Before we get started, I want to announce my new FREE weekly podcast.

It's called Room to Run with Robert Ross. Each 10-15 minute episode will include market analysis, Q&A, and an overview of the market moving events (e.g. earnings, economic releases, etc) that need to be on your radar… all in 10 minutes or less.

This has been many months in the making, so I'm very excited to show you what I've been working on. If you want to check out the first episode, you can listen here on Spotify.

Do you think we’re in a recession?

There’s a good chance you do. According to a recent Harris Poll, 49% of Democrats, 53% of independents, and 67% of Republicans believe the US is currently in a recession.

This is despite the unemployment rate near its lowest level in history, corporate earnings growing 11% in 2024, and US GDP growth expected to hit 2.5% this year.

Unfortunately, because of the erosion of trust in our institutions, many people do not believe these economic statistics. Skeptics contend the economic data is fudged to make President Biden look better (although I’m not sure it’s possible for him to look worse after last week’s debate).

But looking at economic data isn’t the only way to forecast the economy…

…and today, I’ll show you a much more unbiased way to tell where the economy is headed.

How the G.O.A.T. Forecast the Economy

Stanley Druckenmiller is arguably the greatest money manager of all-time.

His hedge fund returned +30% annual returns for thirty straight years. And even more remarkable is he never had a losing year during this period.

It’s safe to say he knows a thing or two about forecasting the economy… and he does so without using traditional economic data like unemployment, GDP, etc.

Instead, Stan’s strategy uses leading and lagging stock market sectors to predict economic trends. He believes the stock market anticipates economic fundamentals by 6-9 months. In other words, stocks are “forward looking” and price-in what investors expect earnings growth to be over the next 6-9 months.

For example, the housing sector is often a leading indicator. When housing stocks rise, it signals future economic growth because increased home building and sales boost various industries, from construction to consumer goods.

In addition, the trucking sector is a leading indicator. An uptick in trucking stocks usually indicates rising demand for goods transportation, suggesting economic expansion. Conversely, when these sectors decline, it can signal upcoming economic slowdowns.

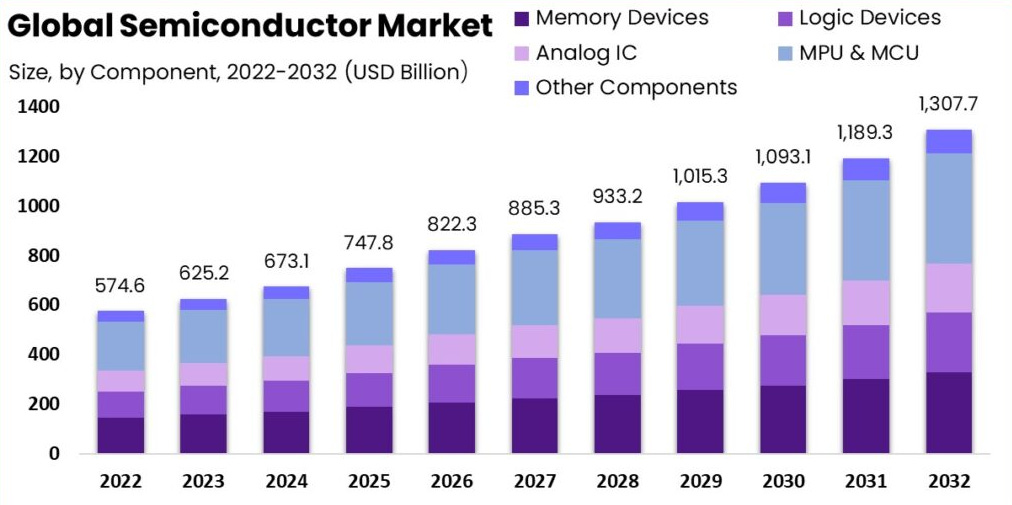

Lastly, the semiconductor industry is also a leading indicator. The demand for semiconductors reflects technological advancements and manufacturing health, as they are integral to many modern technologies. A surge in semiconductor demand can indicate robust economic activity, while a decline may signal a slowdown.

So what are these three sectors telling us now about how the economy will perform over the next 6-9 months?

The Outlook for the U.S. Economy is Positive

To see what investors expect the economy to do over the next 6-9 months, we can look at ETFs for each of these forward looking industries.

Housing

Trucking

Semiconductors

The first is the SPDR S&P Homebuilder ETF (XHB). At present, this ETF - which represents the outlook of the housing market over the next 6-9 months - is currently -10% off all-time highs:

I’d like to see housing continue to make all-time highs as that would imply investor optimism for the US housing market. But for now, it does not look like a red flag when using Druckenmiller’s approach as the index is still near all-time highs.

The same can be said for the iShares Transportation ETF (IYT), which represents the outlook for the trucking industry over the next 6-9 months:

This ETF is -8% off all-time highs. While it’s one you will want to keep an eye on, it is not flashing any warning signs about the health of the economy as it’s still near record highs.

And lastly, we have the VanEck Semiconductor ETF (SMH).

The ETF is only a hair off all-time highs, meaning the outlook for global semiconductor demand - a key economic indicator - is positive.

Overall, Druckenmiller’s approach implies the outlook for the economy is positive.

However, make sure to keep an eye on these ETFs as if we get a sustained pullback it may mean economic troubles are ahead. But for now, I’m happy to go on record saying the U.S. is not at risk of falling into recession any time soon.

And if my thinking changes, you’ll be the first to know.

Stay safe out there,

Robert