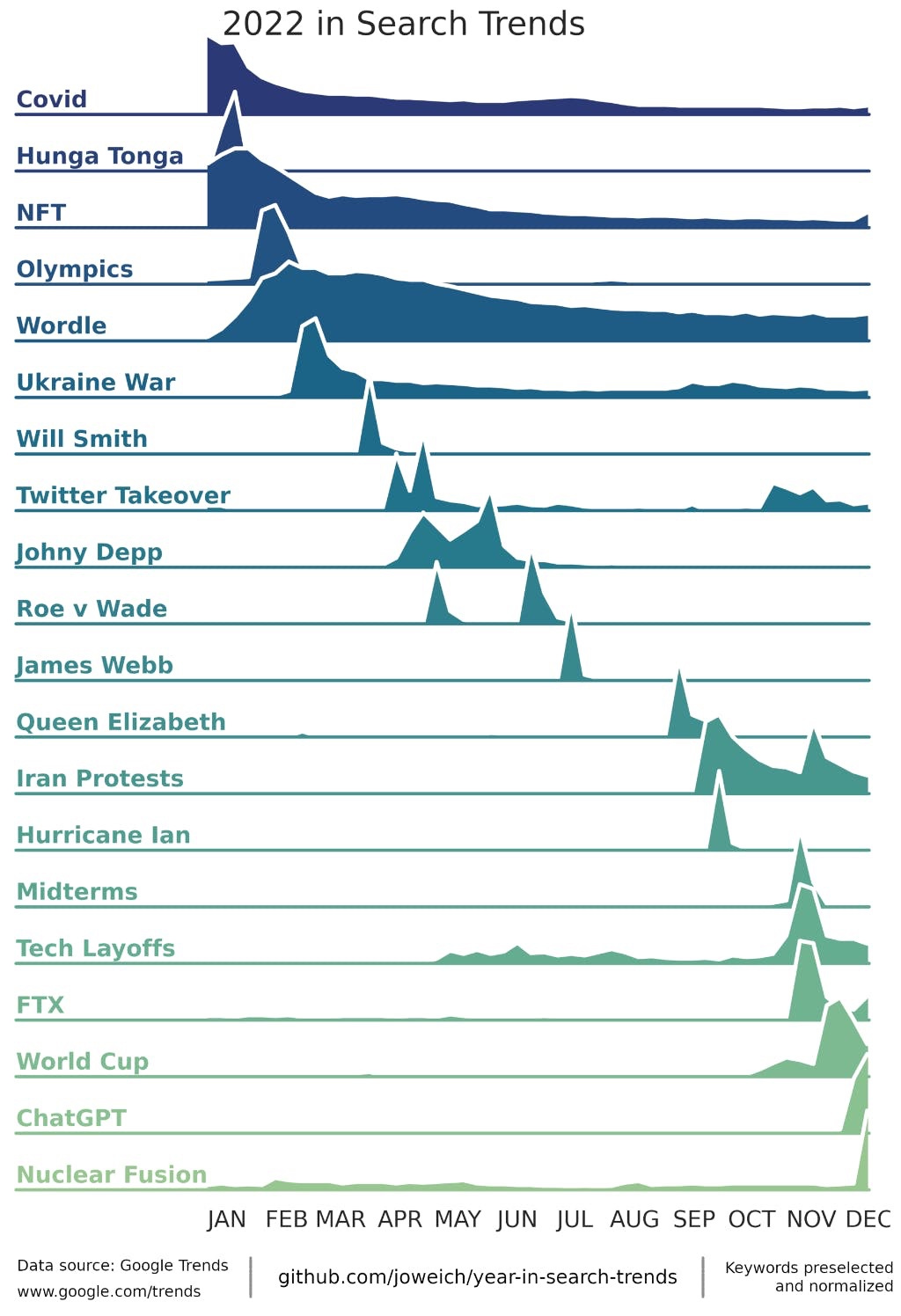

For instance, this table from 2022 shows every “current thing” the media would cover ad nauseam…

…many of which faded into obscurity, because in the grand scheme of things, they were not important.

This goes for social media as well. Every “content creator” you see is vying for your attention. In the investing space, they often say that an “imminent crash” is coming so that you watch their full video (which only makes the video go more viral).

Whether they’re in the traditional or social media space, both will also make a mountain out of a molehill. There is a monetary incentive for them to do so, as more views translates to more sponsorships and thus more money.

Now I’m not saying the first former President being charged with a crime isn’t a big deal (it is a historical event). However, it does not mean there are implications for your portfolio.

In fact, from an investing standpoint, you should ignore this news.

We’ve Seen Much Worse (and Still Prevailed)

Who is elected president does have a marginal impact on the markets.

Tax policy, regulatory changes, trade agreements, and fiscal stimulus plans introduced by the president can influence investor sentiment and market behavior.

However, Trump’s guilty ruling did not change the odds of who will be our next president according to betting platform Polymmarket:

But even if it had, it still wouldn’t be a reason to be concerned for your portfolio.

For instance, since 2017 we’ve seen:

a 100-year pandemic

A global economic lockdown + supply chain disruptions

The highest inflation in 40 years

The highest interest rates in a decade

Two bear markets (2020 and 2022) and a near-bear market in 2018

Multiple global conflicts (Ukraine, Palestine, Yemen, Syria, etc.)

Yet during this period, the S&P 500 has more than doubled:

The fact is there are always things to worry about. That is simply the world’s steady state.

But how you react to these events will define you from a financial standpoint.

Ignore the “Bad Dogs”

Famed businessman David Ogilvy once said to avoid, “sad dogs who spread doom.”

And as far as I can tell, 95% of both mainstream and social media accounts are in the business of selling doom. But as an investor, you need to continually climb the “wall of worry”:

Because while the Trump guilty verdict may seem like the end of the world to some of you, you will likely have forgotten about it a year from now.

As an investor, you need to keep your eyes squarely on the things that matter in markets: fundamentals, technicals, and sentiment. And for now, all three of these factors are saying now is a great time to stay fully invested.

And if that outlook changes, you’ll be the first to know.

Stay safe out there,

Robert